The ascent of artificial intelligence (AI) stocks has taken a bit of a pause recently as investors grow more concerned that the sector might be in a bubble. While I think some of the spending by companies like OpenAI is a bit absurd and suspect, the money being spent by the AI hyperscalers is real and backed by solid cash flows.

As a result, shares of several companies that are key suppliers on the hardware side of this megatrend arms are now off a bit from their all-time highs. All these stocks are poised to head higher in 2026, and I think the recent dip has created a great opportunity to scoop them up.

Image source: Getty Images.

Nvidia

Nvidia (NVDA 1.35%) has been a leader in the AI space ever since OpenAI set the current phase of the trend in motion in late 2022. Its industry-leading graphics processing units (GPUs) make up the vast majority of the artificial intelligence accelerator market, and a lot of the AI tech we know today wouldn't have been possible without them.

Nvidia's most recent quarterly results served to somewhat quell the market's fear that AI stocks are in a bubble, as CEO and founder Jensen Huang noted that its cloud GPUs are sold out and that demand remains greater than supply. The chip designer can keep capitalizing on this imbalance.

NASDAQ: NVDA

Key Data Points

In Q3, its revenue rose an incredible 62% to $57 billion. It also became more profitable, with diluted earnings per share (EPS) increasing by 67%.

Nvidia's results demonstrate that the AI infrastructure buildout is far from over. The company's forecast is that global data center capital expenditures could reach between $3 trillion and $4 trillion by 2030. If that proves to be the case, then Nvidia is a must-buy now, and so are the rest of the stocks on this list.

AMD

AMD (AMD 3.93%) has played second fiddle to Nvidia in the market for AI accelerator chips. While its GPU hardware technology was comparable to Nvidia's, its software lagged. However, it has significantly narrowed the gap on that front over the past few months.

AMD's business is starting to gain more traction. Its CEO, Dr. Lisa Su, made some bold claims at the company's financial analyst day, and predicted that its data center division will grow at a 60% compound annual rate through 2030. If that projection comes true, it could send the stock skyrocketing.

NASDAQ: AMD

Key Data Points

AMD is quite a bit more diversified than Nvidia, so its overall compound annual growth rate is projected to be about 35%. Still, that's something few companies ever achieve, and it makes AMD a great stock to buy now, as it could be enough growth to send its market cap above the $1 trillion threshold.

Broadcom

Broadcom (AVGO +0.80%) is taking a different approach to AI hardware than Nvidia or AMD. Instead of building general-purpose computing units, it partners with its hyperscaler clients to develop custom AI chips, also known as application-specific integrated circuits (ASICs). By optimizing its chips for the precise types of workloads they will handle, Broadcom can develop cheaper and more powerful options. Because those advantages come at the cost of flexibility, Broadcom's ASICs will never fully replace the GPUs made by Nvidia or AMD. But they can take a piece of the overall AI accelerator market by supplementing them.

NASDAQ: AVGO

Key Data Points

Broadcom is seeing rapid growth from its custom chip division. Revenue rose 63% year over year in its most recent quarter to $5.2 billion, and it expects that number to rise to $6.2 billion in Q4. Broadcom is a stock to watch in 2026, and could be a dark-horse candidate to outperform Nvidia and AMD.

Taiwan Semiconductor

None of these companies can manufacture its own chips, so they outsource most of that work to Taiwan Semiconductor (TSM +1.53%). As the leading third-party foundry, TSMC is a neutral player, positioned to benefit regardless of which companies' hardware ends up powering the majority of the AI workloads. TSMC is my favorite AI stock to invest in for this very reason, and it's also delivering impressive growth.

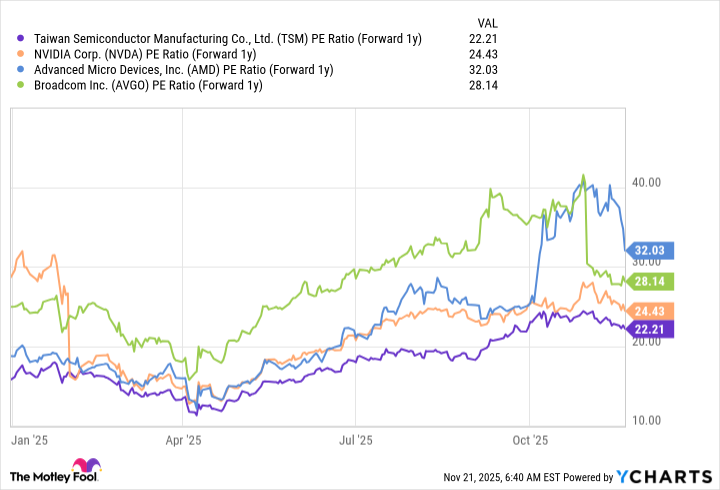

In Q3, its revenue rose an impressive 41% year over year, mainly on the back of strong AI computing hardware demand. With companies like Nvidia and AMD projecting massive growth in demand and sales between now and 2030, Taiwan Semiconductor is in a perfect position to benefit. As a result, it's an excellent stock to buy now. This is particularly true as it sports the cheapest price tag of the group based on forward P/E.

TSM PE Ratio (Forward 1y) data by YCharts.