With the market looking a bit weak, it's time to go ahead and deploy some cash to take advantage of these opportunities. I've got five stocks that all look like strong buys headed into 2026, and with access to fractional shares, you can spread $1,000 evenly among all of them and give yourself a great chance at turning a profit.

My five best stocks to buy right now are Nvidia (NVDA +7.34%), Taiwan Semiconductor Manufacturing (TSM +5.64%), Alphabet (GOOG 2.58%) (GOOGL 2.31%), Meta Platforms (META 1.10%), and The Trade Desk (TTD +2.13%). All of these have great long-term prospects, and are genius stocks to buy now and hold for the next few years.

Image source: Getty Images.

Nvidia

Nvidia has been the leader of the artificial intelligence (AI) race for a while due to its graphics processing units (GPUs) being the building block for most of the AI technology we experience today. It recently delivered another exciting result that put the idea of an AI bubble to rest.

NASDAQ: NVDA

Key Data Points

Nvidia's revenue rose a jaw-dropping 62% to $57 billion, and reaffirmed its guidance of a $3 trillion to $4 trillion spend on data center capital expenditures by 2030. This implies massive growth for Nvidia, making it a must-own stock.

Taiwan Semiconductor

With Nvida's success, Taiwan Semiconductor is also piggybacking on its massive growth. Nvidia doesn't have the capabilities to make its own chips; it just designs them. The manufacturing work is handled by Taiwan Semiconductor, which has factories worldwide, including the U.S.

TSMC handles most of Nvidia's fabrication work, and is also seeing incredible results, with revenue rising 41% year over year in Q3. In addition to Nvidia, many of the other AI computing hardware companies utilize Taiwan Semiconductor's services. TSMC is set to cash in on the same growth wave that Nvidia is, making it an excellent investment option, too.

Alphabet

Alphabet is one of the companies spending a ton on AI computing power, but it's also renting it out via its cloud computing platform, Google Cloud. Alphabet has turned from an AI loser to an AI leader recently, as its Gemini model has emerged as a top option in the space. Despite its maturity, Alphabet continues to post strong results, delivering 16% revenue growth and 35% diluted earnings-per-share (EPS) growth in Q3.

NASDAQ: GOOGL

Key Data Points

Alphabet is a top big tech company to invest in, and its role in the AI revolution is only going to grow.

Meta Platforms

While the market is OK with some companies spending a ton on AI, Meta Platforms has not received that benefit. It's planning on massive capital expenditure spending for 2026, with most estimates coming in above $100 billion. That's a significant amount more than its cash flows, which worries investors that Meta may be getting ahead of itself. However, I think this massive spending spree is table stakes for participation in the AI arms race.

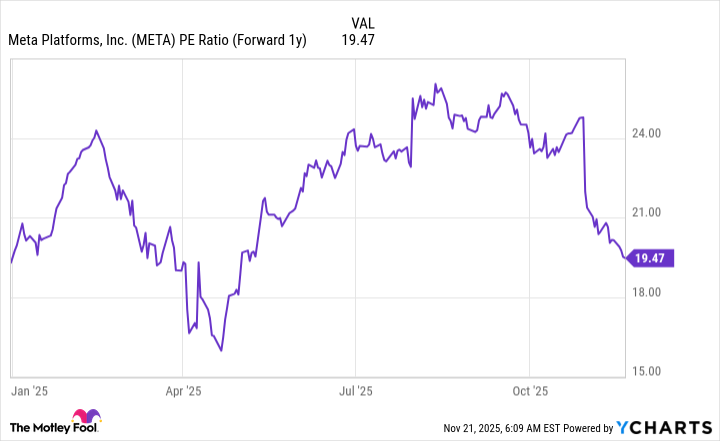

If you can forget about its spending for a second, Meta is actually delivering unbelievable growth. In Q3, its revenue rose 26% to $51.2 billion. CEO Mark Zuckerberg has long told investors that advertising would dramatically improve with AI integration, and we're seeing signs of it already. With Meta trading for a cheap price tag, 19 times next year's earnings, I think it's a smart buy now.

META PE Ratio (Forward 1y) data by YCharts

The Trade Desk

The Trade Desk is another advertising company that has fallen on hard times. Its user base wasn't receptive to the rollout of its AI-based platform, Kokai. While it's working to improve the product, some of the damage has been done. However, it's still posting strong results, with revenue rising 18% year over year in Q3.

NASDAQ: TTD

Key Data Points

That's an impressive growth rate considering how much money was spent on political ads last year -- a revenue stream that doesn't exist this year. This result is actually a lot better than most give it credit for, and The Trade Desk is primed to bounce back in 2026, making it a great stock to buy now.