Nuclear energy stocks have had a monster year so far in 2025. The Global X Uranium ETF (URA +1.62%) -- which has positions in some of the industry's biggest gainers, like Oklo , Cameco, and Centrus Energy -- is up over 62% on the year, a huge gain for an exchange-traded fund (ETF).

One nuclear stock that's gotten a lot of press this year is Nano Nuclear Energy (NNE 3.15%). It's not hard to see why. The company is designing a small nuclear reactor that can be transported by truck. If you've ever seen a nuclear power plant in real life -- with its huge cooling towers -- you can how game-changing Nano's microreactor could be.

Emphasize there on "could." Nano is pre-revenue and still seeking regulatory approval for its designs. The nuclear energy stock has also been in free fall since the end of October, trading almost 50% lower than its October highs.

For aggressive investors looking for a window, the sell-off might offer you one. Before you bite, let's take a closer look at the company.

Image source: Getty Images.

Why Nano is worth watching

Nano is at the center of a trifecta of megatrends: the global nuclear energy resurgence, a push for clean energy, and the growth of artificial intelligence (AI).

The company's pitch is pretty simple: Build small reactors and send them where power is scarce or unreliable. In practice, that could mean supplying electricity to data centers, mining sites, military camps, off-grid communities, and even outer space.

NYSE: CCJ

Key Data Points

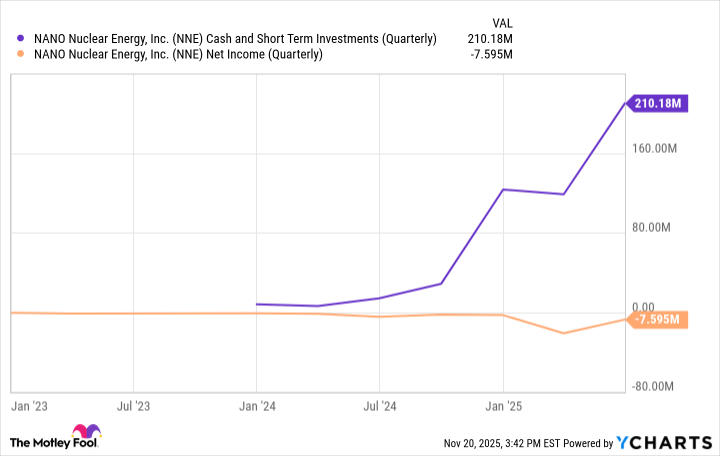

On the balance sheet, Nano looks pretty fortified. It had about $210 million in cash at the end of June, and it recently sold $400 million worth of stock to private investors.

Its trailing-12-month cash burn is about $30 million, which gives it more than enough runway.

NNE Cash and Short Term Investments (Quarterly) data by YCharts

Still, the big question is when Nano will pass the regulatory process. Until it does, the company's revenue will be essentially zilch.

Because of that uncertainty, this stock will likely be volatile. Conservative investors may be better served by a nuclear energy ETF.