Carnival (CCL +7.16%) (CUK +7.02%) has experienced both the worst and the best of times in recent years. The world's biggest cruise operator saw business reach a standstill during the height of the pandemic as the company was forced to temporarily halt sailings -- and this resulted in a net loss and soaring debt.

But after Carnival emerged from that rough period, it set its sights on recovery and made moves to accelerate its progress to that goal. Those efforts, along with high demand for cruise vacations, have helped the cruise giant increase revenue and return to profit. How has this translated into stock performance? Let's find out.

Image source: Carnival.

Carnival's tough times

As mentioned, Carnival faced difficult times just a few years ago, but the company took a series of actions to turn things around. For example, Carnival replaced older ships with newer ones that are more fuel-efficient, and the company designed cruise routes that use less fuel too. Carnival also made moves to boost onboard spending and even set out a specific plan including financial and sustainability goals known as "SEA Change" -- earlier this year, the company said it surpassed 2026 financial targets 18 months early.

In the most recent quarter, Carnival reached record high net income of $1.9 billion and revenue of $8.2 billion. This represents the 10th straight quarter of record revenue. Importantly, Carnival has reported quarter after quarter of strong advanced booked positions at higher prices -- this shows customers like Carnival's cruises so much that they're willing to overlook price increases and book anyway.

Now, let's consider how Carnival stock has done for investors. You probably won't be surprised to learn that the shares plunged during the early days of the coronavirus crisis -- they sank more than 80% from the start of 2020 through March of that year.

NYSE: CCL

Key Data Points

And the stock still is down about 50% from its pre-pandemic level.

This year's performance

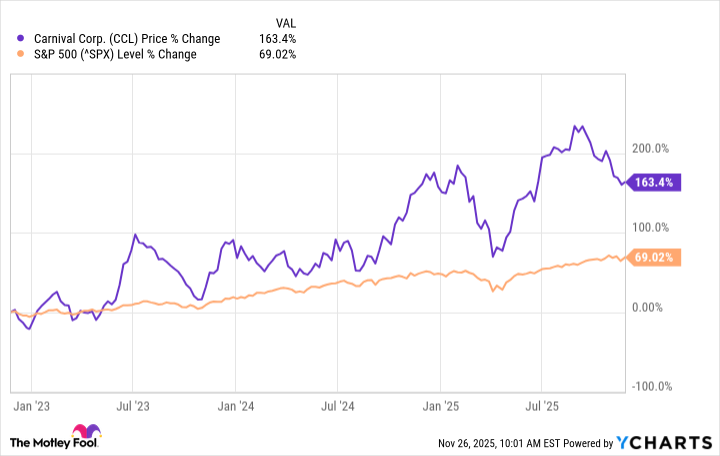

This year, Carnival has advanced only about 2% as concerns about President Donald Trump's import tariffs weighed on the stock back in April. But here's some good news: Carnival stock has been progressively on the rise as the company's recovery story took shape, and over the past three years, it's climbed more than 160% and outperformed the S&P 500.

All of this tells us a few things. Carnival, being a company linked to consumer spending and consumers' ability to travel, is vulnerable during certain times -- such as during a pandemic or when concerns about consumers' wallets arise. But, in general, over the long term, Carnival has proven itself to be a good investment, and the company's recent recovery and return to growth may keep that positive momentum going well into the future.