Few stocks have been as successful as Palantir (PLTR 0.25%) and Nvidia (NVDA +0.47%) have been during the artificial intelligence (AI) arms race. Since 2023, Nvidia's stock is up 1,100%, and Palantir's is up nearly 2,300% (at the time of this writing). That's an impressive run in just under three years' time, but what they've each done in 2025 is also impressive. Palantir is up around 100% in 2025, while Nvidia is up over 30%. Both of those are market-beating returns, but will they continue that run into 2026?

I think one of these is a much better buy than the other heading into 2026, and one of these impressive stocks could struggle to live up to expectations. Which one is which? Let's take a look.

Image source: Getty Images.

Nvidia and Palantir represent two separate sides of the AI arms race

Nvidia and Palantir aren't competitors in the artificial intelligence arms race. In fact, they recently teamed up to offer Palantir's Ontology in a pre-built Nvidia stack.

Palantir is a software company that specializes in AI-powered data analytics. It got its start by offering its software to government agencies, and eventually expanded onto the commercial side. Its platform has evolved over the years, with its latest update involving generative AI-powered agents. Demand for Palantir's products has been insatiable and has led to impressive growth rates.

NASDAQ: PLTR

Key Data Points

During Q3 2025, Palantir's revenue rose by 63% year over year. Strength came from three of its four sectors, with U.S. government and international government revenue growing at a strong pace, and U.S. commercial revenue stealing the show at 121% year-over-year growth. About the only division that's lagging for Palantir is international AI adoption, which is partially out of Palantir's control.

Palantir has delivered impressive growth, but Nvidia's is just as impressive, especially when its size is factored in.

Nvidia makes graphics processing units (GPUs) and various equipment that's used to support them in a data center. Considering the massive amount of money AI hyperscalers are dumping into the AI arms race, this has been an incredible business to be in over the past few years. Nvidia just announced Q3 FY 2026 (ending Oct. 26), and the results were nothing short of incredible.

NASDAQ: NVDA

Key Data Points

It delivered revenue of $57 billion, growing at a 62% pace -- just shy of Palantir's growth rate. That exceeded internal expectations, as management told investors it expected $54 billion for Q3 during its Q2 results. For perspective, Nvidia exceeded revenue expectations by about triple the revenue Palantir generated during Q3. That shows the sheer size and scale of Nvidia, and despite common wisdom stating it should be harder to grow the larger you get, Nvidia is defying that logic.

Each company is delivering incredible results to end 2025, but which will be able to sustain that throughout 2026?

Stock valuation is my primary concern

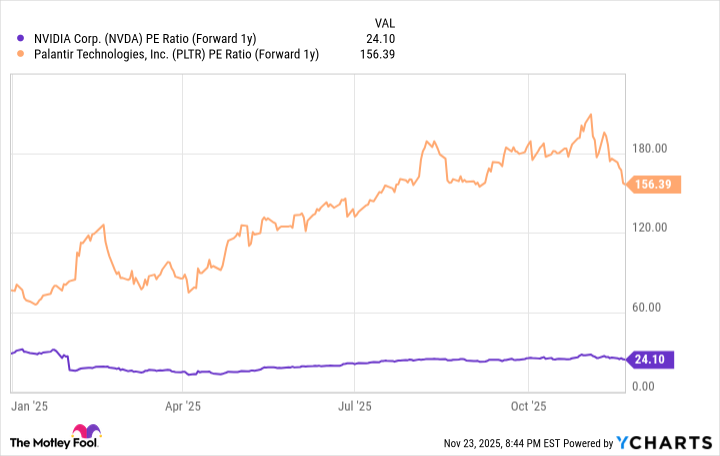

With the AI arms race waging on, I don't see signs of either of these businesses slowing down during 2026. However, one stock has considerably high expectations built into it. If you examine each stock's valuation from a forward earnings perspective, it's clear that Palantir is valued at a far higher level.

NVDA PE Ratio (Forward 1y) data by YCharts

Palantir trades at 156 times 2026 earnings, while Nvidia is below 25. This conveys that there are far higher expectations baked into Palantir's stock price, making it difficult to rise any further. In comparison, Nvidia is valued at around the same level as its big tech peers, and if it can exceed expectations, it may be able to match 2025's stock performance.

For 2026, I think Nvidia will be a far better stock pick based solely on valuation. However, I think both businesses will continue to excel, as AI demand is still rising.