Palantir (PLTR +0.85%) has been one of the best stocks in the AI race to own, and anyone associated with the company likely knows what it's doing. However, one warning flag is that Palantir's co-founder, Peter Thiel, dumped all of his Nvidia (NVDA 0.45%) stock during Q3 2025.

That's obviously concerning for Nvidia investors, but should the chip-maker's shareholders follow suit?

Let's take a look at Nvidia's stock. Did Thiel make a genius move, or is there something else going on here?

Image source: Getty Images.

Peter Thiel is a legend in the tech space

Thiel has left his mark on many businesses. He co-founded Palantir and was also one of the earliest investors in Facebook (now Meta Platforms (META 0.94%)). Before Palantir, he also co-founded PayPal (PYPL 0.87%). His track record is incredible, and when he makes a move, it's worth paying attention to.

Before selling off his Nvidia stake in Q2, Thiel owned around 537,000 shares. While it's impossible to know when exactly Thiel sold it during Q2, Nvidia's average price during Q2 was $174. If he sold at the average, that means he cleared over $93 million from the proceeds of the sale. That's a huge chunk of change, but he wasn't idle with his money, either.

NASDAQ: NVDA

Key Data Points

Thiel also sold a large chunk of Tesla (TSLA +0.86%) stock and purchased some Microsoft (MSFT 0.05%) and Apple (AAPL 0.08%) stock, although neither of those purchases even came close to the amount of Tesla and Nvidia stock he sold.

This leaves a couple of possibilities. First, Thiel could be looking to make a new investment, perhaps something in the artificial intelligence (AI) realm or maybe even a cutting-edge quantum computing business. Second, Thiel could be getting cautious about the future of AI, which would be a massive concern for all investors, as he is in a great position to be able to see this coming. Lastly, he may have just sold because he was ready to make a large purchase.

It's impossible to know what Thiel was thinking, but was it the right move?

Nvidia looks strong as ever

Nvidia recently reported Q3 results, and it appears to be unstoppable. During the quarter, Nvidia exceeded expectations, delivering $57 billion in revenue while it had only expected $54 billion. That led to a 62% year-over-year growth rate, which was faster than Q2's 56%. So, not only is Nvidia continuing to post incredible results, its growth is actually accelerating.

That's impressive for the world's largest company by market cap, and showcases that Nvidia isn't going anywhere. CEO Jensen Huang also dropped a hint that cloud graphics processing units (GPUs) are sold out, which conveys that supply continues to lag demand. That's an excellent place for Nvidia to be, and considering that the AI hyperscalers have all announced even higher capital expenditure expectations for 2026, it means Nvidia will continue to grow at a rapid pace for the foreseeable future.

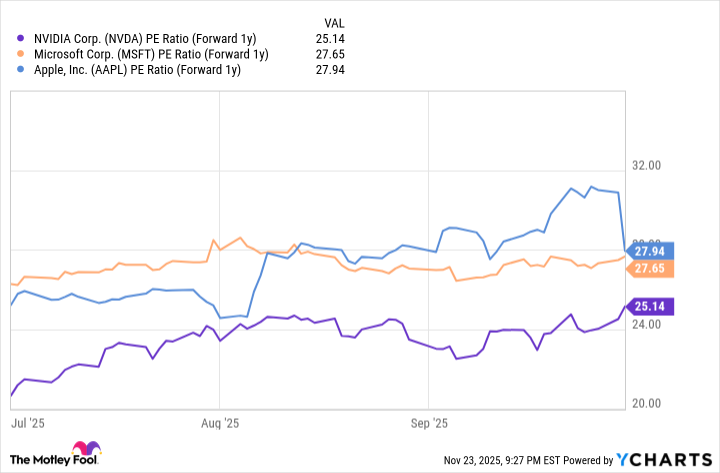

One common concern with Nvidia is that it is overvalued. However, I don't think that's a fair argument. If you look at Nvidia's price-to-earnings ratio using next year's projections as a denominator, it's actually cheaper than where Microsoft and Apple are trading.

NVDA PE Ratio (Forward 1y) data by YCharts

This suggests that Nvidia's valuation is roughly in line with that of other major tech companies, considering future growth. It's impossible to know exactly why Thiel sold his Nvidia shares, but I don't think it was because of Nvidia's businesses being weak or AI demand falling. There are clear signs that Nvidia has all the demand it can handle and that it's a great investment at today's prices.