Both Microsoft (MSFT 0.74%) and Alphabet (GOOG 0.02%) (GOOGL 0.07%) have a market cap of at least $3 trillion. But thanks to a recent surge, Alphabet is nearly a $4 trillion company. Still, these two are fairly close in size and may have investors wondering which stock is the better buy right now.

I think both have their merits, but one stands out as the better pick.

Image source: Getty Images.

Alphabet and Microsoft have two different base business models

Alphabet is the parent company of Google, along with several other brands, like YouTube, the Android operating system, and Waymo. It's a fairly wide business, but when you boil it down, most of Alphabet's revenue comes from advertising. In Q3 2025, Alphabet's ad revenue totaled $74.2 billion, with total revenue coming in at $102.3 billion. When the economy and the consumer are fairly strong, advertising is a great business to be in. However, once companies start to fear that a recession is imminent, they quickly pull back their spending, harming companies like Alphabet.

NASDAQ: GOOGL

Key Data Points

Currently, advertising revenue is growing across the board, so Alphabet is enjoying strong growth. But that could flip at any moment, making its business a bit more precarious than Microsoft's.

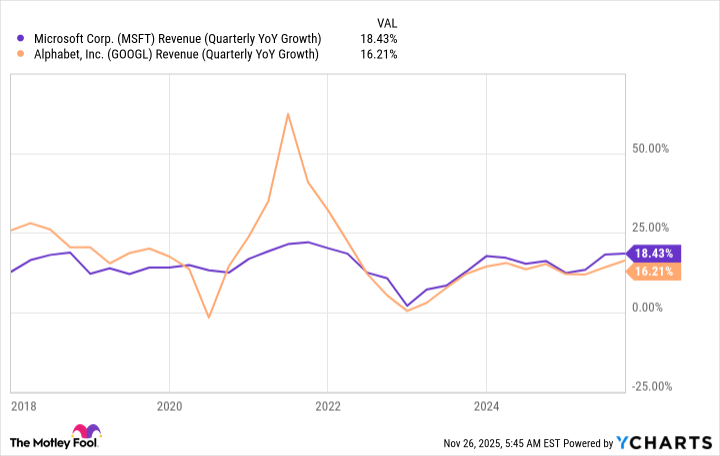

Microsoft has a sprawling business ranging from business productivity tools to cloud computing to gaming and computing hardware. Microsoft's most important segments are those devoted to business and cloud computing, and these two segments accounted for $33 billion and $30.9 billion, respectively, of Microsoft's $77.7 billion in revenue in Q1 of fiscal year 2026 (ended Sept. 30). These units may not see as strong growth if we enter a recession, but they are still more resilient than Alphabet's. If you compare both companies' growth rates over the past few years, it's evident that Microsoft may not grow as fast as Alphabet, but its growth is far steadier.

MSFT Revenue (Quarterly YoY Growth) data by YCharts

This isn't a knock against either company; it's just the reality of the core business each is involved in. Right now, the most exciting business units for each company are their cloud computing operations. Cloud computing is seeing a huge spike in demand from artificial intelligence workloads, and each is delivering excellent results. In Q1 FY 2026, Microsoft Azure's revenue rose 40% year over year. While Microsoft doesn't break out how much revenue Azure actually generated, we know from previous announcements that Azure accounts for more than 50% of the Intelligent Cloud division's revenue, which totaled $30.9 billion in Q1 FY 2026.

NASDAQ: MSFT

Key Data Points

Google Cloud didn't grow quite as fast in Q3 2025, with revenue rising 34% year over year, but it has made some major announcements recently. One key advantage of using Google Cloud is that it grants access to its tensor processing units (TPUs). These computing devices are an alternative to graphics processing units (GPUs) from Nvidia, and are much cheaper to run on at the cost of being less flexible. Alphabet made headlines recently when reports circulated that Meta Platforms could be purchasing TPUs from Alphabet instead of just running workloads via Google Cloud. That could open up a brand new revenue stream for Alphabet, giving it a potential leg up on Microsoft.

In terms of which business is better, it's really more personal preference. Alphabet's fastest-growing years will be better than Microsoft's, but Microsoft will be steadier. However, with Alphabet potentially starting to sell its custom TPUs, I think it's the better buy right now from a business perspective. But what about valuation?

Alphabet's stock has soared in recent days

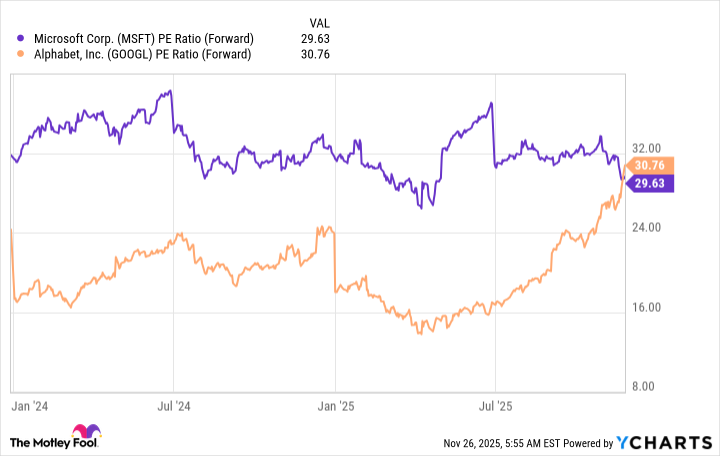

Alphabet's stock has been on a monster run over the past few weeks, as Berkshire Hathaway announced a stake in Alphabet, and the news broke about Meta considering purchasing TPUs from Alphabet. This has caused Alphabet's valuation to spike.

MSFT PE Ratio (Forward) data by YCharts

Alphabet now trades for 31 times forward earnings, which is slightly more expensive than Microsoft. However, analysts haven't had time to model what selling TPUs could do for Alphabet's profits, which is what the forward earnings metric relies on. As a result, Alphabet's stock could be slightly cheaper than it appears, which I think makes it the better stock to buy right now.