Ares Capital (ARCC +0.02%) is somewhat outside the mainstream when it comes to investing. The lofty 9.3% dividend yield on offer is attractive. However, you need to understand what you are buying, or you could end up disappointed with the company's performance. Here's why ultra-high-yield Ares Capital could be a buy now and, perhaps more importantly, for whom.

What does Ares Capital do?

Ares Capital is a business development company (BDC). This is a highly specialized corporate structure designed to distribute income to shareholders in a tax-efficient manner. The company avoids corporate-level taxation by distributing at least 90% of taxable income as dividends. The trade-off is that shareholders must treat those dividends as income when reporting their taxes. The 9.3% dividend yield is partly a reflection of Ares Capital being a BDC.

Image source: Getty Images.

That said, the bigger issue for most dividend investors is what Ares Capital actually does. BDCs make loans to smaller companies. These companies generally have limited access to capital and are willing to pay high interest rates for the loans they can obtain. For example, Ares Capital's average interest rate on its portfolio of loans at the end of the third quarter of 2025 was 10.6%.

For Ares Capital, 10.6% sounds great. However, if you step back and think critically about that rate, it is actually quite high. A company that could access capital at a lower rate would likely do so. It isn't that the companies in which Ares Capital invests are inherently bad; they are simply smaller, which limits banks' willingness to lend to them. It also makes it harder to tap the capital markets through bond and stock sales. Making loans to smaller businesses can be a risky endeavor.

What kinds of investors should buy Ares Capital now?

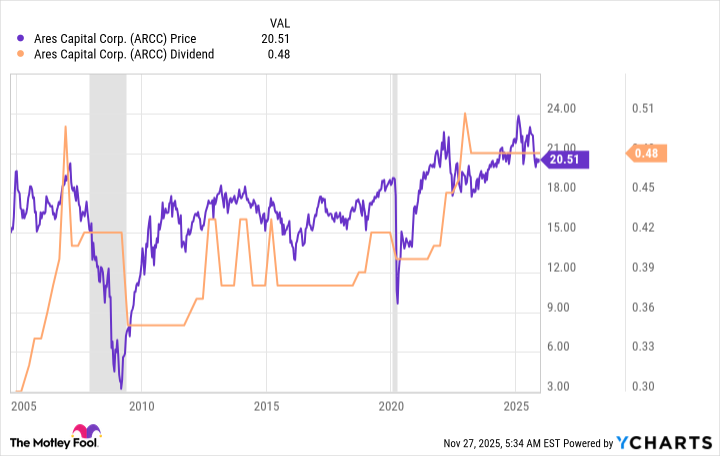

If you are a risk-averse dividend investor looking for a company that pays reliable, and hopefully growing, dividends, you should not own Ares Capital. As the chart above clearly shows, the dividend is volatile. Note, too, that the stock price tends to track the dividend, so the stock is somewhat volatile as well. This company should only be considered by more aggressive investors.

That's not a knock on Ares Capital. It is actually one of the largest BDCs, and it is highly respected. It just isn't a particularly reliable dividend payer thanks to the nature of its business. The same can be said of, essentially, all BDCs. There's a particular risk during recessions, when weak economic conditions can put additional pressure on smaller companies. Note in the graph above the steep drop in the dividend during the Great Recession and the more modest drop that occurred during the short recession during the coronavirus pandemic.

There are two ways you might view the stock. From a dividend perspective, it could be a high yield that you layer on top of more reliable dividend stocks. A "kicker," if you will, to add a little extra income. You just need to understand that the dividend will be variable and, thus, you can't rely on that income for daily living expenses. It's fun money for trips and eating out, not what you should rely on to pay for medical care or rent.

NASDAQ: ARCC

Key Data Points

Moving away from the dividend angle, you could also just view Ares Capital as a way to invest in smaller businesses. In some ways, it is like a private equity investment. However, given that the focus is on loans, Ares is taking on less risk than it would if it made an equity investment in a smaller company. Therefore, more conservative investors may view this as a reasonable risk that allows them to dip a toe into a fairly high-risk style of investing. The upside may not be as rewarding, but the high yield offers a consistent and tangible return.

Is now the time to buy Ares Capital?

Ares Capital's portfolio includes over 580 investments. There's a material amount of diversification in its loan book. That's a clear positive, but its dividend track record shows that recessions can still be difficult times. Ares Capital is likely to survive the next recession, but history suggests that the dividend will be at risk of a cut. Given that consumers appear to be hunkering down and seeking bargains, economic concerns seem elevated at present.

If you think long-term and are looking for a more aggressive investment that mimics private equity in some ways, Ares Capital is a good option to consider. But if you are worried that a recession could be in the cards, the risk of buying Ares Capital probably won't be worth it for you right now.