Figma (FIG 4.25%) fell again last month as the high-flying user-interface, user-experience (UI/UX) cloud software company continued to retreat following its blockbuster IPO at the end of July.

In November, the stock pulled back even as it delivered solid results as concerns about an AI bubble, competition from Adobe, and its valuation all seemed to weigh on the stock.

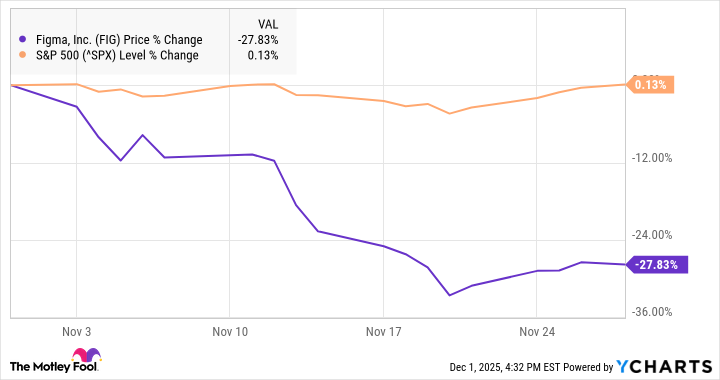

According to data from S&P Global Market Intelligence, the stock finished the month down 28%. As you can see from the chart below, shares were heading lower through most of the month, though it did recoup some of its losses when the S&P 500 rallied at the end of the month.

Why Figma is back down near its IPO price

Figma's slide last month seemed to be mostly a continuation of a trend that began following its IPO pop and was exacerbated by the broader malaise around tech stocks for most of the month.

However, the biggest news out on the stock -- its third-quarter earnings report -- was mostly positive. Figma beat estimates on both the top and bottom lines. Revenue rose 38% to $274.2 million, which topped estimates at $264 million, with growth balanced between both new customers and existing ones. On the bottom line, adjusted net income jumped from $9.9 million to $45.4 million, or $0.10 per share, beating the consensus at $0.05.

The stock rose in response to the report, but it resumed the sell-off soon after as the results weren't enough to stave off the broader headwinds in the market.

Over the remainder of the month, there was not much company-specific news out on Figma, but the stock slumped due to a sell-off in tech stocks triggered by fears that AI stocks had gotten overvalued. Additionally, rival Adobe announced its acquisition of Semrush. While that move doesn't directly threaten Figma, it does show the larger Adobe being proactive and leaning into growth.

Image source: Figma.

What's next for Figma

Figma's guidance for the fourth quarter was solid, calling for 35% revenue growth to $292 million-$294 million, and the company expects adjusted operating income of $112 million-$117 million for the full year.

Figma is also rolling out new AI-powered products like Figma Make, which has a suite of design tools to help users build faster.

Additionally, the stock looks well-priced now that its market cap has fallen below the $20 billion that Adobe offered to buy it for in 2022, and its share price is just north of its $33 IPO price.

Given the business momentum, new product releases, and discounted price, Figma looks like an attractive buy right now.