The S&P 500 index generated healthy gains of 17% in 2025, as of this writing, reaching a level of almost 6,850. The good news is that the index is expected to sustain its momentum in 2026.

According to HSBC, the S&P 500 index could reach 7,500 by next December. That points toward a potential jump of 10% from the index's current reading.

The investment bank notes that robust spending on artificial intelligence (AI) infrastructure is expected to be a key catalyst for the index in 2026. That's why now would be a good time to take a close look at one S&P 500 component -- Broadcom (AVGO 1.17%) -- which has delivered healthy gains in 2025 and seems set to fly higher next year, as well.

Image source: Getty Images

Broadcom's AI business is all set to step on the gas

Broadcom is one of the most important players in the AI chip market and the sixth-largest component of the S&P 500 index by weight. The company makes application-specific integrated circuits (ASICs) and networking chips, such as switches and routers. Its products have been in great demand, thanks to the AI boom, as they enable data center operators to reduce the cost of running AI workloads.

NASDAQ: AVGO

Key Data Points

Broadcom's AI accelerators, known as XPUs, integrate ASICs, high-bandwidth memory (HBM), and connectivity chips to deliver higher power efficiency and compute performance. As ASICs are designed to perform specific tasks, they can outperform graphics processing units (GPUs) in compute performance and power efficiency while performing the tasks they're designed for.

This explains why Broadcom has been making big waves in the AI chip market. It designs custom AI accelerators for companies such as Alphabet, Meta Platforms, and ByteDance. What's more, it recently added a new customer in the form of OpenAI, which will be deploying 10 gigawatts (GW) worth of Broadcom's AI accelerators through 2029.

The OpenAI deal alone has the potential to add between $70 billion to $90 billion in revenue for Broadcom during its tenure, according to JPMorgan analyst Harlan Sur. That's a big deal for a company with $60 billion in revenue in the trailing 12 months.

It's easy to see why the JPMorgan analyst has such a sunny forecast. A 1 GW data center costs around $10 billion to build, with 60% of that money going toward hardware components such as chips. Broadcom, therefore, is probably sitting on a massive opportunity, thanks to OpenAI.

However, what's worth noting is that the company's AI chip prospects have just received another massive boost. Reports indicate that Meta Platforms is reportedly looking to purchase custom AI chips from Alphabet. Given that Alphabet's custom AI accelerators are designed by Broadcom, this reported development is good news for the latter.

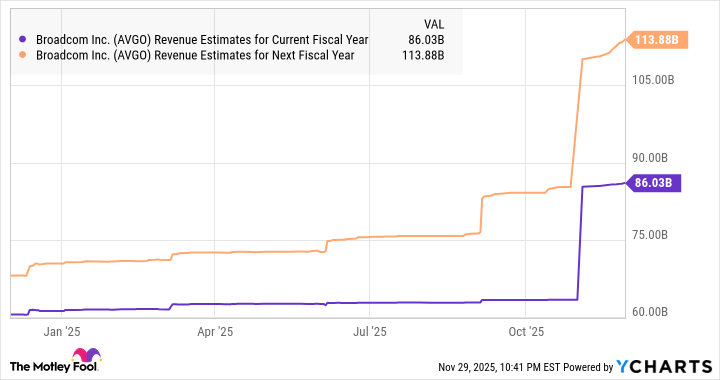

As such, it's easy to see why analysts are expecting Broadcom's top-line growth to accelerate from 23% in the recently concluded fiscal year to 35% in the current one to almost $86 billion. This is expected to be followed by another solid increase in the next fiscal year.

AVGO Revenue Estimates for Current Fiscal Year data by YCharts.

What about the valuation?

Broadcom stock has gained 68% so far this year, which explains why it's now trading at an expensive 99 times earnings. However, the forward earnings multiple of 41 points toward a solid bottom-line jump. Another point worth noting is that Broadcom is undervalued when its long-term growth potential is considered.

Broadcom has a price/earnings-to-growth ratio (PEG ratio) of 0.60. This is a forward-looking valuation metric that takes into account a company's estimated annual earnings growth for the next five years. A reading of less than 1 indicates that a stock is undervalued in relation to the growth it is capable of achieving.

Growth investors can still consider buying Broadcom. The company's AI business is likely to expand significantly over the next three years, thanks to its recent contracts and a solid revenue pipeline worth $110 billion, as reported at the end of the fiscal third quarter (which ended in August). That could help this AI stock soar higher in 2026 and beyond.