Over the past few weeks, Nvidia (NVDA 0.29%) hasn't been the strong stock it typically is. The shares are down around 15% from their all-time high, stemming from reports that Meta Platforms could be purchasing tensor processing units (TPUs) from Alphabet. That would shift some of Meta's spending to Alphabet, which is concerning for Nvidia because Meta is such a large customer.

However, I think investors are missing the bigger picture here. While Nvidia would benefit from capturing as much AI computing hardware spending as possible, the reality is that there's more demand for computing hardware than the company can satisfy. As a result, alternative suppliers must rise; otherwise, the chipmaker may overextend itself during this build-out and cause issues down the road when AI spending isn't as intense.

This reality is reflected in Nvidia's long-term outlook, and there are 4 trillion reasons why I think Nvidia stock is a great one to buy on the dip.

Image source: Getty Images.

The market opportunity for AI computing is huge

Artificial intelligence hyperscalers have spent billions of dollars on computing power in 2025, and all of them have told investors that 2026 will be a year of even greater spending.

This bodes well for Nvidia, since its graphics processing units (GPUs) are at the heart of this spending. But CEO Jensen Huang said that its cloud GPUs are "sold out." If customers like Meta decide that they want more computing power than they originally planned for, they're out of luck. So, to get more, they needed to turn to alternative suppliers such as Advanced Micro Devices or Alphabet.

The decision for Meta to potentially use some of Alphabet's computing hardware isn't as much of a slight to Nvidia as it is to AMD, because it shows that Meta doesn't believe AMD's computing hardware is as good an alternative as Alphabet's. Still, what hyperscalers plan on spending on artificial intelligence (AI) during 2026 is a drop in the bucket compared to what Nvidia thinks it will be by 2030.

NASDAQ: NVDA

Key Data Points

Management believes that global data center capital expenditures (capex) will reach $3 trillion to $4 trillion by 2030. That's a huge increase from 2025's levels, which are projected to be about $600 billion. It isn't feasible for Nvidia to scale up to meet all of that computing capacity, since it could be left with plenty of unused capacity following 2030 if that's when the AI infrastructure build-out has neared completion.

So, seeing alternatives to Nvidia GPUs pop up isn't necessarily a bad thing; it's more like the company is conceding some of its market share in exchange for long-term stability.

Its investors have been burned by the company overextending into certain areas before (like a couple of cryptocurrency crashes), so this pivot is welcome. Still, even if Nvidia loses some of its market share, the stock could skyrocket if AI spending truly reaches $4 trillion by 2030.

Nvidia's stock is just getting started

In fiscal 2026 (ending January 2026), Wall Street analysts project the chipmaker will generate about $213 billion in revenue. So, if management believes that global data center spend in 2025 will be about $600 billion, that means about 35% of all money spent on data centers goes to the company. Some of these funds go toward categories that are not computing hardware, like land acquisition, construction, and infrastructure, which Nvidia will never capture.

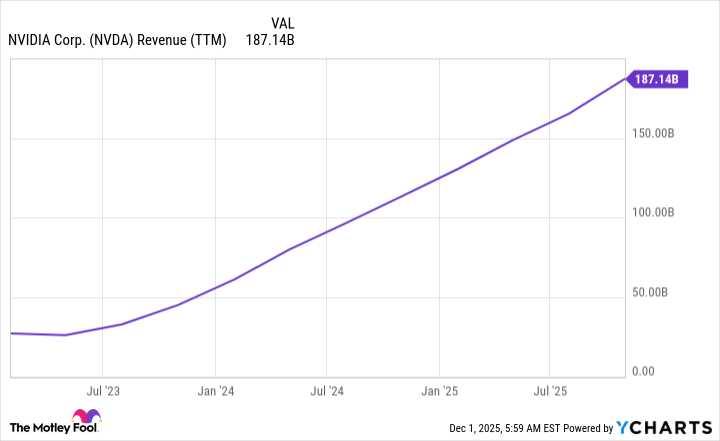

NVDA Revenue (TTM) data by YCharts; TTM = trailing 12 months.

If we assume the non-hardware share of data center construction costs falls to 20% by 2030 (which would be a significant tumble), but that AI spending reaches $4 trillion, that would indicate Nvidia would generate $800 billion in revenue. Its sales would nearly quadruple over the next five years if its spending projection pans out, making it a monster winner.

I think that $3 trillion to $4 trillion in annual spending is an aggressive estimate, but the direction is likely correct. Even if the estimate is off by 50%, that would still indicate Nvidia's revenue could double in five years -- which would likely result in the stock following suit.

We're still in the early innings of the AI build-out, and Nvidia is still providing the most commonly used hardware. This bodes well for its future, and I think investors can confidently buy the dip today.