To date, investors have mostly used revenue growth to measure an artificial intelligence (AI)-related company's success. And understandably so. Young industries aren't always profitable, but they don't necessarily need to be. It's often more important to establish market share first and worry about profits later.

Now, three years after the debut of OpenAI's ChatGPT and several years following the construction of many modern-day AI data centers, however, expectations are changing. Investors are now looking for an adequate return on their investment.

In some cases, they're finding it. In other cases, they're not ... at least not yet. And in a handful of cases like Nvidia (NVDA 0.29%) or Broadcom (AVGO +2.63%), investors are even seeing incredible overperformance in terms of profitability, even if it isn't built to last.

To this end, here's some perspective on the metric(s) you'll increasingly want to consider when picking artificial intelligence stocks.

Image source: Getty Images.

The rhetoric is shifting; take the hint

There are actually two different groups of stocks to consider here.

The first of these groups is the companies providing AI technology, like the aforementioned Nvidia and Broadcom. The former makes high-performance processors, while the latter makes blazing-fast networking equipment, connecting those processors into a single neural network.

And the other group? Companies using artificial intelligence technology to improve productivity and efficiency. Think Amazon (which uses AI to make product recommendations to customers, or map delivery routes) or the virtual drug-discovery work that Recursion Pharmaceuticals' software makes possible.

The ultimate expectation is the same: It's time for these companies' expenditures to start adding to the bottom line rather than subtracting from it.

And that's a tall order to be sure. Some recent number-crunching from J.P. Morgan concludes, "To drive a 10% return on our modeled AI investments through 2030 would route ~$650 billion of annual revenue into perpetuity." That's an enormous number ... a scope many investors up until this point just weren't appreciating. Even more daunting is a recent study done by MIT, which showed 95% of institutional investments in AI aren't yet providing any meaningful return.

And it's starting to matter more. Goldman Sachs' senior equity research analyst Eric Sheridan recently noted: "If the [investment] dollars keep rising, we will struggle to answer the ROI [return on investment] question based on what we know today. In every computing cycle I've ever analyzed, that has eventually led to a trough of disillusionment. I would be shocked if we avoided one this time."

It's something Sheridan added, however, that should really get investors thinking. He goes on to say, "In any technology cycle, typically only 2–3 companies in the same vertical earn an excess return on their cost of capital. And here, too, I see no reason why the AI cycle will prove any different."

In other words, investors better start getting picky.

Profits are important, but profit margins reflect marketability

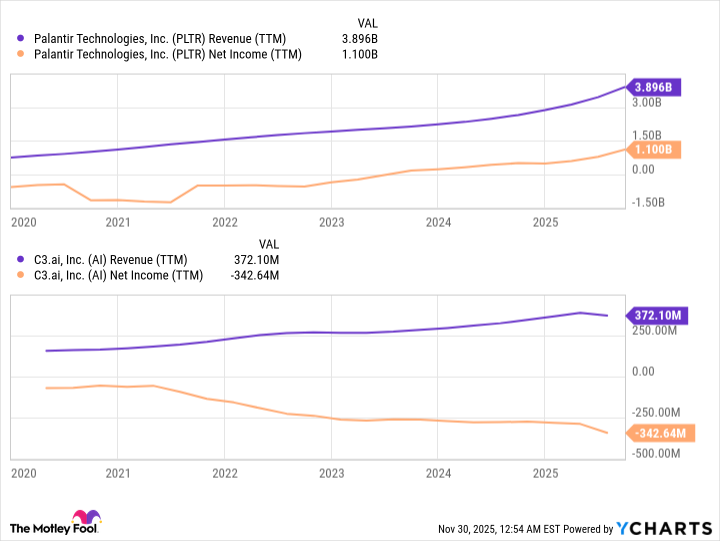

Some AI industries' leaders and losers are clear. Compare decision-making software name Palantir Technologies (PLTR 3.40%) to smaller rival C3.ai (AI 3.62%), for instance. Palantir's already reached critical mass, to so speak, with last quarter's revenue growth of 63% -- to nearly $1.2 billion -- more than tripling net income, to $477 million. That's a hefty profit margin rate of 40%.

Conversely, not only is C3.ai still in the red, but its losses are getting bigger as its top line grows. Being in business since 2009, investors may be understandably asking if C3.ai will ever be able to turn a sustainable profit.

Data by YCharts.

Not all comparisons will be as easy to make, though. In some cases, several companies within one aspect of the AI market are profitable.

Perhaps a better way of determining a stock's current and future value, therefore, is looking at the underlying company's ability to maintain a healthy net profit margin rate as an indication of its technology's continued marketability. For example, while AI data center service provider Iren (IREN +11.23%) and Nebius (NBIS +4.80%) are both currently profitable, Iren's historically been -- and still is -- a Bitcoin mining specialist. It's not a well-established data center outfit, and its expansion plans are incredibly ambitious with no room for error.

Rival Nebius, on the other hand, isn't wildly profitable right now, but it offers a range of specialized AI solutions such as inference machine leaning and image-generation that the industry increasingly needs. In the long run, it may be the more decisively profitable name.

Not even powerhouse Nvidia can sidestep this profitability scrutiny forever, even if its scrutiny will be different.

For perspective, of Nvidia's Q3 top line of $57 billion, a whopping $31.9 billion -- or 55% -- of it was turned into net income. That's still jaw-dropping, even if this net profit margin rate has been the company's norm since the middle of last year, when demand for artificial intelligence processors far outstripped supply. Clearly, with Nvidia facing no real competition, it's enjoyed some incredible pricing power!

Data by YCharts.

It's a profit margin rate, however, that's not likely to be sustained now that viable competition like Alphabet (GOOG 0.85%) (GOOGL 0.80%) and chip specialist Marvell Technology (MRVL +0.10%) are entering the AI chipmaking picture. Nvidia will almost certainly continue growing its top line, to be clear. But, investors will be forced to rethink this stock's usually rich valuation once the company's profit margins begin to be pressured by competing tech.

More than anything, though, keep the insight of Goldman's Sheridan in mind: There are only two or three companies in any particular sliver of the technology sector that maintain enough pricing power to thrive. The rest end up just chasing that market's leaders, often with margin-crimping price breaks.

Don't wait to follow the crowd

But you're sure that the AI market just isn't mature enough for metrics like profitability rates to matter yet? Maybe you're right.

There's never any official announcement that such a shift has been made, however. Investors often simply wake up one day and learn the hard way that things that didn't matter suddenly do matter.

That said, the sheer amount of talk about an AI bubble and increasingly voiced profit concerns (like those from Sheridan or J.P. Morgan's analysts) are a subtle warning that things are moving in this more discriminating direction. You don't necessarily need to be the very first investor to start thinking in terms of AI's actual profitability. But, you certainly don't want to be the last.