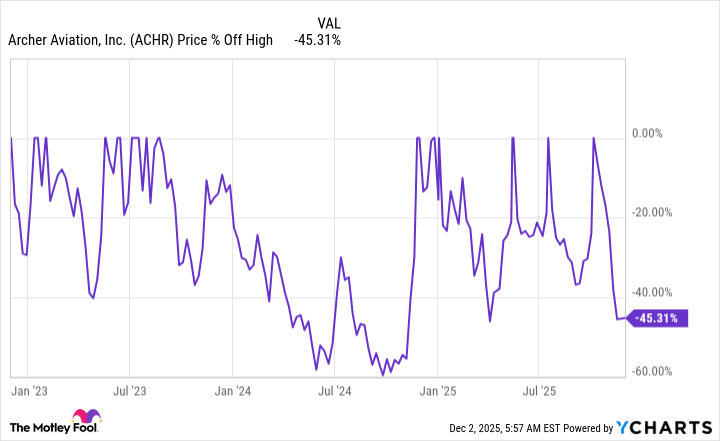

Shares of Archer Aviation (ACHR 2.60%) have fallen roughly 45% from their recent highs. The drop has been fairly swift, occurring since early October 2025. The stock is now down 22% over the past year. And yet it is still higher by nearly 190% over the past three years.

It isn't unusual for start-ups like Archer Aviation to go through heart-stopping price swings. So the question is, is this company worth buying now? Here's a look at the cases for buying, selling, and holding Archer Aviation.

The argument to sell (or not to buy) Archer Aviation

It is easiest to quantify the types of investors that shouldn't buy Archer Aviation and why. Regardless of the opportunities ahead for the company, it is currently still in start-up mode. It has an aircraft, but it is still seeking regulatory approval for its commercial use and ramping up its production capacity. Although it seems unlikely, it is entirely possible that the company falls short of successfully bringing its Midnight aircraft to market.

Image source: Getty Images.

In addition to execution risk, investors must consider that Archer Aviation is incurring significant losses despite the ongoing need for substantial capital investment in the business. That's not shocking, given the early stage of the business' development. But only the most aggressive investors should really buy money-losing start-ups that are attempting to bring new technology to market. If you are a risk-averse investor, you should steer clear of Archer Aviation.

The argument to buy Archer Aviation

If you believe that air taxis will change the way people travel in large cities, then you might want to take a ride with an investment in Archer Aviation. As noted, however, you need to be able to handle some turbulence. That's normal with start-ups.

What's more exciting about Archer Aviation is the material strides it is making toward its first commercial flight. The company's Midnight aircraft is successfully flying and working through the regulatory process. The company has a partner lined up in Abu Dhabi, where the Midnight aircraft is expected to carry its first commercial customer. After Abu Dhabi, Archer has partners in Japan, Korea, and Indonesia waiting in the wings.

NYSE: ACHR

Key Data Points

Meanwhile, in the United States, Archer Aviation plans to operate its own air taxi services in major cities, notably in New York and California. It recently agreed to acquire control of an airport in California that will act as a hub for the business in the future. Preparations for commercial operation in the U.S. market have also included getting regulatory approval to operate an airline and regulatory approval to train pilots.

Assuming everything goes smoothly from a business perspective, Archer Aviation is ready to launch air taxi services both internationally and domestically as soon as it gets the final nod from regulators. If execution is strong, Archer Aviation could see material upside for its stock as it establishes a foothold in a new niche within the aerospace industry.

The argument to hold Archer Aviation

What if you bought Archer Aviation at the recent high-water mark and are now down 45%? You have to make a couple of big decisions.

First, if this level of price volatility is too much for you, owning a stock like Archer Aviation may not be a good idea. You may want to cut your losses and find a less risky investment opportunity.

You may also want to sell your stock to capture the loss if you have gains elsewhere in your portfolio that you want to offset for tax purposes. Just make sure you don't buy it back within 30 days, or you'll nullify the tax benefit by running afoul of tax regulations.

That said, if you still believe in the story and can handle a volatile stock, you might as well stick around. The shares of start-up companies can move quickly both up and down, and dumping out now would leave you with the tough choice of deciding when the right time is to get back in.

It is probably better to think of Archer Aviation as a long-term commitment and hold through the rough patches. This is, after all, an aggressive growth investment. Big drawdowns are fairly common.

Archer Aviation: Some clear choices and some harder ones

The buy, sell, or hold decision with Archer Aviation involves some straightforward calls and others that are more challenging. If you are risk-averse, you probably shouldn't even consider owning this high-risk stock. It is only suitable for more aggressive investors, and even then, only for those who are willing to hold an investment for the long term.

However, Archer Aviation is making significant progress toward its ambitious goal of developing an air taxi and air taxi service. It may take some time, but the successful execution of management's long-term goals could turn it into a major player in the aerospace industry.