Alphabet (GOOG 1.30%)(GOOGL 1.38%) has made an impressive turnaround this year. In April, its share price sank as low as $141. It's currently sitting above $300 and is up nearly 69% year to date (as of Dec. 5).

There's understandable trepidation about investing in stocks after this rate of growth. But the parent company of Google remains an excellent investment, and there's one reason in particular it could continue to do well.

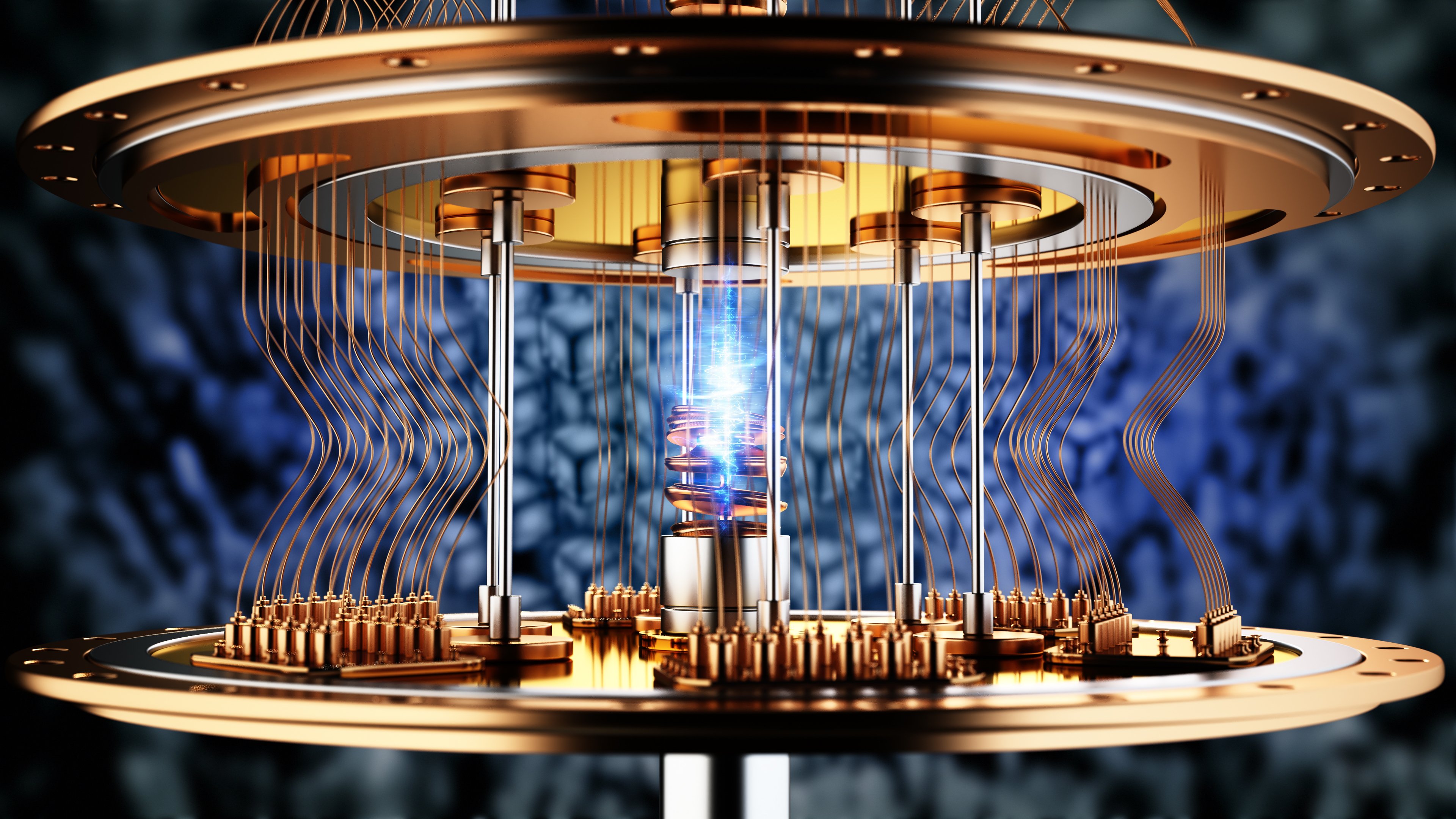

Image source: Alphabet.

Alphabet's AI stack gives it a significant edge

Artificial intelligence (AI) has been a major growth driver for tech companies, including Alphabet. The key differentiator for Alphabet is its full-stack approach. Other AI companies rely on partnerships, typically with Nvidia for graphics processing units (GPUs) and OpenAI, the developer of ChatGPT, for AI models.

Alphabet, on the other hand, develops its own custom Tensor Processing Units (TPUs) to train AI models. It has its own software framework, research lab, and large language model (LLM), Gemini. Gemini 3, which was released on Nov. 18, has received rave reviews so far and been part of Alphabet's recent success. Because Alphabet can do everything in-house, it isn't reliant on other companies for its AI development.

NASDAQ: GOOGL

Key Data Points

This vertical integration allows Alphabet to reduce the notoriously high costs involved with AI computing. It's also a revenue driver, as Alphabet can sell its AI products and services to other companies. For a recent example, Bloomberg has reported that Meta Platforms is considering purchasing Alphabet's TPUs for its data centers instead of Nvidia GPUs.

Alphabet stock was a bargain earlier this year. Although it's now trading at a much higher valuation, this is still one of the best tech companies and one that's well-positioned to capitalize on the growth of AI.