High-yield dividend stocks are an excellent means of participating in the stock market while generating passive income. But even the highest-yielding stock in the S&P 500 -- LyondellBasell Industries (yielding 12.6%) -- couldn't keep up with recent S&P 500 gains on dividends alone. At the time of this writing, the index is up 16.6% year to date after gaining more than 20% in both 2023 and 2024.

The best reason to buy high-yield dividend stocks isn't to try to beat the indexes with dividends. Rather, it's to invest in solid companies at good values that also reward investors with dividends. A dividend is reliable only if the company paying it can support the expense.

By investing $4,000 in United Parcel Service (UPS 1.61%), investors can expect to earn $275 in annual dividends, based on its current yield. Here's why the value stock is a buy in 2026.

Image source: Getty Images.

UPS is testing investor patience

UPS continues to disappoint investors, down around 25% year to date and up just 15% from its 12-year low. Revenue and margins surged during the COVID-19 pandemic. Both metrics have been steadily declining for the last three years, in lockstep with UPS's falling stock price.

Despite the challenges, UPS has remained committed to its dividend, which now yields a staggering 6.9% because the stock has fallen so much. That's a tasty incentive for folks willing to hold the stock in the hopes that UPS can turn things around.

But it's a mistake to buy a stock solely for the yield -- as evidenced by UPS' recent performance. Even factoring in dividends, UPS investors have still lost 28.1% over the last five years, while the S&P 500 would have doubled your money during that period.

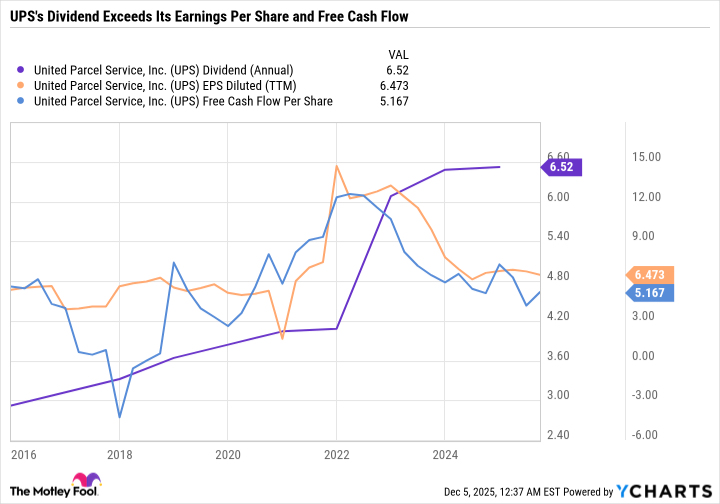

As you can see in the following chart, UPS' dividend has increased significantly in recent years while its earnings and free cash flow (FCF) have continued to slide.

UPS Dividend (Annual) data by YCharts

Now, the dividend is slightly larger than earnings and FCF, which is usually a red flag that a dividend cut could be on the way. However, UPS believes that its dividend is sustainable and could even increase. UPS CFO Brian Dykes said the following on UPS' third-quarter fiscal 2025 earnings call:

We're seeing growth in the areas of the markets where we want to grow that allows us to drive better returns and better margins. With the cost takeout and the network efficiency that we're creating through our automation investment, we do expect the business to generate significantly more free cash flow over time. Clearly we've got a dividend of around $5.4 to $5.5 billion and we expect it to be above that in the very near future.

UPS is deep in the bargain bin

After overexpanding its network during the pandemic, UPS has been working to drive efficiency and adjust to the new normal of slower package delivery growth, particularly in the residential sector, as consumers tighten their spending. Those improvements are already starting to pay off, as UPS' margins have at least stopped going down.

NYSE: UPS

Key Data Points

UPS's margins should continue to recover because it is making a concerted effort to reduce low-margin, high-volume deliveries and focus on more profitable areas like small and medium-sized businesses, business-to-business, and time- and temperature-sensitive healthcare deliveries. In fact, UPS plans to slash delivery volumes for Amazon by 50% by June 2026. Given that Amazon is UPS's largest customer, this may cause a revenue decrease. However, it could be the right long-term move if it enables UPS to capture higher-margin opportunities while making the company leaner and more flexible.

Analysts seem to agree, as consensus estimates have UPS booking $6.87 in 2025 earnings per share (EPS) and $7.16 in 2026 EPS.

IF UPS achieves 2026 estimated EPS, it will have a price-to-earnings (P/E) ratio of just 13.2 based on a stock price of $94.76 per share at the time of this writing.

For context, UPS' 10-year median P/E is 19.7 -- showcasing just how discounted the stock is right now.

UPS has fallen far enough

UPS hasn't given investors a lot to cheer about in recent years. With a massive network reconfiguration underway to prepare for the Amazon change in 2026, it's understandable that some investors may not want to invest in the stock now.

Management's confidence in improving FCF to justify future dividend raises is a relief for passive income investors. UPS could still potentially cut its dividend if the plan doesn't go well, but that seems less likely now.

Even if UPS does cut its dividend, it would still be a high-yield stock and yield more than its peer FedEx.

Given its dirt-cheap valuation, income investors looking for high-yield stocks at a good value may want to take a closer look at UPS for 2026.