For the last three years, one theme has dominated the stock market: artificial intelligence (AI). Since the end of 2022 -- when OpenAI kicked off the AI revolution with the commercial launch of ChatGPT -- shares of the Roundhill Generative AI & Technology ETF and the Invesco QQQ Trust have soared by 137% and 84%, respectively -- each handily outperforming the S&P 500 (^GSPC +0.67%).

This level of prolonged momentum, and the resultant higher valuations of some of the tech stocks that drove it, have led some on Wall Street to assert that AI stocks are in a bubble. Indeed, it's hard to deny that the market has become frothy.

However, many of the biggest gainers in these technology ETFs -- namely, the "Magnificent Seven" -- arguably trade at relatively reasonable valuations when compared to their current and expected growth rates.

So while I do not think the AI sector itself is in bubble territory, I think prices in one specific area of the technology sector have flown too close to the sun after a recent period of abnormally high returns. I'm talking about quantum computing.

In particular, I see three specific quantum computing stocks that smart investors should avoid now.

Image source: Getty Images.

Quantum computing stocks are soaring...

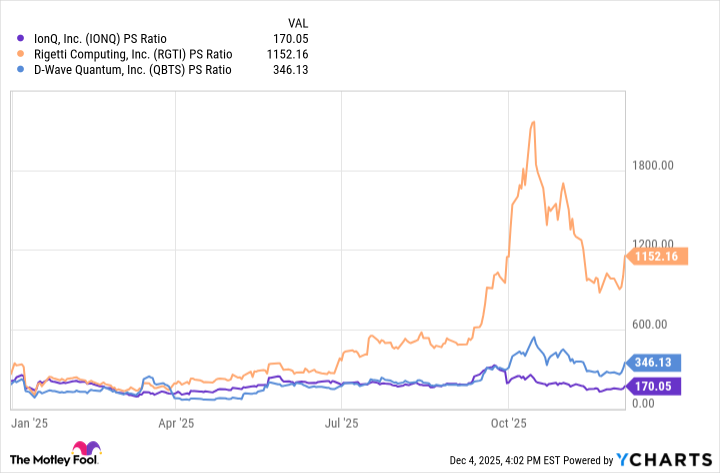

The biggest gainers in the quantum computing space over the past few years have been pure plays such as IonQ (IONQ +1.39%), Rigetti Computing (RGTI +6.63%), and D-Wave Quantum (QBTS +4.07%). Since the dawn of the AI revolution, each of them has skyrocketed by more than 1,000%.

As the chart above illustrates, the majority of these gains have taken place throughout 2025. So, what happened this year?

The answer is... nothing. None of the quantum computing pure plays have achieved meaningful technological breakthroughs, nor have they gained significant customer traction at the enterprise level.

Instead, IonQ, Rigetti, and D-Wave are pouring billions of dollars into acquisitions and developing new computing architectures using trapped ions and superconducting techniques.

The main catalyst behind the rise of quantum computing stocks has been the hype-driven narratives circulating in online forums and on social media. Risk-seeking day traders are riding the momentum in IonQ, Rigetti, and D-Wave -- turning these potential long-term opportunities into meme stocks.

Image source: Getty Images.

...but history shows these valuations are unsustainable

One of the most obvious parallels to the current situation in the tech sector is the early era of the internet. During the late 1990s, Wall Street got caught up in the notion that every type of business would turn to the internet for growth.

Virtually any company that added a "dot-com" to its name seemed to fetch a premium valuation. Stock prices soared based on aggressive and unrealistic forecasts rooted in user growth, clicks, and page views, as opposed to concrete financials or measurable operating benchmarks.

These same dynamics are increasingly visible in quantum computing stocks. Though IonQ, Rigetti, and D-Wave have little traction and large ongoing cash burn rates, each boasts a price-to-sales (P/S) ratio well above what was common for the darlings of the dot-com bubble.

IONQ PS Ratio data by YCharts

Prior to the dot-com bubble bursting in early 2000, companies like Microsoft, Amazon, and Cisco witnessed peak P/S multiples in the range of 31 to 51. Online marketplace eBay soared to 144 times sales at its record high.

Quantum computing pure plays are trading at valuation multiples much higher than that.

Not only were the prominent dot-com era companies unable to sustain their premium valuations, a fair number of them eventually went bankrupt because they lacked either a commercially viable product, a clear strategy to reach profitability, or both.

When will the quantum computing bubble pop?

Nobody has a reliable crystal ball that can tell us precisely when -- or if -- this apparent quantum computing bubble will burst. However, given everything, I think it's more likely than not that a sharp correction is in store for IonQ, Rigetti, and D-Wave.

Indeed, I think such a reversal may already be in motion. A number of insiders at D-Wave -- including its CEO, CFO, and other board members have been selling shares. So has the CEO of Rigetti.

I suspect that these executives fully understand that the current trajectory of quantum computing stocks is unsustainable, and they are capitalizing on the outsized momentum and taking profits in the expectation that shares will plummet.

With all that in mind, I expect quantum computing stocks are going to crater in 2026, and the pure plays run the biggest risk of becoming falling knives. So investing in IonQ, Rigetti, or D-Wave now puts you at risk of becoming a bag holder.