Costco Wholesale (COST +0.76%) has been lagging behind the broader stock market recently, but the retail giant may have deserved a break. The stock has still crushed the market over the long haul.

How a $10,000 Costco bet would have gone in six months

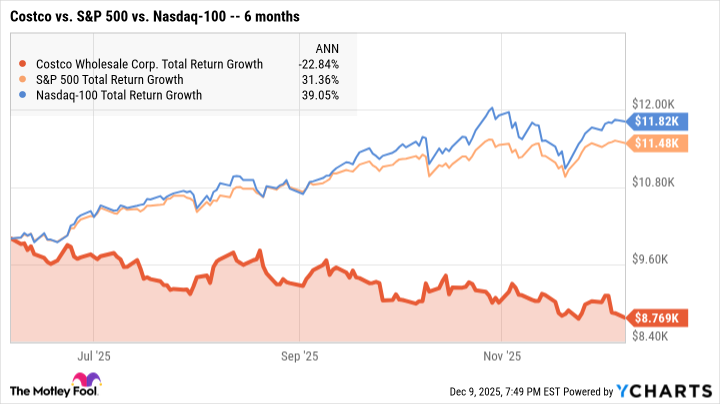

Let's say you invested $10,000 in Costco stock six months ago, enabled your brokerage's dividend reinvestment plan (DRIP), and left the stock alone. That position would be worth $8,769 by Dec. 9. That's a total return of negative-12.3%, or an annualized return of negative-22.8%.

Putting the same money in an S&P 500 (^GSPC +0.03%) index fund instead would have resulted in a single-ticker portfolio worth $11,480. And the tech-heavy Nasdaq-100 index ran even further ahead; an index tracker such as the Invesco Nasdaq 100 ETF (QQQM +0.32%) would be up to $11,820 today.

COST Total Return Level data by YCharts

Costco looks better on a three-year chart

The story changes if you stretch the timeline a bit. Costco investors have outperformed the S&P 500 over the past three years, for example. (Keeping pace with the supercharged Nasdaq-100 during the artificial intelligence (AI) boom was a tougher task.)

COST Total Return Level data by YCharts

Costco shines over time

And what if you held your Costco stock for five years, dating back to December 2020? The longer time span really puts Costco in the spotlight, as it outperformed both the S&P 500 and the Nasdaq-100 in this period.

COST Total Return Level data by YCharts

Valuation check: Is Costco's stock still a Kirkland bargain?

Bearish investors might say that Costco is running out of rocket fuel. The stock traded at a lofty 95 times free cash flow (FCF) in the spring of 2025. The current multiple of 50 is far lower, but still nosebleed-inducing if you're a diehard value investor. And wasn't Costco supposed to be a value play in the first place? It's kind of ironic when the stock of a legendary discount retailer trades at a rich price premium.

Moreover, Costco faces the same challenging economic environment as everyone else, with operating costs increasing because of tariffs and inflation. It can't be easy to run a low-margin warehouse retailer under these conditions.

Image source: Getty Images.

Costco bulls see this deep price dip as a buying opportunity instead. Costco's financial results are soaring as belt-tightening consumers turn to Costco's wallet-saving goods. Trailing-12-month sales are 19% higher than three years ago, while FCF nearly tripled. I'm talking about a fine-tuned cash machine.

I'm siding with Costco's fans at this point (Costco investors and customers, not their ceiling fans). Yes, the stock still trades at sky-high valuation ratios, but the company has earned that price premium by thriving in both good and bad times. Temporary pullbacks can happen to any stock; patience is a life-saving virtue on Wall Street.