Entertainment legend Michael Ovitz, co-founder of Creative Artists Agency, once called the film industry "the most cut-throat, competitive, difficult business in the world." That description seems apt as we watch the intensifying battle between Netflix (NFLX +0.40%) and Paramount Skydance (PSKY 0.44%) to acquire the assets of Warner Bros. Discovery (WBD 0.22%).

After Netflix apparently came out victorious in the recent bidding war, Paramount turned up the heat by launching a hostile takeover bid. The action demonstrates the high stakes involved in this industry consolidation phase of the streaming wars. But where does the ongoing battle leave investors?

Image source: Getty Images.

What's involved in the Netflix deal

Understanding the proposed acquisition's ramifications requires first unraveling the intricacies of Netflix's agreement. Netflix is offering to pay WBD shareholders $23.25 in cash and $4.50 in Netflix stock for each WBD share. This values Warner Bros. Discovery stock at $27.75 per share with an enterprise value of $82.7 billion.

But the devil is in the details. The amount of Netflix stock they will actually receive isn't guaranteed. The agreement includes a collar where WBD shareholders will only receive $4.50 in Netflix shares if the stock's 15-day volume weighted average price falls between $97.91 and $119.67 in the three days before the deal closes. If not, WBD shareholders will get either 0.0460 or 0.0376 Netflix shares for each WBD share, depending on whether Netflix's stock price is below or above the range.

That's not all. The Netflix deal is expected to take between 12 months and 18 months to close. Before then, Warner Bros. Discovery intends to complete its previously announced split into two publicly traded businesses. One would be called Warner Bros., and include the film and TV divisions, the HBO brand, and the gaming segment. The other would take Discovery, CNN, TNT, and the other TV outlets, and form a company called Discovery Global.

Netflix wants to buy just the Warner Bros. business. This means the $23.25 in cash and $4.50 in Netflix stock paid to WBD shareholders would apply only to the future shares held in the standalone Warner Bros. company. Warner Bros. Discovery shareholders would still get, and be able to keep, their shares in the new Discovery Global, post acquisition.

NASDAQ: NFLX

Key Data Points

Why Paramount Skydance thinks it has the superior offer

Paramount believes its offer, with an enterprise value of $108.4 billion, is better for Warner Bros. Discovery shareholders. It proposes to pay $30 per share in an all-cash deal that encompasses the entire company, including the Discovery Global portion.

The Paramount offer avoids the uncertainty of the Netflix collar and the as-yet unknown market value of Discovery Global. Paramount management has also suggested that Discovery Global on its own would only be worth about $1 per share, given the debt load the new company could be saddled with.

Paramount also argues Netflix's acquisition faces greater regulatory scrutiny, and may be blocked by Washington because it would combine the top streaming service with the third largest. In fact, a recent Bank of America report analyzing the proposed deal stated, "If Netflix acquires Warner Bros., the streaming wars are effectively over. Netflix would become the undisputed global powerhouse of Hollywood beyond even its currently lofty position."

Netflix has demonstrated some confidence in its ability to close the deal by offering to pay Warner Bros. Discovery a $5.8 billion break-up fee if it falls through. However, President Donald Trump introduced an unusual wrinkle to the situation by getting directly involved in the regulatory approval process. Notably, his son-in-law Jared Kushner is among the investors backing Paramount's offer.

NASDAQ: PSKY

Key Data Points

Netflix stock vs. Paramount Skydance stock

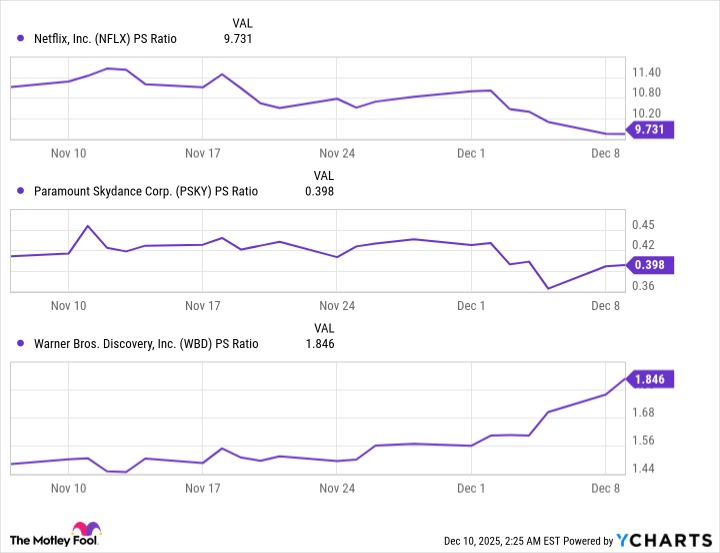

The whirlwind of events has transformed the valuations of the stocks involved. This can be seen in their price-to-sales ratios.

Data by YCharts.

Netflix's P/S multiple dropped in December, indicating its shares have gotten less expensive. So did Paramount's. Meanwhile, WBD's P/S ratio soared this month, thanks to the battle between its suitors.

For investors, this creates an opportunity to buy Netflix or Paramount stock, but this doesn't look like the best time to buy WBD, which closed trading Thursday at $29.49 -- more than the apparent value of the Netflix bid, and just shy of the value of the Paramount offer. For WBD shareholders who want to avoid worrying about the uncertainty of which company will end up the victor, it's a good time to sell, given that the stock has gained 179% in 2025 through Dec. 11.

If Netflix can prevail and gain regulatory approval for the acquisition, it will be well positioned to dominate the entertainment sector. Yet even if it fails to acquire Warner Bros. Discovery, it remains the streaming industry leader, and in the wake of its P/S ratio drop, now would be a good time to scoop up shares.

If Paramount achieves victory in its hostile takeover bid, the addition of Warner Bros. Discovery to its portfolio would, in principle, lead to a stronger combined company, with HBO Max boosting its streaming segment while WBD's various television and cable outlets complement Paramount's networks, including its flagship CBS.

However, it's too early to tell if the recently combined Paramount Skydance can achieve streaming success against Netflix. Therefore, regardless of the WBD acquisition's outcome, Netflix looks like the superior stock to pick now.