Bitcoin treasury companies are all the rage. These companies hold large amounts of Bitcoin (BTC 1.09%) on their balance sheets, often selling stocks or bonds to accumulate even more Bitcoin over time. According to a Glassnode analysis, the total Bitcoin holdings of public and private companies have increased nearly 450% since January 2023.

Strategy (MSTR 1.74%), which began hoarding Bitcoin in August 2020, is considered the pioneer of the crypto treasury model. The business-to-business software provider proudly proclaims that it's the largest corporate holder of Bitcoin, with around 660,000 Bitcoin on its balance sheet as of Dec. 12.

The price of Bitcoin has appreciated by 19,300% since its inception, making it a life-changing investment for long-term holders. Should you consider investing in a Bitcoin treasury company for additional exposure?

Image source: Getty Images.

Not all Bitcoin treasury companies are created equal

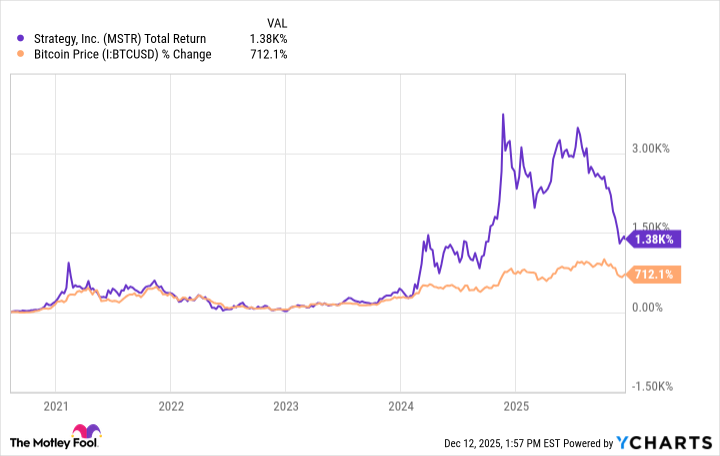

With roughly 3% of the world's total Bitcoin supply on its balance sheet, Strategy says its stock gives investors "amplified exposure to Bitcoin." Since the dawn of Strategy's self-proclaimed "Bitcoin Standard Era" in August 2020, MSTR has delivered a total return of nearly 1,400%, while Bitcoin is up 712%.

Data by YCharts.

In 2025, however, MSTR is down 38%, while Bitcoin is down nearly 3%. So that amplified exposure comes with a lot of volatility.

On the list of the top 100 publicly traded Bitcoin treasury firms ranked by holdings, you'll find a smattering of widely known companies like Tesla and MercadoLibre, as well as Reddit favorites like MARA Holdings, Riot Platforms, and Cipher Mining. You'll also find some fly-by-night penny stocks that have jumped on the Bitcoin bandwagon to prop up their highly unprofitable businesses and/or enrich their founders.

If you're a believer in Bitcoin as a store of value and an attractive long-term investment, I like Strategy as a leveraged play on the cryptocurrency. But I wouldn't recommend investing in a company solely because it holds a lot of crypto on its balance sheet. If you're looking to pour your hard-earned money into a stock, make sure the underlying business has strong growth prospects and solid fundamentals.