Growth in artificial intelligence (AI) looks relentless. Tech companies continue to spend feverishly on new products and services, aiming to stay on top of one another. That growth has enabled chipmaker Nvidia (NVDA +0.81%) to become the most valuable company in the world, with a market cap of around $4.2 trillion today.

The tech giant has grown both sales and profits at rapid rates. Its dominance in the AI chip market has drawn the attention of other companies, which are developing their own chips in an effort to be less dependent on Nvidia. But that may not necessarily be the biggest concern for the business. CEO Jensen Huang believes that what could weigh down not only Nvidia but the entire industry is regulation, if it's done wrong.

Image source: Getty Images.

Regulation by individual states could cripple the industry's growth prospects

One thing that's clear with AI's growth is that there needs to be some strict regulations in place. Companies that run popular chatbots are facing lawsuits for multiple reasons, including copyright infringement and a lack of proper safeguards for users. In some rare instances, users contemplating suicide have had questionable chatbot interactions. In at least one case, rather than providing a troubled user with advice on how to seek help, ChatGPT was accused of encouraging the user to go forward with the act. And this isn't an isolated incident.

The specifics of any regulation for AI are still uncertain. But if the regulations get complicated or vary by state, it could impact AI's growth prospects in a big way. "State-by-state AI regulation would drag this industry to a halt, and it would create a national security concern, as we need to make sure that the United States advances AI technology as quickly as possible," Huang told reporters on Capitol Hill earlier this month after meeting with President Donald Trump. Trump is in favor of putting in place a federal standard that would allow for greater clarity and consistency, which Huang believes is the right approach. Trump issued an executive order on Dec. 11 that purports to require that AI regulations be instituted nationally and not state-by-state. The legality of such an order is likely to be challenged.

While tech companies like Nvidia would be in favor of policies that would allow them to continue growing at fast rates, it's inevitable that some level of oversight is coming. How complicated and restrictive it proves to be could significantly impact the industry's short- and long-term growth prospects, and it's an uncertainty that investors buying AI stocks should be aware of.

Nvidia's growth rate has been strong due to AI in recent years

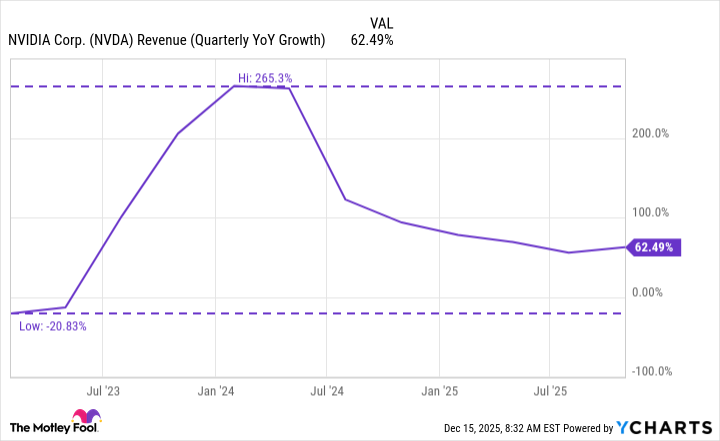

It's been three years since the emergence of OpenAI's ChatGPT back in 2022, and that sparked a rally in both the stock market and Nvidia's sales. Three years ago, the business was struggling to grow, and things changed drastically afterward. Demand for Nvidia's cutting-edge AI chips exploded. And while its growth rate has come down over the past year, it remains high at over 60%.

Data by YCharts.

Maintaining a high growth rate is key for Nvidia to continue commanding a high valuation. The stock currently trades at a price-to-earnings multiple of 43, but investors remain bullish simply because of the expected growth that lies ahead. The stock's price-to-earnings-growth (PEG) multiple is around 0.7, which signifies good value when factoring in analyst expectations for future growth. But if those expectations are adjusted downward due to an increase in regulation, then Nvidia could suddenly start to look like a much more expensive stock to own.

NASDAQ: NVDA

Key Data Points

Should you invest in Nvidia's stock today?

Heading into trading today, Nvidia's stock has risen by 30% since the start of the year. There's still plenty of excitement around the stock, despite its elevated valuation. If you're a long-term investor who's willing to hold on for multiple years, Nvidia can still make for a good investment. However, it's important to consider the near-term risks and uncertainty related to the economy and AI.

It's likely to be a bumpy road ahead, but with Nvidia becoming a leader in the space, it remains on track for a lot more growth in the future. Buying the stock at these levels can still make a lot of sense, but you should also brace for the possibility of a pullback in the short term.