After peaking at $124,774 per coin on Oct. 7, 2025, Bitcoin (BTC 4.09%) has taken a tumble. As of the market close on Dec. 16, the leading cryptocurrency has dropped 31% to $86,413.

At the same time, Bitcoin mining veteran MARA Holdings (MARA 3.65%) has plunged 53% since mid-October. Assuming you see brighter days ahead for Bitcoin and the broader crypto market, should you forget about Bitcoin and invest in MARA's deeper discount today?

NASDAQ: MARA

Key Data Points

How MARA became a Bitcoin-first business

MARA has been a cryptocurrency mining specialist for a few years now. Then known as Marathon Patent Group, the company had built expertise in encryption technologies for more than a decade. It bought its first $150 million of Bitcoin and some mining equipment in January 2021, changed its name to Marathon Digital Holdings to reflect its newfound cryptocurrency focus, and set off on new adventures.

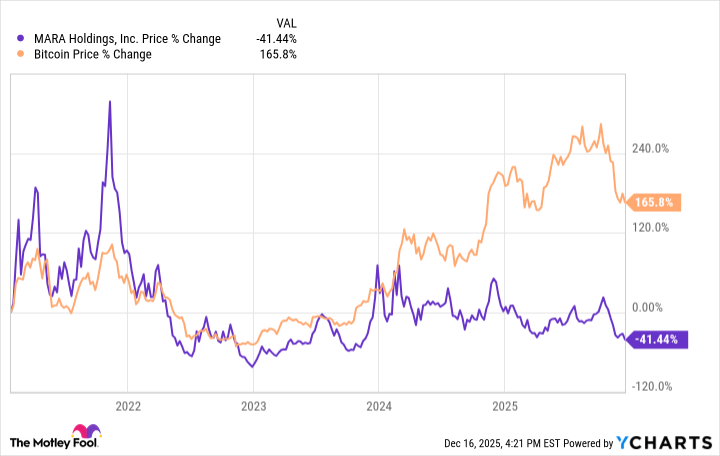

Marathon Digital Holdings often amplified whatever market moves Bitcoin was making. If the crypto was up, Marathon gained more. On a bearish Bitcoin day, Marathon posted a deeper dive. Generally speaking, the stock was just a more volatile version of owning Bitcoin.

The math changed for MARA

That tight correlation snapped in the spring of 2024:

Bitcoin had a couple of forces working in its favor.

- The U.S. Securities and Exchange Commission (SEC) approved the first spot Bitcoin exchange-traded funds (ETFs) in January that year, fueling an inrush of capital into leading funds such as the iShares Bitcoin ETF (IBIT 0.23%) and the Bitwise Bitcoin ETF (BITB 0.35%).

- Three months later, Bitcoin miners started receiving 3.125 Bitcoin instead of 6.25 Bitcoin as a reward for validating the next block of transaction data. The fourth halving in Bitcoin's history lowered its effective inflation rate and disrupted the economic model of Bitcoin mining operations.

As you might imagine, the halving event made Marathon's mining efforts less profitable. The costs of buying number-crunching equipment remained the same, and the electric bills increased. Sure, Bitcoin prices more than doubled over the next year and a half, but the competition for those sweet mining rewards also increased.

On average, Marathon produced about 28.8 Bitcoin per day in March 2024. The production rate fell to 24.5 Bitcoin per day 18 months later. Thanks to the increasing Bitcoin prices, Marathon's quarterly crypto-mining revenue rose 37% over this period. At the same time, the cost of producing the Bitcoin jumped 82% higher.

Image source: Getty Images.

MARA's next new plan: data centers, power sales, and AI

Marathon is no stranger to trying new ideas. The company changed names again in August 2024, and the revamped MARA Holdings company has expanded its business plan to include selling electric energy and data center space to other companies. That's mainly a play on the ongoing artificial intelligence (AI) boom, which shares much of its infrastructure with the crypto-mining community.

So you may see MARA's stock chart continue to loosen its Bitcoin bands over time. The company is still mining Bitcoin and buying more coins on the open market, and it's early days for its installation of AI-computing hardware in the Bitcoin mining centers, but MARA takes this alternative business seriously.

CRYPTO: BTC

Key Data Points

MARA's discount comes with strings attached

MARA Holdings is a distinctly different company again, and its flexible operating plan could set the company up for Bitcoin-beating success over time. The idea is simple: Lean into AI computing when that's the more lucrative business, and refocus on Bitcoin mining when the AI demand is low, or Bitcoin prices are deeply discounted, or both.

However, MARA is entering another heavily contested market. It's not the only former Bitcoin mining specialist making this switch, and the repurposed miners face off against a plethora of much larger companies. Until further notice, I will continue to see MARA as a Bitcoin mining company, because it doesn't have any AI-related contracts to speak of yet.

I own a few MARA shares, but they are a microscopic part of my diversified portfolio. My direct exposure to Bitcoin is significantly larger, and that won't change anytime soon.

MARA's more sustainable long-term plan may make it a decent investment at today's low prices, but I'm in no hurry to forget about Bitcoin. If anything, I'm more likely to double down on my Bitwise Bitcoin ETF and direct Bitcoin holdings than to grow my MARA position in this dip. MARA's business is still primarily focused on Bitcoin-related activities, and the costs are rising faster than the mining rewards.