Warren Buffett's time as CEO of Berkshire Hathaway (BRK.A 0.56%) (BRK.B 0.67%) is unfortunately coming to a close. The legendary CEO has provided investors with incredible advice and has made some savvy investments along the way.

During the latest round of filing Form 13Fs with the SEC, it was revealed that Berkshire took a new stake in Alphabet (GOOG +0.62%) (GOOGL +0.59%). This shouldn't come as a surprise, as Buffett has long regretted not investing in Alphabet sooner. However, this latest stock pick has already paid off in a big way, as Alphabet's stock has risen dramatically since he took a position.

The question is, is it still a great stock pick for 2026?

Image source: The Motley Fool.

Buffett's trades are lagging indicators

When a firm has over $100 million in assets, as Berkshire certainly does, it must file a Form 13F to disclose its holdings at the end of the quarter. This information is then made available to the public 45 days later. This means that Berkshire purchased shares of Alphabet between July 1 and Sept. 30, and depending on when they took their positions, Berkshire could be sitting on massive gains.

Alphabet's stock has been on fire since July 1, and if Berkshire bought all of its Alphabet shares on that day (an unlikely proposition), it's about 75% since then. If Berkshire waited until Sept. 30 (another unlikely proposition), it's still up nearly 30%, an outstanding return in a short timeframe.

Berkshire's Alphabet investment has been successful so far, but the problem for individual investors tracking their trades is that you cannot go back and purchase the stock at the same price that Buffett and Berkshire did. So, investors must consider whether the price to pay now is too steep compared to what Berkshire paid for it.

Alphabet has a bright future

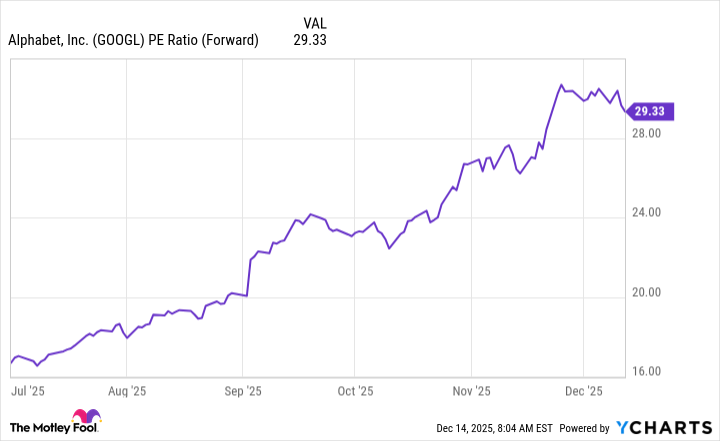

At the start of the period when Berkshire could have bought Alphabet, the stock was trading for just over 16 times forward earnings.

GOOGL PE Ratio (Forward) data by YCharts. PE = price-to-earnings.

Now, it's priced at 29 times forward earnings. That's a massive difference, because it used to trade at a huge discount to the market (as measured by the S&P 500, but now it trades at a large premium (the S&P 500 trades for 22 times forward earnings).

So, is Alphabet worth buying now?

Alphabet had a massive run-up in that short timeframe for a few reasons. First, Alphabet received positive news in a court case surrounding the status of its crown jewel, the Google Search engine. Alphabet only had to make a few concessions in its business, which is a far cry from the breakup that the Justice Department was seeking.

Second, Alphabet has emerged as a top player in the generative AI realm. It has mounted such a comeback that OpenAI, the makers of ChatGPT, declared a "code red" regarding Alphabet's Gemini model. Alphabet is clearly a top player in this area, and that dominance could make it a strong buy for the future.

NASDAQ: GOOGL

Key Data Points

Alphabet's legacy businesses, advertising and cloud computing, have also put up respectable growth figures in recent quarters. In the third quarter, Google Search revenue rose 15% year over year, and Google Cloud saw a 34% growth rate. This led to overall growth of 16% for the quarter and diluted earnings per share (EPS) rising 35%.

Alphabet is in a great position to have a strong 2026, so I think investors can follow Buffett's lead and scoop up Alphabet. However, your returns won't be nearly the same as Buffett's because of getting in late, versus when Buffett and Berkshire did in the second quarter.