IonQ (IONQ 0.28%) has never been a stock meant for conservative investors' portfolios. It's a high-risk, high-potential-reward stock, but the company is making rapid strides toward developing a commercially useful quantum computer, which many expect will be one of the most disruptive technologies of the next decade.

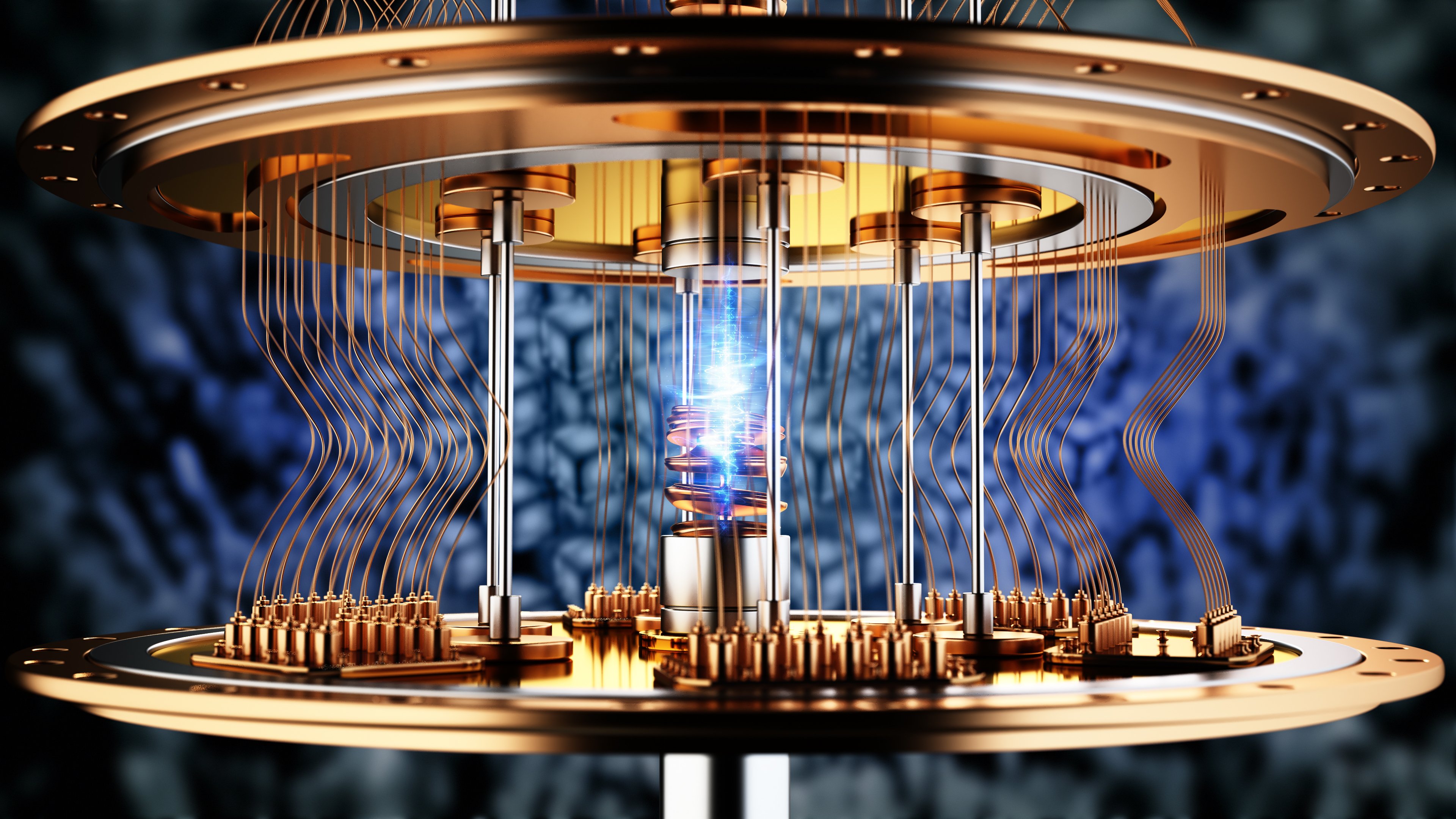

Image source: Getty Images.

Recent developments suggest IonQ's shares can almost double and reach nearly $100 by 2026. In fact, Jefferies this past week initiated coverage for the stock with a buy rating and a target price of $100, highlighting IonQ's trapped ion quantum computing architecture as a key differentiator that could allow it to build low-error, highly coherent quantum computing solutions at commercial scale.

Here's why this is a plausible target price for the company.

Growth catalysts

The company's exceptional operating performance backs the bullish thesis. In the third quarter, IonQ grew revenues at a record rate of of 222% year over year to $39.9 million, beating the high end of management's guidance range by 37%. The company also has a robust balance sheet, with $3.5 billion in pro forma cash and no debt.

NYSE: IONQ

Key Data Points

IonQ is increasingly winning large-scale, solution-based contracts and executing a land-and-expand strategy across quantum computing, networking, sensing, and cybersecurity, rather than selling isolated systems. In addition to commercial momentum, the company is also achieving multiple technological milestones.

The company's fifth-generation Tempo system has achieved an algorithmic qubit score of 64, implying that it can now tackle complex problems like a quantum system with 64 high-quality algorithmic qubits. The company also achieved 99.99% two-qubit fidelity, which means that its two-qubit systems perform error-free computations 99.99% of the time. These milestones will further boost the company's commercial progress.

IonQ is now aiming to develop quantum computing systems with 256 physical qubits by 2026 and 10,000 physical qubits by 2027. If the company hits those goals, its quantum systems would be capable of solving problems that would require an unimaginable amount of power for classical computing systems.

Although it may require robust execution capabilities and sustained investor confidence for Ion stock to hit $100 by 2026, long-term investors who can tolerate near-term volatility could consider picking up a small stake in IonQ now.