With 2025 nearly in the books, now is the perfect time for investors to review their financial portfolio to see where they stand and where they want to go in 2026. And as tempting as it may be to dive headfirst into this year's hottest stocks, the market tends to care more about where a company is headed than where it has been.

Some hot stocks certainly have room to run. But recency bias is a fickle beast. Viewing investment opportunities with a clean slate can help you weigh the pros and cons more fairly, rather than overemphasizing the factors that led to gains in the prior year.

Nike (NKE +4.64%) just fell 10.5% the day after reporting earnings. The stock is down 57% in the last five years compared to an 84% gain in the S&P 500. But that doesn't matter now. What matters is where Nike is headed from here. And there's an argument that Nike, despite myriad flaws, has become too cheap to ignore.

Image source: Getty Images.

Nike's DTC dilemma

Nike's quarterly results were decent, with a 1% increase in total revenue, including an encouraging 8% increase in wholesale revenue, but an 8% decrease in Nike Direct revenue. Nike Direct consists of Nike Digital and Nike-owned stores -- which are direct-to-consumer (DTC) channels that streamline Nike's supply chain and marketing.

When Nike Direct is at its best, these channels can boost engagement and help Nike stay in tune with changing consumer preferences. However, the business model also has its downsides.

Nike Digital relies on online customer loyalty, while Nike-owned stores depend on in-person customer loyalty. That means Nike has to be on the ball with fresh product cycles and storytelling while balancing price sensitivity. The wholesale sales funnel, which has been performing far better than DTC as of late, puts less pressure on Nike because its partners essentially help make the sale in exchange for a cut of the profits.

To be fair, even DTC native brand Lululemon Athletica, which heavily relies on company-owned stores and e-commerce, is struggling due to consumer spending pressures. Wholesale or DTC aside, the larger issue at Nike is that the company's sales are falling and margins are eroding.

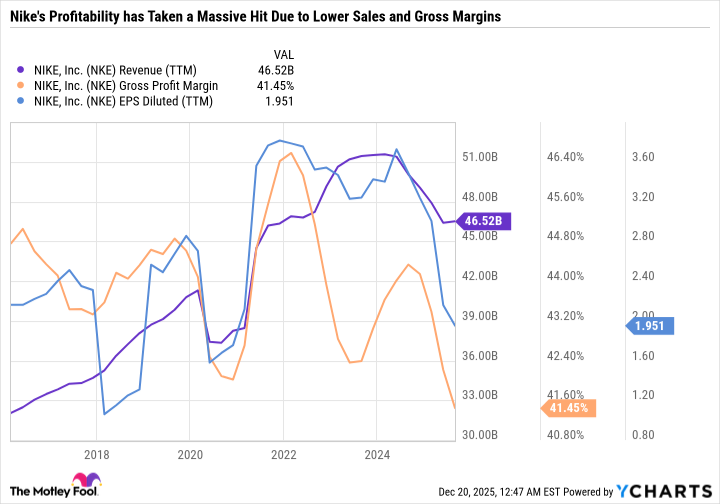

NKE Revenue (TTM) data by YCharts

In its latest quarter, Nike attributed a further 330 basis point reduction in gross margin to higher tariffs in North America, which impacted gross margin by 520 basis points. So it's worth noting that the gross margin would have been higher without the tariff impact. But margins are only part of the story.

The bigger picture is weak demand for Nike's products, bloated inventories, and consistent promotions that take a sledgehammer to profitability. The problem is painfully apparent in Greater China, where Nike's revenue for the six months ended Nov. 30 was down 13%, but operating income plummeted a staggering 35%.

All told, diluted earnings per share decreased 32% year over year to $0.53 per share.

NYSE: NKE

Key Data Points

Nike continues to return capital to shareholders

Nike's results have been poor and are improving at a snail's pace. The company has given investors every reason to lose confidence, and that's been reflected in the stock price.

When looking at Nike for 2026, I see a brand chock-full of potential. Nike's sales and margins may be in decline, but the company remains an incredibly profitable business. Even with its struggles, Nike continues to consistently repurchase stock and has raised its dividend for 24 consecutive years.

Nike's dividend yield is hovering around a 10-year high -- at 2.7%. In that period, Nike's dividend has increased by 156% while its share count has decreased by 13.2%, which makes the stock a better value by boosting earnings per share. Nike looks somewhat expensive because its earnings have been so poor. But that could quickly change as the turnaround progresses.

Nike is a dividend stock to buy in 2026 and hold

Nike is a buy for 2026 because the company has drastically improved what it can control, which means fixing its business model so that it can succeed with wholesalers and DTC rather than abandoning wholesalers and wrongfully assuming DTC is the ultimate solution. The company's results look especially bad because of tariffs and an operating environment challenged by strained consumer spending. If those factors weren't at play, Nike's turnaround would be much further along.

All told, Nike's brand is simply too elite to pass up the stock now. With a dividend now approaching high-yield territory, Nike is offering investors a worthwhile incentive to hold the stock during this challenging period.