The artificial intelligence (AI) buildout has been ongoing since 2023, but it's far from over.

The AI hyperscalers have nearly completed their record-setting capital expenditures for 2025, but they've already informed their investors that 2026 will be a year of even greater spending. While some investors are growing worried over those figures, some of the smartest people in the world think we need more AI computing power, and going against that trend likely isn't a smart move for investors.

Investors need to find the companies that are slated to cash in on these massive data center buildouts, and there are a handful of companies that can. One of the best to own over the past three years has been Nvidia (NVDA +1.78%). It has delivered investors excellent returns, and seems poised to do so again in 2026.

While I can't say for certain if Nvidia will be the best AI stock for 2026, I'm fairly confident it will be one of the best AI stocks, and it is also an attractive bet that it will outperform the market. These two projections combine to make Nvidia an excellent buy right now, and I can think of few better stocks to scoop up in the last few days of 2025.

Image source: Getty Images.

Nvidia's dominance appears to be slipping, or is it?

Nvidia makes graphics processing units (GPUs) and the technology stack that supports them. Combined, Nvidia's technology is the most flexible and easiest to use, and has some of the best performance available. This has made it the go-to computing unit of choice since the AI race began, but investors are worried that the company's dominance is slipping.

Headlines are filled with rising competition from AMD or how Broadcom has signed another client to spec out a custom AI chip. There are also innovative companies like Amazon that designed their own chip for their cloud computing platform. All of those headlines make it seem like Nvidia's grasp on the market is slipping, but that couldn't be further from the truth.

NASDAQ: NVDA

Key Data Points

In its FY 2026 third quarter (ended Oct. 26) earnings release, CEO Jensen Huang noted that the company was "sold out" of cloud GPUs. Although Nvidia is ramping up production as fast as it can, it is unable to meet the current computing demands of the market. As a result, clients are starting to look elsewhere to meet their massive computing demands. While they may prefer Nvidia hardware, some computing power is better than none.

Furthermore, the market for these computing units is expected to be massive. In 2025, Nvidia expects global data center capital expenditures to total $600 billion. That figure is expected to rapidly increase to $3 trillion to $4 trillion by 2030. There is plenty of room for multiple companies to thrive in that space, and with how profitable these devices can be, it's no surprise that there are other entrants to the computing realm.

Demand for AI computing power isn't slowing down, and Nvidia is well-positioned to take advantage of this massive growth.

Nvidia's stock is on sale

While the market has remained fairly strong toward the end of the year, AI stocks have sold off. Nvidia recently was down around 15% from its all-time high, giving investors a solid entry price on one of the best companies to own for 2026.

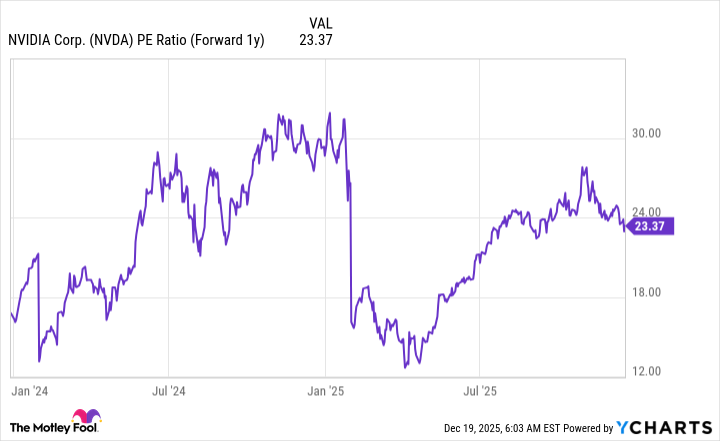

Nvidia's stock trades for 23 times next year's earnings, which is a reasonable price tag to pay for any company.

NVDA PE Ratio (Forward 1y) data by YCharts

Once you consider that growth is expected to be rapid and persist for several years after 2026, this price tag looks like a steal. However, it requires one thing: AI hyperscalers must keep spending their resources on data centers. If they continue to do that, Nvidia's stock has plenty of room to run. If they do not, it could be a disaster for Nvidia investors.

However, all signs point to AI spending continuing to ramp up over the next few years, making Nvidia a fantastic stock to own for 2026.