Investors in stocks often focus solely on price appreciation but overlook the quiet power of dividends, a force that can dramatically boost the stock's total returns over time.

History speaks for itself. Between 1940 and 2024, dividends contributed an average of 34% to the S&P 500's (^GSPC 0.03%) total returns, according to data from Morningstar and Hartford Funds.

History also shows that companies that consistently increase their dividends tend to outperform those that don't. If you allow those dividends to compound, you'd have cracked the code to becoming a dividend millionaire. A whopping 85% of the S&P 500 index's total returns between 1960 and 2023 can be attributed to "reinvested dividends and the power of compounding", according to the Hartford Funds report.

Image source: Getty Images.

The secret to becoming a dividend millionaire

Income investors often chase high-yield stocks, believing that they will help them grow wealth faster than lower-yielding stocks. That's far from the truth. If a company pays big dividends but struggles to grow earnings and cash flows, carries excessive debt, or faces headwinds that threaten future profitability, the odds of a dividend cut and weak stock performance rise sharply.

Conversely, a company with a sustainable business model, generating steady cash flows and prioritizing business and dividend growth, could pay a low dividend yield but still deliver multi-bagger returns for investors over time.

Let me show you an example.

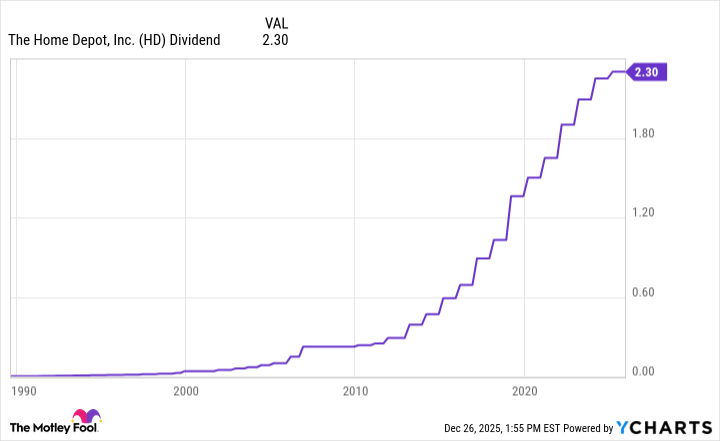

Home Depot (HD +0.72%) yields a modest 2.6% but exemplifies the power of dividend compounding. An investment of $10,000 in Home Depot stock in early 1990 grew to $1 million by the end of 2015, with reinvested dividends. A $50,000 investment would have made you a millionaire by 2010.

What's the secret sauce? It is Home Depot's leadership in home improvement, operational efficiency, superior margins, disciplined capital management, and commitment to its shareholders. Home Depot has paid a dividend every quarter since mid-1987 and has a long history of dividend increases.

Building a portfolio of dividend growth stocks, therefore, is one of the best ways to become a dividend millionaire. Look for companies with:

- Proven business models and visible growth catalysts.

- A strong track record of cash flow and dividend growth.

- Commitment to pay regular and rising dividends.

- A safe and sustainable dividend payout ratio and yield.

If you aren't sure where to start, Dividend Kings are an excellent place to look at. Dividend Kings are an elite group of publicly listed companies in the U.S. that have raised their dividend payouts every year for at least 50 consecutive years. There are currently 56 Dividend Kings to choose from. Just bear in mind that each stock has its own set of risks and opportunities that can affect its pace of dividend growth and total returns.

You could also buy an exchange-traded fund (ETF) instead, or allocate a portion of your funds to it to diversify as you build a dividend portfolio. An ETF focused on dividend growth is your best bet.

Top stock and ETF for a potential millionaire dividend portfolio

Parker-Hannifin (PH +0.04%) is one of the best Dividend Kings that has also flown under the radar. It has increased its dividend for 69 consecutive years and has generated phenomenal returns over time. Parker-Hannifin stock has risen 3,800% since 2000, with reinvested dividends.

Parker-Hannifin yields barely 0.8%, but it checks all the factors I listed above to look for in a dividend growth stock. It is an industry leader in motion and control technologies, consistently growing sales and income over the years, boasting rock-solid financials, and utilizing cash flows to expand its business and pay out sustainable dividends year after year. Aftermarket and acquisitions should support further cash flow and dividend growth.

If researching and buying individual stocks isn't your thing, take a look at the Vanguard Dividend Appreciation ETF (VIG +0.05%).

The Vanguard Dividend Appreciation ETF tracks the S&P U.S. Dividend Growers Index, comprising large-cap stocks that have increased dividends for at least 10 consecutive years. The fund's portfolio comprises 338 stocks, making it an exceptionally diversified ETF. Large-cap stocks from tech, financials, and healthcare sectors make up nearly 66% of the fund's portfolio.

An expense ratio of only 0.05% makes it one of the lowest-cost ETFs to own. Since its inception in 2006, the Vanguard Dividend Appreciation ETF has generated total returns exceeding 500%, with dividends accounting for a significant portion of these returns.

This ETF also perfectly underscores my argument about why dividend growth tops high yields. The underlying index the ETF tracks, the S&P U.S. Dividend Growers Index, excludes the top 25% highest-yielding eligible stocks to mitigate risk. The ETF's focus is purely on companies with a strong track record of sustainable dividend growth -- which should also be your go-to strategy to become a dividend millionaire.