Oklo (OKLO 5.40%) has been 2025's most exciting nuclear stocks, with a more than 275% gain on the year. The Sam Altman-backed company has been positioned as the poster child for "data center nuclear," a next-gen reactor designer whose "Aurora powerhouse" could power AI infrastructure.

NYSE: OKLO

Key Data Points

That, at least, is the dream.

Today, Oklo is pre-revenue, and it's in the very early stages of development. How early? Well, for one, it doesn't have the NRC's blessing to build powerhouses commercially. The company isn't expected to generate revenue until 2027, and even then, it's projected to generate about $16 million.

These are all real reasons to be cautious on Oklo right now. But they're not the reason why I wouldn't touch it with a 10-foot pole.

Image source: Getty Images.

Oklo is priced like it's ready to deploy, not just demonstrate, a reactor

Oklo got a huge valuation boost this year, fueled in large part by the AI data center narrative. At today's price (about $82 a share), Oklo is valued at about $12 billion (in large-cap territory), and is valued at about 750 times projected 2027 sales.

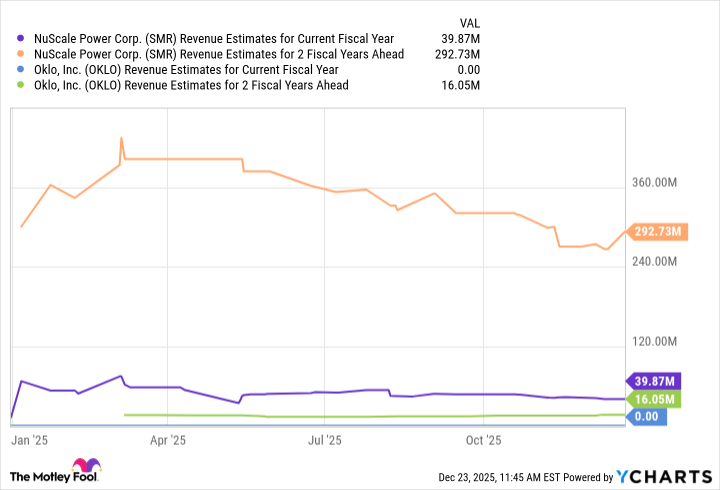

To put that in perspective, nuclear company NuScale Power (SMR 7.65%), which already has an NRC-approved small modular reactor design, has a roughly $5 billion market cap and is trading at about 16 times its projected 2027 revenue.

SMR Revenue Estimates for Current Fiscal Year data by YCharts

In other words, Oklo is valued more richly than a company that appears further along the commercialization path. To put it differently: Oklo is being treated as if it were ready to start deploying its reactors, while NuScale is valued more like what it is: a developer trying to prove that microreactors have a place in today's energy landscape.

Oklo may have an exciting future, but it's not without a rocky road

A rich valuation is one reason to avoid Oklo, but it's not the only one.

In April 2025, the Department of Energy (DOE) published an article on its website, "Advantages and Challenges of Nuclear-Powered Data Centers." The advantages listed were all the ones that have made Oklo stand out: 24/7 power, compact design, grid-free capacity, and flexibility.

However, investors also need to consider the challenges to nuclear-powered data centers.

As the DOE notes, the U.S. is still building out its domestic supply of uranium fuel -- especially high-assay, low-enriched uranium (HALEU), which many advanced reactors will need. Capital costs for building new reactor technology could be substantial, and the timeline for licensing and deployment remains long and uncertain. Indeed, the DOE doesn't expect widespread commercial reactors to arrive until the 2030s.

To be sure, Oklo's reactor design has promise, but its valuation leaves very little room for disappointment. I'd keep it on your watchlist, or open a small position if you can afford to part with the money.