I don't generally buy stocks with the intention of selling them within a short period. However, there are situations -- whether business-specific, industry-related, or economy-related -- that cause me to finally cut ties with a stock.

On the other hand, there are a few stocks in my portfolio that I refuse to cut ties with, regardless of the environment. One of those is retail giant Walmart (WMT +0.13%). Walmart is a staple in the business and investing world and is a stock that has been battle-tested and stood the test of time.

Image source: Getty Images.

Walmart provides what people always seek

There is no truly recession-proof stock in the sense of being completely immune to the negative effects of a recession. However, if we're referring to a company that historically overperforms during a market downturn, Walmart checks the box. And it all comes back to the company's core DNA: Selling everyday items at low prices.

The retail giant has done a great job of expanding its business with its annual membership, growing advertising business, and e-commerce presence, but when it's all said and done, Walmart's bread and butter will likely always be its brick-and-mortar presence throughout the country.

Walmart sells products that consumers buy regardless of economic conditions, and during periods of higher inflation, it's generally the go-to for consumers seeking discounts they likely won't find at retailers focused on more premium brands and experiences. It's true that Amazon also offers lower prices than most retailers, but Walmart stands out because of physical convenience -- especially in more rural areas.

NASDAQ: WMT

Key Data Points

Thriving through some rough economic times

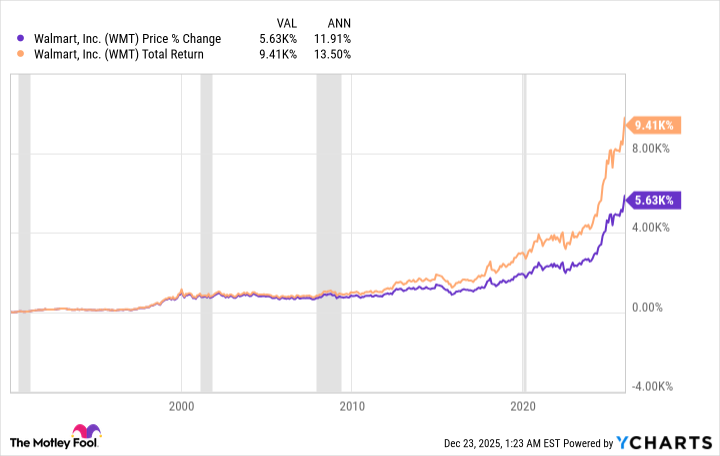

Below is how Walmart's stock has performed since January 1990, with the grey vertical bars representing U.S. recessions (as defined by the National Bureau of Economic Research):

For perspective, here's a quick rundown of Walmart's performance compared to the S&P 500 during some notable recessions:

- From the beginning of March 2001 to the end of November 2001 (the dot-com bubble bust), Walmart's stock rose about 14%, while the S&P 500 declined about 8%.

- From the beginning of October 2007 to the end of March 2009 (the Great Recession), Walmart rose about 8%, while the S&P 500 declined about 36%.

- From the beginning of February 2020 to the end of March 2020 (the COVID-19 crash), Walmart declined by less than 1%, while the S&P 500 declined about 20%.

Past results don't guarantee future performance, but Walmart has consistently proven it can thrive through tough economic and stock market conditions. It will experience volatility like any other stock, but it remains a reliable long-term anchor.