Microsoft (MSFT 0.13%) has been an OK stock pick in 2025. While it's up around 15% so far in 2025, which would normally be considered successful, the S&P 500 is up more than 16%. This places Microsoft as a market loser, which nobody wants to own. However, the tides could shift in 2026, and Microsoft could be one of the best artificial intelligence (AI) stocks to own.

Two billionaires are incredibly confident in Microsoft's potential and loaded up on its stock during the third quarter. Is there something they know that we don't for 2026?

Image source: Getty Images.

Billionaires love Microsoft's stock

The two billionaires I follow who loaded up on Microsoft stock during the third quarter were the legendary Peter Thiel and Daniel Loeb at Third Point. Thiel is a legend on Wall Street, as he was one of the founders of PayPal and Palantir Technologies. He was also one of the first outside investors of Facebook (now Meta Platforms). When he makes a move, investors should pay attention, as he has a phenomenal track record.

During Q3, Thiel sold off a hefty amount of Tesla stock and all of his Nvidia stock. He then used some of those proceeds to take a $25 million stake in Microsoft, now his second-largest holding. That's a big deal, and could indicate that he believes Microsoft is due for a strong 2026.

NASDAQ: MSFT

Key Data Points

Loeb at Third Point more than doubled its stake in Microsoft during Q3, and it now accounts for its third-largest position at 6.9% of the portfolio. That's a huge move, and signals something big could be coming.

Other billionaires own Microsoft stock, like Chase Coleman at Tiger Global Management. Although he didn't buy any Microsoft stock in Q3, it's his portfolio's largest position at a 10.5% weighting.

Clearly, Microsoft stock is incredibly popular among billionaires, but why is that the case?

Microsoft is an AI facilitator

Microsoft has delivered strong growth since the artificial intelligence arms race began. While it hasn't developed its own generative AI model, it has partnered with others who have. None is more significant than OpenAI. Microsoft owns about a 27% stake in OpenAI, so an investment in Microsoft acts as a proxy investment in OpenAI -- a company generally recognized as being one of the leaders of the generative AI movement.

That's likely the biggest reason why Microsoft is a top investment among these funds, but its regular businesses aren't too shabby either. During its fiscal 2026's first quarter (ended Sept. 30), Microsoft's revenue rose 18% year over year while diluted earnings per share (EPS) rose 13%. Those are impressive figures, and a key part of that is Microsoft's top-tier cloud computing offering, Azure.

Azure grew 40% in the quarter, far outpacing some of its cloud computing peers. Azure has become a top spot to build AI applications in, as it offers access to multiple generative AI models -- not just OpenAI's ChatGPT. This makes it an attractive offering, and is a key reason why it's growing so quickly.

Microsoft may be doing well right now, but its market underperformance is something many investors are likely concerned about these days. Some of that value would be unlocked by OpenAI going public, as Microsoft's stake in OpenAI would be easier to value. Still, Microsoft is fairly pricey as is.

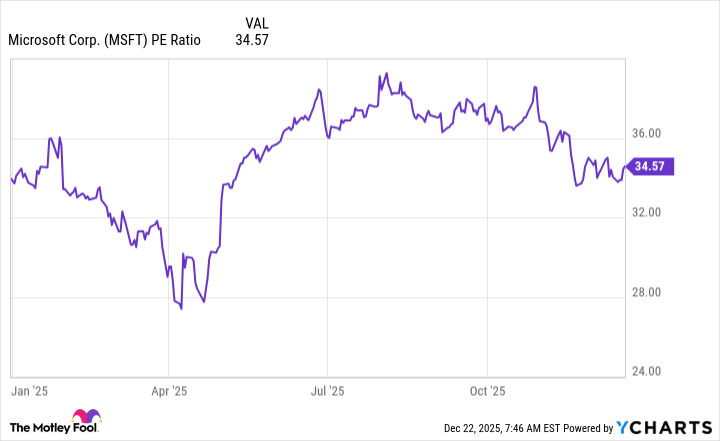

At a price-to-earnings ratio of 35, it's among the more expensive AI stocks on the market.

MSFT PE Ratio data by YCharts

While Microsoft's growth has been strong, it's nothing compared to what some others are proposing. This makes Microsoft's stock look expensive with no future in sight, which will make returns difficult to come by. I think Microsoft will be a market-average stock next year, with the only help coming from an OpenAI IPO.

Microsoft is a great company, but it just doesn't have the growth for me to recommend it over some other faster-growing AI stocks today.