AMD (AMD +0.16%) has spent most of the artificial intelligence (AI) buildout in second place to Nvidia (NVDA 1.39%). This has caused AMD's stock to dramatically underperform Nvidia since 2023, with AMD rising aboiut 230% while Nvidia is up around 1,160%. However, AMD flipped the script in 2025, as it outperformed Nvidia stock significantly. AMD is up nearly 80% while Nvidia rose around 35%.

That's strong performance from both stocks, but AMD's 2025 comeback made it a must-own stock this year. The question is, will AMD be a must-own stock in 2026? Let's find out.

Image source: Getty Images.

AMD's comeback is real

Nvidia was, and still is, the preferred graphics processing unit (GPU) vendor for the AI hyperscalers. Its GPUs and technology stack truly lead the industry, with AMD serving as a viable alternative. However, AMD has started to close the gap, particularly with controlling software.

Nvidia's CUDA software was one of the major differentiators between the two offerings, as AMD's wasn't nearly as good. However, thanks to various acquisitions and partnerships, AMD's ROCm software has dramatically improved. In fact, AMD reported that downloads for ROCm software increased 10 times year over year as of November 2025. This shows AMD is gaining ground, and there's another important consideration as well.

NASDAQ: AMD

Key Data Points

During Nvidia's Q3 FY 2026 results, its CEO, Jensen Huang, noted that the company was "sold out" of cloud GPUs. This is a huge deal, as its cloud clients aren't going to sit around idle while Nvidia fulfills demand. Instead, they're going to go looking for alternative computing providers, and AMD is near the top of the list. This could allow AMD to build a strong position in the computing hardware industry. If AI clients find out that AMD's hardware offers similar performance at a much lower price point, you could see more clients begin to use AMD's hardware stack instead of Nvidia's. This would be a huge shift for AMD, making it one of the best AI stocks to own in 2026 and beyond.

AMD's internal projections reflect this, as management believes the data center division can achieve a 60% compounded annual growth rate (CAGR) through 2030. In Q3, its data center growth rate was a mere 22%. This is a lofty goal AMD set for itself, but if it can achieve it, AMD will become a top artificial intelligence stock to own for the next few years.

Companywide, AMD expects its CAGR to come in around 35%, because its consumer hardware and embedded processor divisions are only expected to grow at around a 10% CAGR over the next five years. Still, a 35% growth rate is nothing to be disappointed with, and if AMD's growth starts to accelerate in 2026, the stock could go on an incredible run. But there's one factor holding it back.

Some of AMD's comeback is already priced in

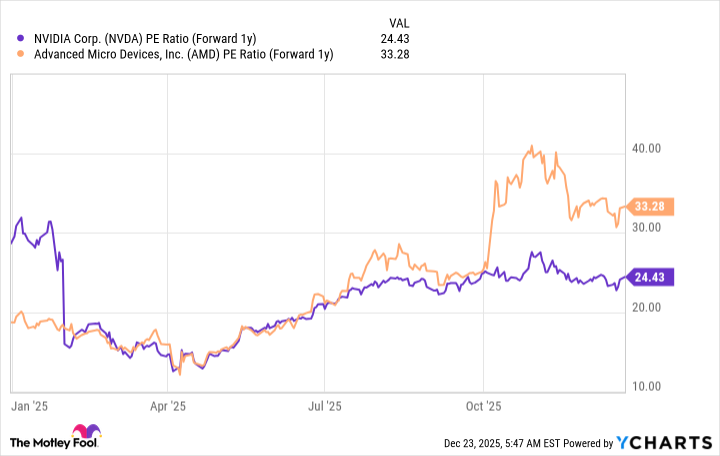

The market is well aware of the situation laid out above, which is why AMD's stock has done so well in 2025. Part of that success is already priced into its stock, as it trades for a significant premium over rival Nvidia when next year's earnings are used as the forward earnings valuation metric.

NVDA PE Ratio (Forward 1y) data by YCharts

Investors must pay nearly 50% more to own AMD's stock versus Nvidia's. That's a hefty premium to place on a company that hasn't started its comeback yet; it's only talked about it. That's concerning to me, as I want to see some progress before I'm willing to say that AMD is the better stock to own for 2026. However, I still think that AMD will be successful, but just maybe not as successful as Nvidia will be in 2026.