Nvidia is the world's largest company at about a $4.6 trillion market cap. It has risen to these lofty heights thanks to huge data centers focused on artificial intelligence (AI). Nvidia is projected to have another incredible year in 2026, so knocking it off its perch on top of the world will be no small task.

There are only a few stocks that have a realistic chance to surpass Nvidia, namely Apple, Alphabet (GOOG 0.24%) (GOOGL 0.27%), and Microsoft, which are valued at $4.1 trillion, $3.8 trillion, and $3.6 trillion, respectively. Outside of these, there's a significant drop in companies' valuations that would make the gap too big to close in 2026.

So, will any of these three topple the leader?

Image source: Getty Images.

There's only one true candidate to overtake Nvidia

Of the three, one stands out as a company that probably will not overtake Nvidia: Apple. Although it's the second-largest company in the world, it doesn't have the growth potential to drive it past the leader.

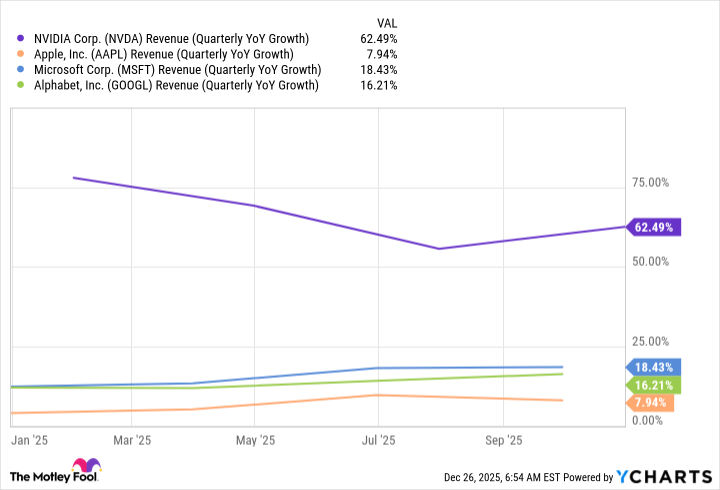

NVDA Revenue (Quarterly YoY Growth), data by YCharts; YoY = year over year.

Apple has struggled to post anything above 10% growth for the last three years, and there isn't a catalyst that will suddenly ramp it up in 2026, either. As a result, I think there's almost no chance Apple can pass Nvidia, unless there is an unforeseen event like a halt in data center construction.

That leaves Alphabet and Microsoft, and of the two, I think Alphabet has the better chance.

Microsoft has a great AI strategy of being a facilitator, rather than a pioneer. However, it doesn't have its own generative AI model. Instead, it allows its clients to deploy whichever model they want. While this is smart from a neutrality standpoint, it could become an issue for Microsoft someday because it doesn't control its own destiny.

That leaves Alphabet as the lone remaining company that could topple Nvidia as the world's largest in 2026.

Passing Nvidia will be no easy task

Alphabet entered 2025 with several question marks surrounding its core business, its AI prowess, and what the company may look like in the future. And investors received resolutions on all of these issues throughout the year -- all of them positive.

Google Search, thanks to its AI Overviews, maintained its dominance and has firmly established itself as the go-to search engine. Google Gemini has also emerged as one of the top generative AI platforms and is seen as a growing threat to OpenAI's ChatGPT. Lastly, Alphabet received a positive ruling in a court case seeking to break up the business due to monopoly concerns, and it is free to operate mostly as it did before the court case.

NASDAQ: GOOGL

Key Data Points

This allows the market to value Alphabet for the impressive business it is, rather than needing to include caveats for future events.

In 2026, the company could gain ground on Nvidia by beating it at its own game. Alphabet and Meta Platforms are reportedly in talks to sell their custom tensor processing units (TPUs), which can replace Nvidia's graphics processing units (GPUs) in some applications. If TPUs become widely available and turn into a popular and cheaper alternative to GPUs, Alphabet could have a brand-new growth division while eating into some of Nvidia's market share.

Alphabet also owns about 7% of SpaceX, which could go public sometime in 2026 at a valuation of over $1 trillion. Still, there's no saying that it would sell its stake even if it did go public. The initial public offering could boost Alphabet's stock, but will it be enough to overtake Nvidia? I'd say no.

Unless an unforeseen event slows data center capital expenditures significantly, Nvidia's projected growth and profitability will continue to make it the largest company in the world. But if its business is disrupted by alternative chip suppliers, such as Alphabet, its market cap may slip, and Alphabet could easily slide in and take its place.