Innovation is a driving force in the healthcare sector. Intuitive Surgical (ISRG 1.46%) is at the forefront of surgical robotics with its da Vinci system. But one of the most exciting stories is actually a subtle one, highlighted by the fact that Intuitive Surgical's installed base increased 13% year over year in the third quarter of 2025, but the number of surgeries using a da Vinci system rose 20%.

Let's see what this could all portend for Intuitive in the next few years ahead.

Intuitive Surgical is getting better all the time

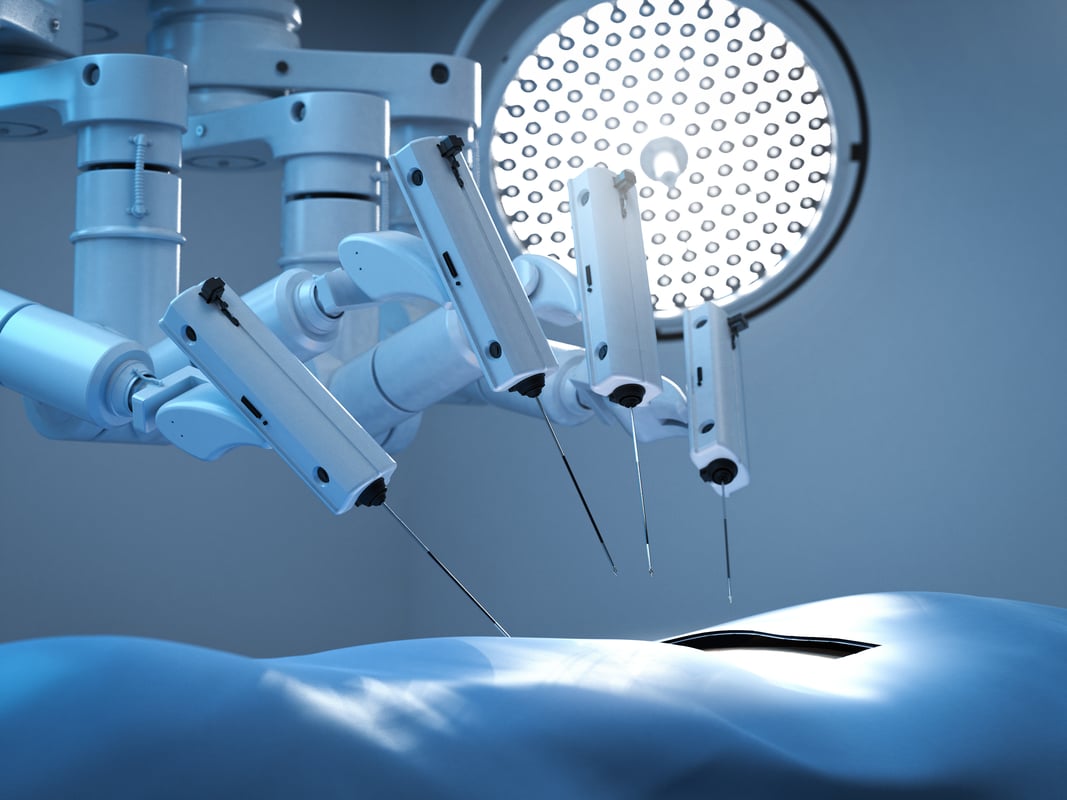

Surgical robots represent a significant advancement over traditional surgery. They offer less invasive procedures and generally better outcomes. This is a big reason why the number of surgeries using a da Vinci system grew faster than the number of new systems sold. Clearly, the value of the surgical robotics innovation that has taken place in the healthcare sector is very high.

Image source: Getty Images.

However, Intuitive Surgical didn't stop innovating after introducing its first surgical robot. As an example, it recently introduced software upgrades for its da Vinci 5 system. The actual tools aren't as important as a single line from the news release announcing them: "Da Vinci 5 has more than 10,000 times the computing power of da Vinci Xi." Very clearly, Intuitive is continuing to focus on this high-tech medical device to make it more and more powerful over time.

That helps it in another way, too. Specifically, Intuitive Surgical's capital investments in technology enable it to obtain U.S. Food & Drug Administration (FDA) approval for additional uses of the da Vinci system. There were two such FDA approvals in recent months, with software approved for the company's Ion endoluminal system and new uses approved for the da Vinci Single Port system (inguinal hernia repair, cholecystectomy, and appendectomy procedures).

Given these trends, in five years, Intuitive Surgical's da Vinci will be even more useful than it is today. And that likely means continued strong sales of the company's robots, as well as even more procedures being performed with them. Both are important.

Intuitive Surgical's flywheel

Growing the installed base of da Vinci systems is obviously important. It generates a substantial amount of revenue for the company, with robot sales totaling around $590 million in the third quarter alone. Annualizing that figure, da Vinci sales could add around $2 billion to the revenue line of the income statement. That's a big number, but it is only around 25% of the top line.

NASDAQ: ISRG

Key Data Points

The rest of the company's revenue is derived from services and the sale of instruments and accessories. Services is the less important, at around 15% of revenues. However, every new da Vinci system still helps to build up the services revenue stream, since systems need to be installed and maintained.

The really big flywheel is instruments and accessories. If 25% of revenue is new sales and 15% is services, then a whopping 60% falls into the instruments and accessories category.

Once a da Vinci is installed, Intuitive Surgical has basically created an annuity-like income stream for what amounts to parts and services. This is the underlying growth story, given that the number of surgeries using a da Vinci robot is increasing faster than the number of surgical robots being sold by the company.

Therefore, in five years, Intuitive Surgical's investment in research and development is likely to lead to further growth. That growth, meanwhile, will be leveraged by the company's ability to increase the usefulness of the da Vinci system to its customers and by further approvals from the FDA for new surgical indications. This is a powerful growth story.

Tread with caution with Intuitive Surgical

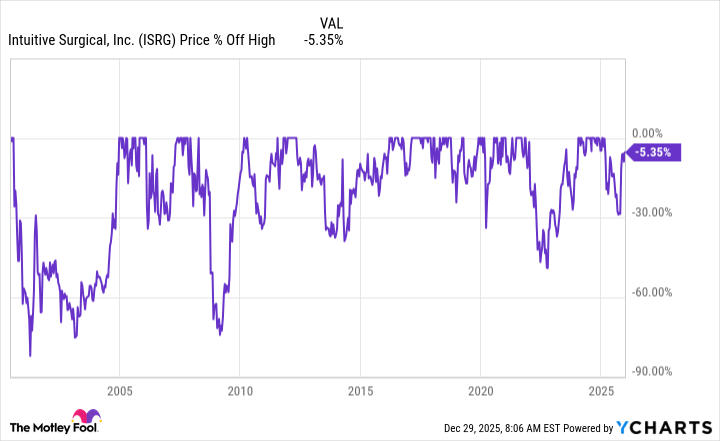

The Intuitive Surgical growth story is a compelling one, but it is also fairly well-known to investors. The stock's price-to-earnings ratio is currently 76x, which is a very large number on an absolute basis. It is also above the company's own five-year average for the P/E ratio. Also above their five-year averages are the price-to-sales and price-to-book value ratios.

Like most fast-growing companies, however, Intuitive Surgical is prone to deep drawdowns. A 30% or greater retrenchment isn't at all unusual. If you like Intuitive Surgical's story, you might want to keep it on your wish list. If you are patient and prepared, you may end up buying it at a more attractive valuation than is currently on offer.