United Parcel Service (UPS +1.50%) is a stock that only more aggressive investors should consider buying. It is in the middle of a turnaround that has taken a big toll on its financial results. While there are positive signs of progress, there is still considerable work to be done.

All that said, if you are a more aggressive investor, this investment could be a significant turnaround opportunity.

What does United Parcel Service do?

From a big-picture perspective, United Parcel Service, often simply referred to as UPS, transports boxes from one location to another. You drop your box at one of the company's collection sites or hand it off to one of the company's drivers. Then, a few days later, it magically appears where you wanted it to go.

It seems like a rather simple and boring industrial task, but it is actually a logistics nightmare with a lot going on between the start and end of that box's journey.

Image source: Getty Images.

UPS has a massive network of stores and delivery/collection routes. Once a box is in the company's system, it is added to a database to determine the best route for its delivery from the point of handoff to UPS to the intended recipient.

The trip will likely start at a sorting and distribution center. In between, there will probably be some form of transportation, which may include a ride on one of the company's long-haul trucks or on its airplane fleet. And then it will be returned to a distribution/sorting center before being sent out on a local delivery truck to reach its final destination.

UPS has been around for a very long time, and technology has changed. More powerful computers can improve the company's efficiency. Sorting can be done more efficiently with robotics rather than relying on human labor. And improved efficiency means that UPS can operate with fewer facilities and fewer employees.

The problem is that incorporating such technological advances requires material capital investment and other sizable organizational changes. In other words, the company's current plan to streamline its business comes with high up-front costs. Those costs are a headwind on the income statement, making earnings appear particularly weak at present.

However, there's another problem as well. Management is also attempting to position the company to benefit from focusing on its highest-margin and fastest-growing businesses. Management has been actively pulling back from customers who have high volumes, but offer low margins. Specifically, UPS has decided to handle fewer Amazon (AMZN 2.06%) packages while expanding in areas such as healthcare. Not only are costs rising, but revenue are also falling.

United Parcel Service is making progress

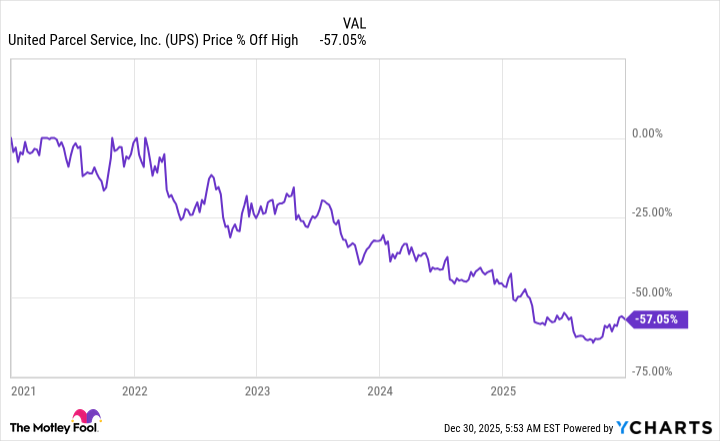

The company's business overhaul is not something that can be accomplished overnight. This is a multi-year turnaround effort that will likely take at least another couple of years to complete. Wall Street doesn't think long term, so investors are downbeat on UPS' shares.

However, positive signs are starting to show up. For example, the revenue per piece in the company's core U.S. market rose 5.5% in the second quarter of 2025. And then it rose 9.8% in Q3. That's an important improvement and exactly what you would expect to see based on what UPS is doing.

NYSE: UPS

Key Data Points

The problem is that revenue in the U.S. market dropped 0.8% year over year in the second quarter of 2025 and 2.6% in the third quarter. Worse, earnings fell 13.4% in Q2, and 1.1% in Q3. Declining earnings is not what investors want to see.

And yet the 1.1% earnings decline in Q3 also hints that the company's efforts are starting to bear fruit, noting that operating profit margin increased 110 basis points year over year even as revenue fell 3.7%. Again, these are early signs of progress, but, keeping in mind that the goal is less revenue but higher profitability, it is progress just the same.

UPS is not for everyone

United Parcel Service may not be a good fit for most investors. The turnaround isn't over yet, and it still involves considerable uncertainty. A big issue is the dividend yield, which is a lofty 6.5%, but it comes with an over 100% dividend payout ratio. It wouldn't be surprising to see the board of directors reset the dividend as the company works to reset its business.

If you are a more aggressive investor who appreciates turnarounds, UPS might be worth buying today. In fact, the stock is still down more than 50% from its 2022 highs, suggesting that there's still material recovery potential. Just go in knowing that there remains a lot of work to do. The hoped-for business upturn could be several years away.