BlackRock is the world's largest asset manager, with $13.5 trillion in client funds in its custody. Around $5 trillion of that total is spread across over 1,600 exchange-traded funds (ETFs) managed by the company's iShares subsidiary.

One of them is the iShares Expanded Tech Sector ETF (IGM 0.97%), which has a concentrated portfolio of technology stocks that includes many of the giants leading the artificial intelligence (AI) race. It soared by 27.5% in 2025, comfortably outpacing the 17.5% return in the S&P 500 (^GSPC 0.74%).

But last year's result wasn't a one-off, because the iShares ETF has beaten the S&P 500 every year (on average) since its inception in 2001. Here's why I predict it will outperform yet again in 2026.

Image source: Getty Images.

America's best tech stocks packed into one ETF

The iShares Expanded Tech Sector ETF holds 291 stocks. It focuses on the technology sector, but it also invests in tech-adjacent companies from the communication services and consumer discretionary sectors. Zooming in even further, almost 27% of the value of its entire portfolio is parked in semiconductor stocks, which supply the data center chips and components powering the AI boom.

Several of the world's best semiconductor stocks have made it into the iShares ETF's top 10 holdings, where they sit alongside many leading developers of AI platforms and software:

|

Stock |

iShares ETF Portfolio Weighting |

|---|---|

|

1. Nvidia |

8.92% |

|

2. Microsoft |

8.87% |

|

3. Apple |

8.55% |

|

4. Alphabet |

8.54% |

|

5. Broadcom |

7.37% |

|

6. Meta Platforms |

4.67% |

|

7. Palantir Technologies |

2.55% |

|

8. Netflix |

2.42% |

|

9. Advanced Micro Devices |

2.13% |

|

10. Micron Technology |

2.01% |

Data source: iShares. Portfolio weightings are accurate as of Dec. 29, 2025, and are subject to change.

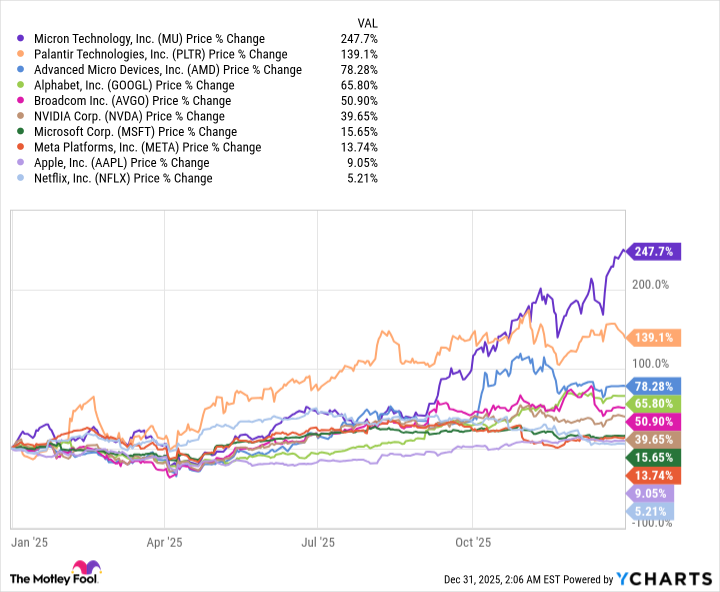

Considering those 10 stocks alone have a combined weighting of 56%, they have a significant influence over the ETF's performance. They delivered an average return of 66% in 2025, so it's no surprise the ETF comfortably beat the S&P 500.

Nvidia, Broadcom, AMD, and Micron Technology are four of the semiconductor industry's top suppliers of data center chips and networking equipment for AI workloads. Alphabet is one of the largest buyers of those chips, but it also designs its own hardware in-house. Its latest Ironwood Tensor Processing Units (TPUs) -- which it developed with Broadcom -- are so powerful that AI start-up Anthropic placed $21 billion worth of orders for them last year.

Alphabet and Microsoft operate cloud computing platforms where they rent data center capacity to other businesses, who use it to develop AI software. This is a very lucrative practice, and both companies have massive order backlogs from customers who are waiting for more infrastructure to come online.

Palantir Technologies also deserves a special mention. The incredible 139% gain in its stock last year was fueled by soaring demand for its Gotham and Foundry AI software products, which help companies and government organizations extract maximum value from their internal data. Palantir stock isn't cheap right now, but this company is an early success story in the AI software space.

Looking beyond its top 10 positions, the iShares ETF holds several other top AI stocks including Oracle, Salesforce, CrowdStrike, and Snowflake, just to name a few.

The iShares ETF has a great track record against the S&P 500

The iShares Expanded Tech Sector ETF has delivered a compound annual return of 11.6% since its inception in 2001, which is much higher than the average annual return of 8.5% in the S&P 500 over the same period. The 3.1-percentage point difference might not sound like much at face value, but it would have resulted in substantially higher returns in dollar terms thanks to the magic of compounding:

|

Starting Balance in 2001 |

Compound Annual Return |

Balance in 2025 |

|---|---|---|

|

$20,000 |

11.6% |

$278,593 |

|

$20,000 |

8.5% |

$141,691 |

Calculations by author.

But thanks to the surging adoption of technologies like cloud computing, enterprise software, and AI, the ETF delivered an accelerated compound annual return of 22.9% over the last decade. That's an even bigger gap to the S&P 500, which climbed by 13.4% per year over the same period.

NYSEMKT: IGM

Key Data Points

Tech giants spent a record amount of money on AI data centers and infrastructure in 2025, and by most accounts, they will likely spend even more in 2026. That will support further returns in stocks like Nvidia, Broadcom, AMD, and Micron. Cloud platforms like Microsoft Azure and Alphabet's Google Cloud also delivered accelerating revenue growth throughout last year, which suggests their AI infrastructure spending is paying off. If that continues, expect further gains in those stocks during 2026, too.

But the tech sector is extremely dynamic, so even if the AI boom unexpectedly cools off this year, other next-big-thing technologies like robotics, autonomous vehicles, and even quantum computing could step up to boost the tech sector and, therefore, the iShares ETF.

That's why I think there is a high chance this fund beats the S&P 500 yet again in 2026.