Costco Wholesale (COST 0.53%) is considered a reliable, market-beating stock by many investors. However, it didn't come through in 2025; it's down 7% over the past year.

If you can appreciate Costco's stellar performance, model, and opportunities, this might look like an excellent opportunity to buy shares on the dip. If you're considering it, here are three things to know before you buy.

Image source: Getty Images.

1. The model is still working

From the stock movement, you might not realize how well Costco is doing this year. It continues to crank out sales increases and high profits, opening new stores and gaining new members.

The 2026 fiscal first quarter (ended Nov. 23) was an excellent example. Sales were up 8.2% from last year, with a 6.4% increase in comparable sales (comps). Earnings per share (EPS) were up from $4.04 last year to $4.50 this year. When there's inflation or other economic pressure, members buy at Costco to save as much money as they can. That means the company does well in almost any kind of environment. However, investors may be concerned about how much it can keep growing as inflation remains high.

Membership metrics were also strong. Member households increased 5.2% over last year in the quarter, and membership fee income was up 14%, inclusive of a fee increase. Executive members increased 9.1% and accounted for 74.3% of sales. U.S. and Canada renewal rates were 92.2%, and global renewal rates were 89.7%. This is another result that might concern investors, since global renewal rates were slightly lower than usual. Management attributed that to an increase in online signups, which have a lower renewal rate. Having an online signup option is mostly a boon for Costco, since it opens the company up to a new set of clients, and specifically a younger set.

Costco still sees plenty of expansion opportunities, both domestically and globally. It plans to open 30 stores annually over the next few years, and each of its huge warehouses generates a large amount of revenue to add to the total. Opening stores at this rate should continue on this trajectory for the foreseeable future.

NASDAQ: COST

Key Data Points

2. It's changing to keep up

There are some changes happening at Costco, since it has to shift to meet evolving trends. It has carved its own niche in e-commerce, or what it now calls digitally enabled sales. That makes sense, since Costco has its own spin on e-commerce; it uses Instacart for same-day grocery delivery instead of its own logistics network, and it uses curbside pickup options for its large and bulky items. Digitally enabled sales are a major growth driver right now, and they increased 20.2% over last year in the first quarter.

Costco recently started offering scanning options at checkout, another way it's aiming to use technology to add value to the shopping experience. It has also improved its product recommendation algorithm to give more precise results, and it's producing positive results. These are enhancements that don't change Costco's essential model but bring it forward to compete in today's digital market. While some of these new methods might create a bit of friction initially, like the change to online signups, they should ensure Costco's long-term growth.

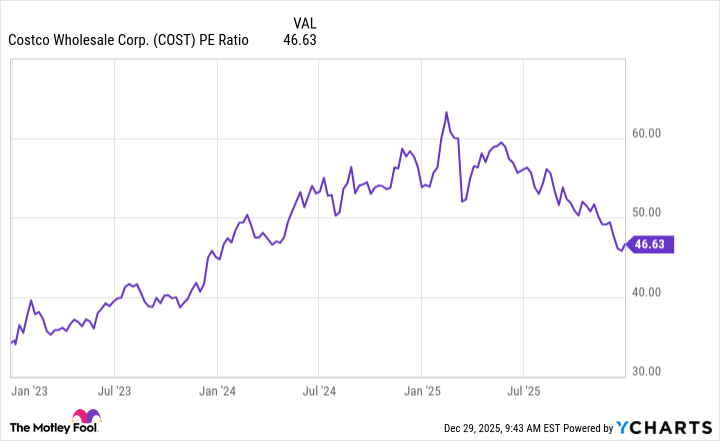

3. The stock is still expensive

As metrics improve and the stock price declines, the valuation has come down significantly. Costco stock now trades at a P/E ratio of 47. That's much lower than the 60-something it was trading at earlier in 2025, but it's still much higher than recent historical levels.

COST PE Ratio data by YCharts

Costco stock could continue to go sideways in the near term as investors assess how inflation and changes in the model will impact its growth prospects. However, the stock is likely to rebound and reward investors for many years. If you want to buy Costco stock, consider a dollar-cost averaging strategy to benefit from more favorable price points.