Picture this. It's mid-October 2025, and you're a shareholder in the nuclear start-up Oklo (OKLO +8.45%). You bought shares in January 2025, and your initial $10,000 stake has climbed roughly 480% to reach about $58,000.

Not bad for a nuclear start-up. Until it started selling off. Fast-forward to Dec. 31, 2025, and that same position would be worth about $23,850.

That's still a strong return for a company with no meaningful revenue, but investing is about the future. If Oklo were to repeat 2025's 238% jump, $500 invested today would be worth about $1,690 in a year. We don't know what the stock will do this year, but if you're interested in Oklo, let's take a look at what you'll be buying.

Artist's rendering of an Oklo Aurora powerhouse. Image source: Oklo.

The hurdle that Oklo must surmount in 2026

Oklo is a pioneer in advanced nuclear technology. Conventional wisdom touts it as an AI-age nuclear play, an energy start-up whose microreactor can meet the surging power needs of data centers and AI.

NYSE: OKLO

Key Data Points

Furthermore, the company has gotten support from the U.S. government. Not only has it benefited from pro-nuclear policies, including executive orders from President Donald Trump, but it's currently building its first Aurora powerhouse at the Idaho National Laboratory -- a facility overseen by the Department of Energy (DOE).

This powerhouse is expected to "demonstrate criticality" by July 4, 2026.

While demonstrating this powerhouse's technology would be a major achievement, it wouldn't substitute for the milestone that would make this company real and formidable: obtaining approval from the Nuclear Regulatory Commission (NRC) to build and operate reactors commercially.

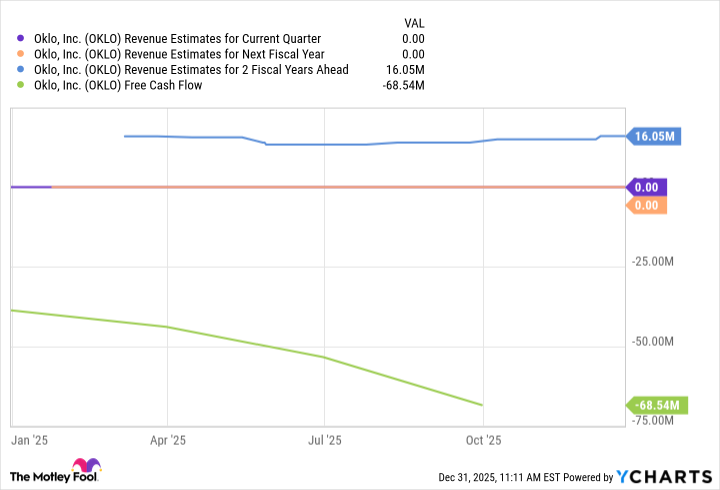

Until it has that license, Oklo's ability to generate revenue will be severely limited. Indeed, investors may need to wait a couple of years before the revenue spigot is turned on, while cash burn continues.

OKLO Revenue Estimates for Current Quarter data by YCharts

As such, Oklo remains a speculative play on the future of energy. Investors with a long time horizon may want to invest $500. Less aggressive investors might want to consider a nuclear energy exchange-traded fund (ETF) that invests in several companies instead.