From an investment standpoint, NuScale Power (SMR 0.59%) is a money-losing start-up. It will not be a good fit for most investors, particularly those with more conservative investment leanings. However, if you are a risk taker, the opportunity for the nuclear reactors NuScale Power hopes to build someday could be huge.

Is it a millionaire-maker stock, or are the risks just too big today?

What does NuScale Power do?

Currently, NuScale Power's revenue is generated through consulting projects. It is helping Fluor with the groundwork necessary for RoPower, a Romanian electric utility company, to make a final investment decision on a nuclear power plant. That plant, if approved, is expected to utilize six of NuScale Power's small modular nuclear reactors, or SMRs.

Image source: Getty Images.

This is a very big deal for NuScale Power, as it would be the company's first sale. Unfortunately, building a nuclear power plant is a massive capital investment, and RoPower is taking its time deciding whether to move forward. Even if it gives the project the green light, financing could still be an issue that derails the project. At the start of 2025, the hope was to get the project approved by early 2026. The hope is now for late 2026 or early 2027.

This isn't the only iron NuScale Power has in the fire, but the RoPower deal is an important project to watch if you are an investor. More recently, NuScale Power signed an agreement with the Tennessee Valley Authority and ENTRA1 Energy to build nuclear power plants using NuScale Power reactors. The company has provided milestones for this partnership, but it hasn't provided actual dates. So, like the RoPower deal, there's no concrete sale here just yet, even though there is obvious interest in NuScale Power's nuclear power technology.

NYSE: SMR

Key Data Points

NuScale needs a first sale to prove itself

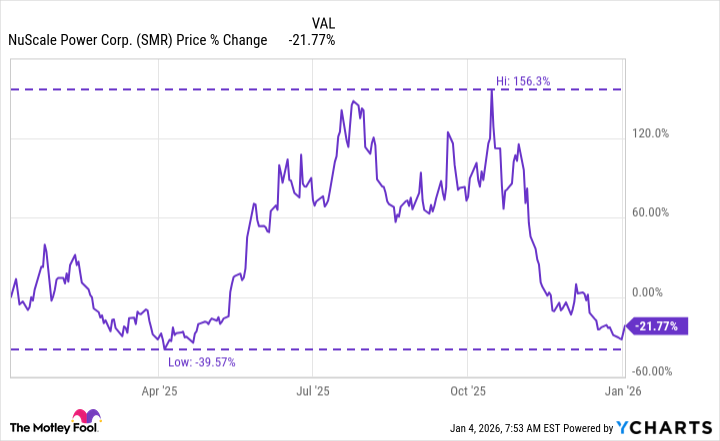

Nuclear power is experiencing something of a renaissance right now, which means that NuScale Power has an opportunity to strike while the iron is hot. Given that its technology is untested, however, the biggest step right now is making that first sale. Until it does, news and investor sentiment are likely to be the driving forces behind the stock's fluctuations. The stock has experienced its ups and downs over the past year.

Over the past year, the stock has risen by as much as 150% and fallen by as much as 40%. However, having given up all of that 150% advance, it is currently down 20% over the past year, but off nearly 70% from its 52-week highs. If you can't handle that kind of volatility, you shouldn't even be considering an investment in NuScale Power at this stage of its business development.

Data by YCharts.

However, if the nuclear power start-up's stock were to rally back toward the highs, it would more than double in value. It wouldn't be a shock to see a rally like that in an early-stage business after that company signed its first confirmed contract. If that sale leads to more sales, there could be even more stock gains ahead. And if NuScale Power manages to create a sustainably profitable business, well, those gains could be more enduring than the stock gains from earlier in the past year.

So, if everything goes well, NuScale Power could turn into a millionaire-maker stock. Still, you have to juxtapose that glass-half-full view against the glass-half-empty view. If no sales ever materialize, NuScale Power would struggle to remain a going concern. The company reported that it ended the third quarter with around $750 million in liquidity, so there's no imminent risk of bankruptcy or anything like that. However, the company has to start building and selling its small modular nuclear reactors, or it doesn't have a business.

NuScale has so much in the air that only aggressive investors should buy it

When you step back and look at this big picture, NuScale Power has a window of opportunity in the nuclear power industry. It is working hard to take advantage of that window, but it still hasn't been able to secure its first sale. That's not the best sign for the company's long-term prospects. All but the most aggressive investors should probably wait until NuScale Power has achieved a few more business milestones, perhaps even until it has completed the construction and installation of its first reactor.

Waiting, however, will likely mean missing out on early stock price gains, assuming the company's future hopes are realized. If you are willing to take on a material amount of idiosyncratic risk, you might want to buy NuScale before it has a contract to sell its first SMR. Just recognize that you are making a very big bet that could help you build a seven-figure portfolio if you win, but could leave you with a total loss if you lose.