With artificial intelligence (AI) usage skyrocketing, this sector of the market is a great place to look for stocks that could double in under a year. Many AI companies are generating explosive growth, and these are the ones to take a look at.

Three, in particular, have a chance to double in value in 2026: Nebius (NBIS +0.65%), Applied Digital (APLD +17.97%), and SoundHound AI (SOUN +6.62%). All three are growing at a rapid pace and could provide investors with a potential doubling of returns in 2026.

Image source: Getty Images.

The AI arms race is alive and ongoing

Nebius and Applied Digital operate in similar industries. Nebius was spun out of Russian-based Yandex after sanctions from the Ukraine war devastated the business, including the non-Russian parts. Nebius is focused on providing computing power to its various clients by renting out space in a data center and placing cutting-edge graphics processing units (GPUs) in them. It also owns some of the locations it operates in.

Demand for computing power has been unprecedented, and Nebius told investors that it has "sold out" all of its available capacity. As it expands capacity, it expects to have a $7 billion to $9 billion annual run rate (ARR) by the end of 2026. For comparison, its ARR at the end of Q3 was $551 million. That's explosive growth for a relatively small business, and I wouldn't be surprised to see the stock double in 2026 as a result.

NASDAQ: NBIS

Key Data Points

Applied Digital builds and operates data centers and has two facilities in North Dakota that it operates. It is working on increasing computing capacity at these two facilities, and is a key CoreWeave (CRWV +3.61%) partner. It has signed 15-year leases for many of its data centers, which gives investors a long-term look into what Applied Digital's future looks like.

In the first quarter of its fiscal year 2026, ended Aug. 31, its revenue rose about 84% year over year. As more computing capacity comes online, its revenue will jump, which could lead to outsize stock performance.

Last is SoundHound AI. SoundHound AI blends generative AI and audio recognition to create a software platform that can be deployed in many applications. This is a key company to watch in 2026, as there could be a huge growth explosion if widespread adoption occurs. Several industries can be streamlined by deploying generative AI agents, such as customer service reps.

NASDAQ: SOUN

Key Data Points

In its latest quarter, SoundHound AI's revenue jumped 68% year over year, and it raised the full-year outlook. We'll see if SoundHound AI's product gains momentum in 2026. But it could be a great year for the company and the stock.

None of these stocks is cheap

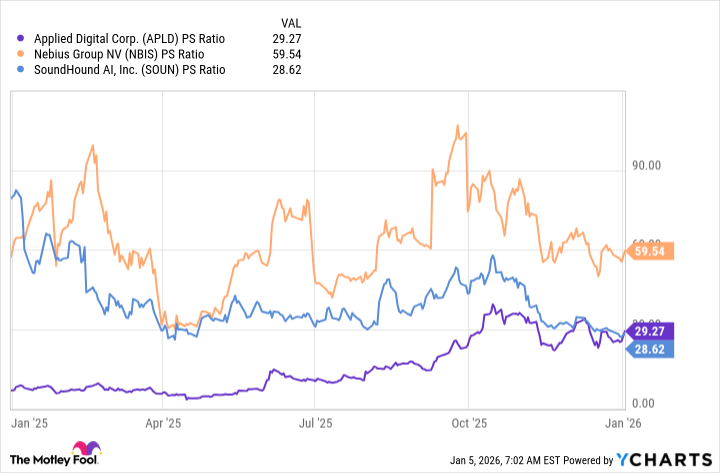

There is a ton of hype baked into all three of these stocks, and none of them are particularly cheap. While the market may ignore their valuations in the short term due to strong results, it could become a problem over the long term to live up to the expectations priced into the stock. None of these investments is profitable at all, so using the price-to-sales metric is the best alternative for comparing valuation.

Data by YCharts.

At first glance, Nebius looks far more expensive than its peers at 60 times sales. However, investors must consider that it's growing the fastest out of all three of them. If you evaluate using forward sales, it's clear that it's the cheapest of the three.

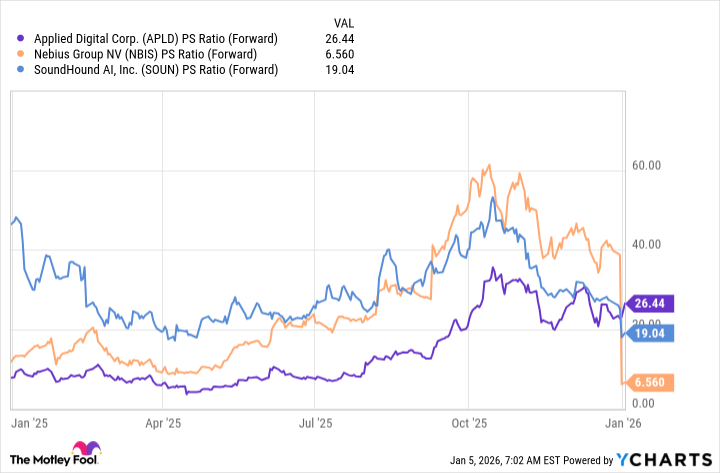

Data by YCharts.

Applied Digital's valuation doesn't change much because its data center construction milestones aren't expected to be hit until late 2026. SoundHound AI is about in the middle, as it trades for 19 times sales.

Depending on whether projections pan out, I would be surprised if Nebius isn't the best-performing stock of this group in 2026. However, a new contract for Applied Digital or a massive customer win for SoundHound AI could tip the scales in their favor.

Either way, all three of these stocks could double in 2026, making them intriguing investments now.