Dividend Kings are an elite group of dividend-paying companies that have boosted their payouts for at least 50 consecutive years. There are fewer than 60 Dividend Kings, and industrial conglomerate Illinois Tool Works (ITW 2.18%) is one of them.

Illinois Tool Works is an excellent company with high operating margins and dozens of brands across multiple industries. However, the company's growth has slowed due to cyclical downturns in key markets, demand and tariff pressures, and currency headwinds.

Despite these challenges, ITW is a strong buy for 2026. The company has increased its dividend for 62 consecutive years and consistently repurchases stock. ITW also commands a reasonable valuation for such a reliable dividend payer, trading at 22.5 times forward earnings with a 2.6% dividend yield.

Here's why PepsiCo (PEP 0.85%) could be an even better Dividend King to buy in the new year -- especially for investors looking to maximize their passive income.

Image source: Getty Images.

Pepsi's growth has stalled

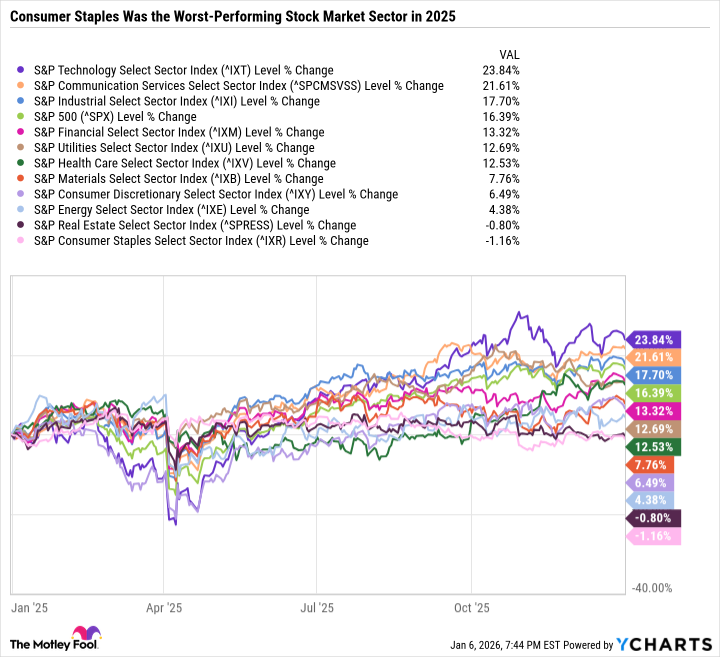

Like many consumer staples stocks, Pepsi had a down year in 2025, with the stock falling 5.6%. Consumer staples were one of two sectors that lost value in 2025 despite an excellent year for the broader market.

Data by YCharts.

In addition to beverage brands like flagship Pepsi, Gatorade, and Mountain Dew, PepsiCo owns Frito-Lay and Quaker Oats, as well as a variety of other brands across snack and mini meals categories. But Pepsi is facing a demand slowdown due to shifting consumer preferences toward health and wellness, as well as the higher cost of living, production cost pressures, and tariffs.

Pepsi is forecasting a low single-digit increase in full-year 2025 organic revenue and flat core constant currency earnings per share. Pepsi's results are poor, but that's already reflected in the stock price.

Pepsi is too cheap to ignore

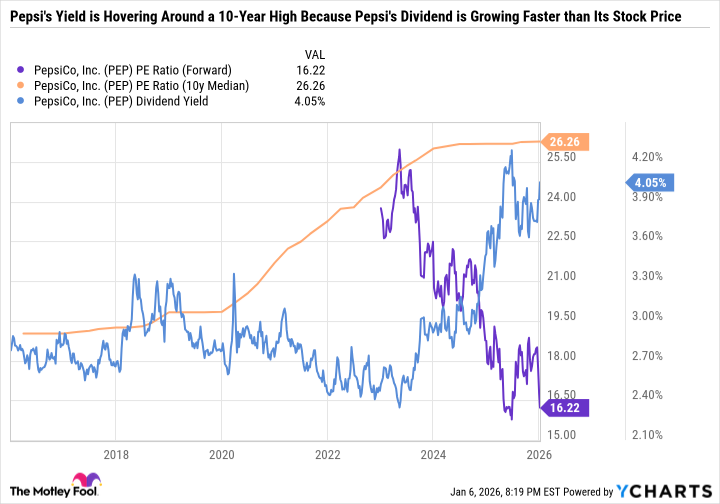

Pepsi stock sports a mere 16.2 forward price-to-earnings ratio compared to a 10-year median P/E of 26.3. Its dividend yield is over 4%, which is significantly higher than its historical average.

Data by YCharts.

Some investors have lost faith in Pepsi or are simply unwilling to pay as high a multiple for its earnings because the company's growth has stalled. But the sell-off has gone too far, especially considering Pepsi's issues are solvable.

Pepsi recognizes that it must improve its product portfolio to lean less on sugary soft drinks and salty snacks by diversifying into healthier options, such as mini meals, healthier drink and snack brands, or healthier versions of existing brands.

After all, the trend toward healthier options is nothing new, as per capita soft drink consumption in the U.S. has been declining for years. And it was all the way back in 2002 when Frito-Lay launched reduced-fat Lay's and Cheetos.

NASDAQ: PEP

Key Data Points

The perfect income stock for patient value investors

In September, activist investor Elliott Asset Management took a $4 billion stake in PepsiCo, arguing that the company can make several operational improvements, such as a refranchised bottler network and brand improvements to improve margins and accelerate earnings growth. If that were to happen, Pepsi could quickly shift from trading at a steep discount to the broader market to reclaiming its premium valuation.

With the valuation discounted and the dividend yield at 4.1%, Pepsi stands out as a no-brainer buy for risk-averse income investors in 2026.