An exchange-traded fund (ETF) lets you invest in a basket of assets, like stocks or bonds, through a single purchase. As such, ETFs can offer diversification, though they often don't match the same upside as a single winning stock. And yet sometimes, an ETF can beat the market. That was the case for a nuclear energy ETF in 2025: the VanEck Uranium and Nuclear ETF (NLR 6.15%).

NYSEMKT: NLR

Key Data Points

This ETF seeks to mirror the performance of the MVIS Global Uranium & Nuclear Energy index, which tracks companies involved in uranium mining, nuclear reactor construction, and generating electricity from nuclear power, among other nuclear-related services. The index has some heavyweight nuclear companies like Cameco and Constellation, as well as advanced nuclear start-ups like Oklo.

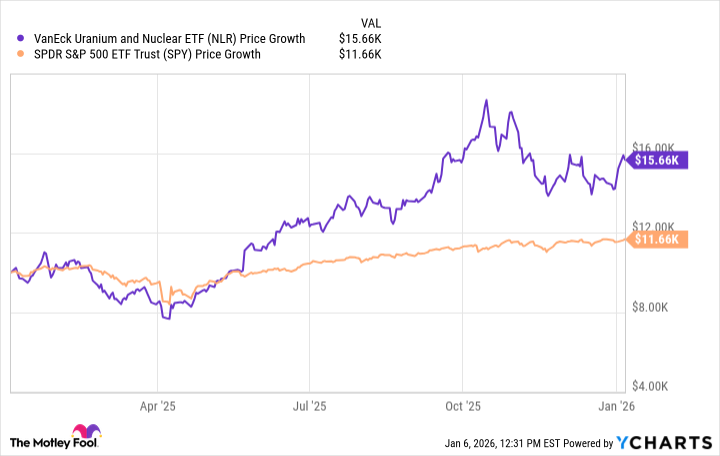

If you had invested $10,000 in the VanEck Uranium and Nuclear ETF one year ago, your investment would have grown to about $15,660 today. That would have beat the same investment in an S&P 500 index fund by a long shot.

Nuclear energy stocks in general have undergone a sharp resurgence, helped in part by federal efforts to strengthen the U.S.'s nuclear supply chain. Nuclear reactors are also seen as a potential power source for artificial intelligence (AI) data centers, which require the kind of continuous power nuclear reactors can produce.

Image source: Getty Images.

Investors who want to tap into this sharp nuclear comeback may prefer a nuclear energy ETF, like VanEck Uranium and Nuclear ETF, especially if they're bullish on the sector but don't want to bet everything on one or two companies.