Warren Buffett earned the nickname the Oracle of Omaha because of his investment track record. He has recently stepped down as the CEO of his investment vehicle, Berkshire Hathaway, but that doesn't change the value of the remarkably successful investor's advice.

Buffett's advice? Most investors should just buy the S&P 500 index (^GSPC +0.65%) and hold forever. Two options for achieving this are Vanguard S&P 500 ETF (VOO +0.67%) and Invesco S&P 500 Equal Weight ETF (RSP +0.58%). Here's what you need to know.

Why the S&P 500 index?

The key fact to understand about the S&P 500 index is that it isn't actually meant to track the stock market. The actual purpose of the index is to track the U.S. economy. The hand-selected list of approximately 500 stocks comprises large and economically significant U.S. businesses spanning all major industries. The reason Buffett likes the S&P 500 index so much is that it grows along with the U.S. economy, which has a long history of steady expansion behind it.

Image source: The Motley Fool.

There are some nuances to understand. For starters, the stocks are selected by a committee. So there is material human influence on and oversight of the index. The companies are not selected because they are performing well, per se, but because they are large and economically important. That fact, combined with the purposeful inclusion of various business sectors, means there will always be a mix of strongly performing and underperforming stocks in the index.

The most important nuance, however, is that the index is market-cap weighted. That means the largest companies will have the greatest impact on the S&P 500's performance. This is both a positive and a negative. On the positive side, a small number of strongly performing stocks can lead the index higher. On the negative side, a small number of poorly performing stocks can cause the index to decline. Which is why you should consider two S&P 500 index alternatives before making a final decision.

NYSEMKT: VOO

Key Data Points

Understand the S&P version you buy

Any investment that fully tracks the S&P 500 index is doing the same exact job. Because of this, investors should focus on the costs and benefits of the specific investment asset. Exchange-traded funds have very low costs and can be traded throughout the day, which gives them an edge over mutual funds that can only be traded at the end of the day. As for the costs, Vanguard S&P 500 ETF's 0.03% expense ratio is as close to free as you are likely to find on Wall Street.

If you have a particular interest in nostalgia, you could invest in SPDR S&P 500 ETF (SPY +0.66%). It is the oldest exchange-traded fund in existence. However, the 0.09% expense ratio, while low on an absolute level, is three times higher than the expense ratio of Vanguard S&P 500 ETF. For most investors, the better option will be the Vanguard ETF.

However, some investors might look at the S&P 500's market cap weighting methodology and hit the pause button today. That's because a small number of large technology-related companies are dominating the index's performance. Technology currently makes up roughly 35% of the index, more than twice the weighting of the next largest sector, which is financials. That's a massive concentration in one sector, but that is what you sometimes get with market cap weighting.

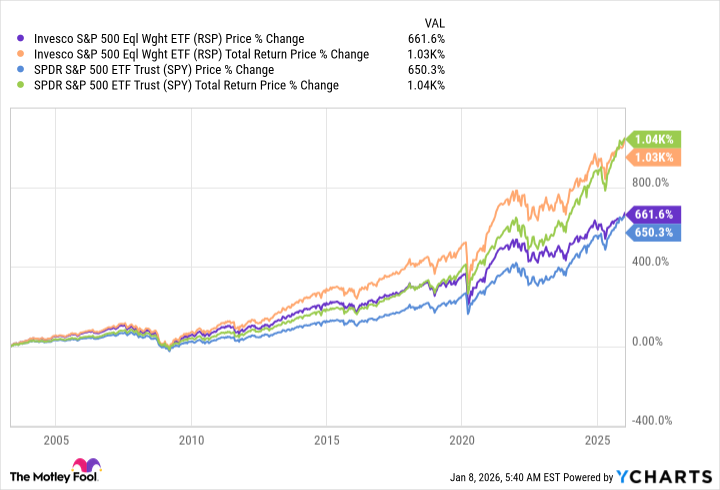

Data by YCharts.

Invesco S&P 500 Equal Weight ETF provides an alternative. Instead of market cap weighting, this ETF uses an equal weighting methodology, so every company has the same impact on overall performance. As the chart above shows, Invesco S&P 500 Equal Weight ETF has basically performed in line with the S&P 500 over the long term. You aren't giving up performance to gain access to what ultimately becomes a more balanced weighting approach.

To put a number on that, technology is the third-largest sector in the Invesco S&P 500 Equal Weight ETF. It accounts for 13.5% of assets, trailing industrials at nearly 16% and financials at roughly 15%. Healthcare is the fourth-largest sector at roughly 12%. There is materially more balance in the portfolio, for those who care about diversification.

NYSEMKT: RSP

Key Data Points

The trade-off is that Invesco S&P 500 Equal Weight ETF has a notably higher expense ratio of 0.20%. However, given the extra work being performed to reweight the holdings in the index, that is probably a worthwhile cost.

Another side effect of the different weighting method is that Invesco S&P 500 Equal Weight ETF's dividend yield is slightly higher at 1.6%, compared to Vanguard S&P 500 ETF's super tiny 1.1%. That yield difference likely won't be the deciding factor, but it is still worth knowing about.

Two S&P 500 index options

Most brokers will allow you to buy fractional shares of ETFs, so $100 will let you buy $100 of either of these ETFs. They both cost well more than $100, with Invesco S&P 500 Equal Weight ETF trading near $200 per share and Vanguard S&P 500 ETF just under $650. If you can't buy fractional shares with your broker, Buffett would probably tell you to keep saving money until you can afford a single share of your chosen S&P 500 variant. And then hold forever, continuing to add money to the S&P 500 every chance you get.