Peter Thiel is one of the most iconic Silicon Valley investors. The entrepreneur's first claim to fame was serving as a co-founder of PayPal with none other than the then-unknown Elon Musk.

After minting a fortune through his PayPal ownership, Thiel moved into a professional investor role. Perhaps his most lucrative opportunities came from being the first outside capital invested in Facebook (now Meta Platforms) as well as co-founding data analytics specialist Palantir Technologies.

Today, the tech savant manages capital through a hedge fund, called Thiel Macro. According to the fund's most recent 13F filing, Thiel completely exited his position in Nvidia (NVDA 0.05%) during the third quarter -- selling 537,742 shares.

Interestingly, Thiel swapped his exposure to the most influential player in the artificial intelligence (AI) arena for a stake in Apple (AAPL +0.19%) -- a stock that Warren Buffett had been trimming prior to his retirement.

Let's dig into what may have influenced these decisions and assess if growth investors should follow Thiel's playbook.

Image source: Nvidia.

Should you sell Nvidia stock right now?

When OpenAI commercially launched ChatGPT on Nov. 30, 2022, Nvidia sported a market capitalization of just $345 billion. As of this writing (Jan. 7), Nvidia's market value is $4.6 trillion -- making it the most valuable company in the world.

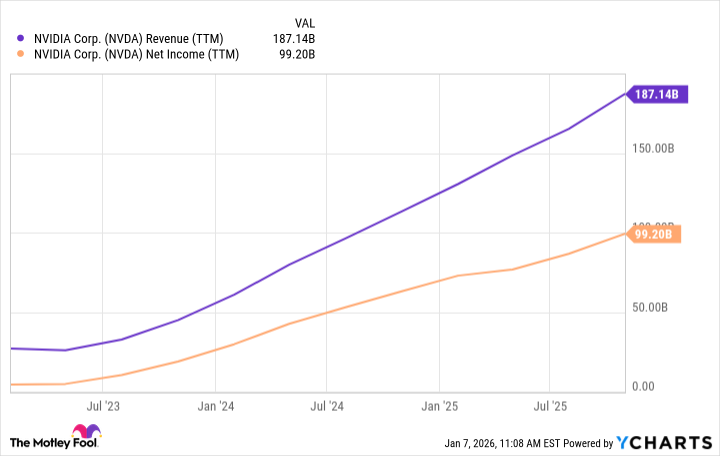

NVDA Revenue (TTM) data by YCharts

While Nvidia's revenue and earnings continue to shatter its own records, underlying activity in the stock suggests investors may be getting a bit leery -- and the rally may finally be fading after three years. Since Nvidia reported earnings for its fiscal third quarter on Nov. 19, 2025, shares have risen by a rather pedestrian 1.7%.

My suspicion is that growth investors are increasingly weighing the impact competition from other GPU designers such as Advanced Micro Devices as well as custom application-specific integrated circuit (ASIC) designers like Broadcom could have on Nvidia's trajectory.

Indeed, Nvidia has numerous opportunities beyond AI accelerators and data centers. However, the timeline and significance of any potential upside from emerging applications remain big question marks at the moment.

This is all to say that investors such as Thiel could be anticipating at least a slowdown to Nvidia's momentum in the near term. As such, rotating capital into more predictable businesses like Apple may seem like the smarter move in terms of maintaining healthy risk-adjusted returns for your portfolio.

Why did Peter Thiel buy Apple stock?

There's a strong case to be made that Apple has achieved the least in terms of AI innovation among its megacap tech peers. Nevertheless, most investors may be overlooking the fact that Apple doesn't actually need to develop a new, groundbreaking device in order to be a winner of the AI revolution.

Apple's installed base of active devices is well north of 2 billion. Against this backdrop, Apple can benefit alongside the proliferation of generative AI as the technology becomes increasingly integrated across its consumer hardware lineup as well as a key driver of services revenue from the App Store.

NASDAQ: AAPL

Key Data Points

Nvidia's share price ebbs and flows based on the latest AI-related headline and the health of the company is generally gauged on a quarterly basis when earnings are published. The paradox here is that despite blowing Wall Street's expectations out of the water time and again, Nvidia is slowly being perceived as a high-beta stock given its volatility. Beta is a measurement used to determine a company's risk profile.

By contrast, Apple's growth has been sluggish for a couple of years and the company's AI roadmap has been ambiguous at best. While mundane, Apple is still about as blue chip an opportunity as you'll see in the tech industry.

Despite a lackluster top line, Apple's cash-flow generation remains incredibly robust and predictable. Apple may present an investment opportunity with smoother returns compared to a volatile momentum stock like Nvidia.

Is Apple stock a buy right now?

Nvidia trades at a forward price-to-earnings (P/E) multiple of about 24. Apple trades at a higher premium, boasting a forward P/E ratio of around 32.

Considering Nvidia's revenue and earnings are accelerating much faster than Apple's, in combination with the company's robust outlook relative to the iPhone maker, Nvidia is the "cheaper" stock. But that doesn't necessarily make it the better buy at this exact moment.

I think Thiel's recent portfolio management suggests that he thinks a pronounced correction could be in store for traditional growth and momentum stocks. Generally speaking, when sell-offs occur in more volatile positions, investors will redeploy capital elsewhere -- usually into more durable opportunities with resilient business models.

In my eyes, Apple checks off this criteria. So while Apple stock isn't a bargain, it's likely a safe bet right now for investors with a long-term time horizon.