There's no denying that the YieldMax TSLA Option Income Strategy ETF (TSLY +1.78%) is an income powerhouse. The exchange-traded fund (ETF) concluded 2025 with a distribution rate of 50.21%.

Under any circumstances, that's eye-catching, let alone when you account for the fact that Tesla (TSLA +2.11%) doesn't pay a dividend. It's not just the yield that draws investors to YieldMax, which is one of the most significant single-stock funds. It's the fact that the "paychecks" arrive weekly. That looks good compared to most dividend payments, which typically arrive quarterly.

Image source: Getty Images.

All of that sounds good, but this ETF is by no means a free lunch. Last week, shares of Tesla dipped 9.75%, including a 2.59% loss on Friday, after the electric vehicle giant reported a slump in fourth-quarter deliveries. The YieldMax ETF was worse for the wear, declining 10.69% on the week and 3.14% on Friday. Fortunately, investors have other options to consider at the intersection of income and growth stocks.

An alternative to the Tesla ETF

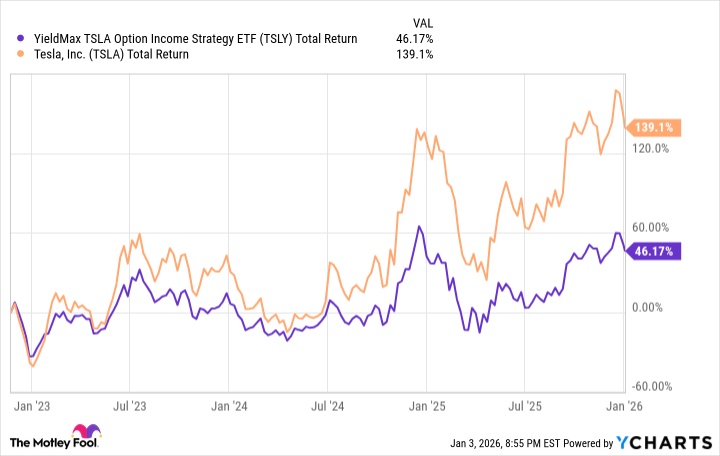

The Tesla ETF taps covered calls to generate income, but there's a rub with that strategy because it caps upside. The issuer explicitly states this, and the chart below confirms it.

TSLY Total Return Level data by YCharts

Don't fear if you're looking for high income on growth stocks because the NEOS Nasdaq-100 High Income ETF (QQQI +0.72%) is here. As its name implies, the NEOS ETF is an income-generating play on the notoriously low-yield Nasdaq-100 Index.

NASDAQ: QQQI

Key Data Points

Like its Tesla counterpart, this ETF is actively managed and utilizes covered calls to enhance its income profile. The similarities basically end there. For example, the NEOS fund pays a monthly dividend and sports a distribution of "just" 14.01%.

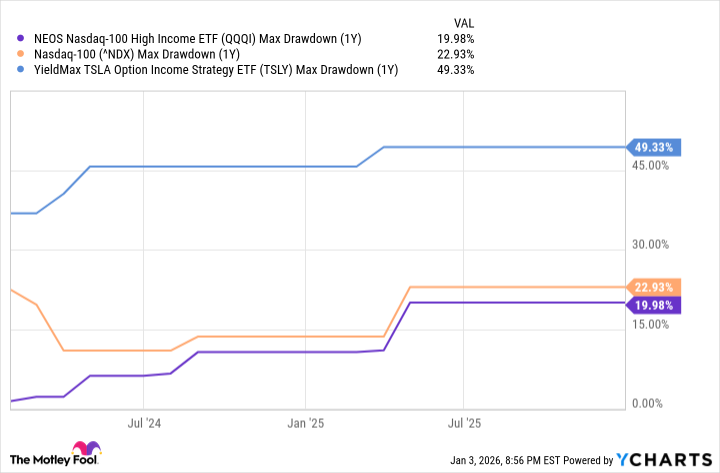

For what it lacks in yield relative to the Tesla fund, the $7.41 billion Nasdaq income ETF has its share of favorable traits. As one example, the NEOS ETF's most significant drawdown over the past year was nearly 300 basis points less than that of the Nasdaq-100 and significantly less than the most considerable drawdown by the Tesla fund.

QQQI Max Drawdown (1Y) data by YCharts

This ETF has some upside, too

To be fair, the Tesla ETF has generated some upside (just not as much as Tesla itself), and it's worth noting that no covered call ETF delivers full upside participation in the underlying asset or index. Still, some do a better job than others.

With the ability to buy some Nasdaq-100 options, the NEOS ETF is in the "better" camp, and that's paid dividends, no pun intended, for investors. Since its debut on Jan. 30, 2024, through Nov. 30, 2025, the NEOS ETF returned 41.53%, which compares quite nicely to the Nasdaq-100's 46.04% gain over the same span.

Equally as important to income investors who like choice, since its birth, this ETF has trounced its two primary rivals while delivering a higher yield than those competitors. So, yes, market participants can have their growth stock income and eat it too.