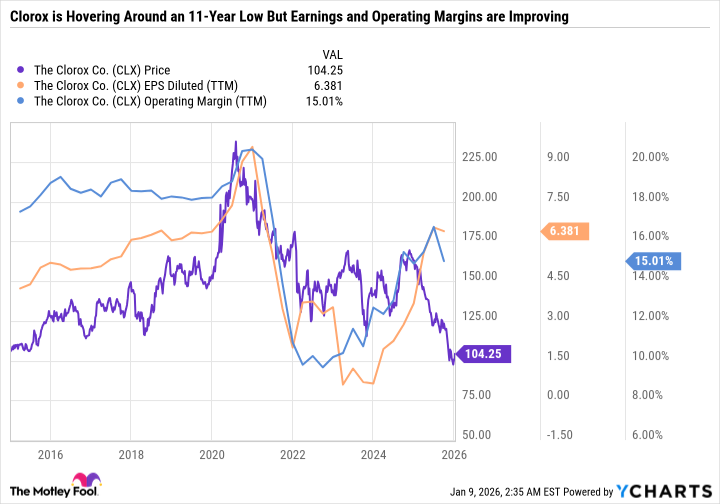

Consumer staples was the worst-performing stock market sector in 2025, falling 1.2% compared to a 16.4% gain in the S&P 500 (^GSPC 0.43%). But Clorox (CLX +2.82%) lost 37.9% of its value.

Clorox's sell-off, paired with ongoing dividend raises, has pushed its yield to 4.9% at the time of this writing. Here's why Clorox is a no-brainer value stock for contrarian investors to buy in 2026.

Image source: Getty Images.

Clorox is nearing the finish line of a multiyear turnaround

Typically, a lot has to go wrong for a stock to underperform the broader market and its sector by such a wide margin. In the case of Clorox, its self-inflicted challenges clashed with broader sector slowdowns in consumer spending and cost pressures due to inflation and tariffs.

Clorox has been undergoing a multiyear turnaround, centered on maximizing the value of its top brands and enhancing internal processes and tools to reduce costs and increase margins.

Investor patience has been tested, as Clorox has been transparent about its current fiscal year being a transition period as it rolls out its new enterprise resource planning (ERP) system. Clorox's international operations, supply chain, finance, and data management were outdated, leaving the company vulnerable to a cyberattack in 2023. Updating these systems with a cloud-based platform should lead to improvements in efficiency.

But Clorox is setting near-term expectations very low. Its ERP transition led to abnormally large shipments to its retail partners at the end of fiscal 2025, which led to less demand at the start of fiscal 2026 (beginning July 1, 2025). Clorox expects full-year fiscal 2026 organic sales growth to decline by 5% to 9%, with a 7.5 basis point impact from the ERP transition. So organic sales are basically projected to be flat when taking out the impact of the transition. Similarly, earnings are expected to decline largely due to ERP transition impacts.

Given the weak expectations and Clorox's stock price hovering around an 11-year low, investors should focus on Clorox's direction over the next few years rather than its upcoming quarterly results.

NYSE: CLX

Key Data Points

Leveraging leading brands

The following management commentary is from Clorox's prepared remarks on its first-quarter fiscal 2026 earnings call.

Category growth rates have stabilized but remain below historical averages, while competitive intensity continues to be high as companies compete for share of wallet. Consumers remain under pressure, and this is driving value-seeking behaviors across all income segments.

With consumer spending under pressure, Clorox is delivering value to shoppers through smaller packaging to address affordability concerns, as well as bulk options with larger sizes for better value.

Clorox has several category-leading or near-category-leading brands that should help drive value as it adapts to changing consumer preferences and optimizes its internal processes. Clorox estimates that approximately 80% of its brands are either No. 1 or No. 2 in their respective categories. Aside from the flagship Clorox label, the company also owns top brands like Hidden Valley Ranch dressing, Pine-Sol cleaning products, Fresh Step cat litter, Glad bags and wraps, Brita, Burt's Bees, and more.

Clorox is a passive income powerhouse

After a period of self-induced blunders and a highly challenging operating environment, Clorox has the potential to return to a high-margin cash cow in the coming years. In the meantime, patient investors can benefit from Clorox's 4.9% dividend yield.

Last summer, Clorox raised its quarterly dividend to $1.24 per share -- marking the 48th consecutive annual increase. That puts Clorox on track to become a Dividend King by 2027. Dividend Kings are companies that have increased their dividends for at least 50 consecutive years. But very few Dividend Kings yield as much as Clorox, making it an appealing income stock to buy for investors looking to boost their passive income stream or supplement retirement income.

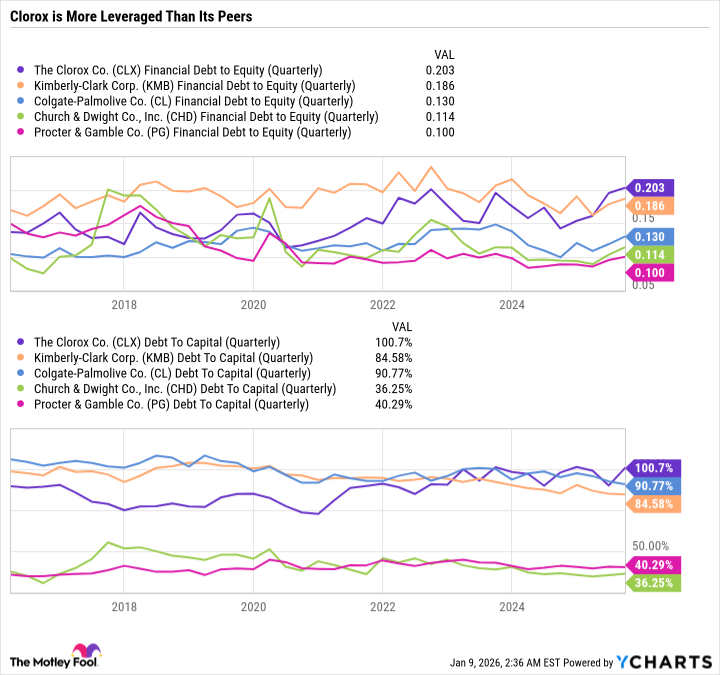

Despite languishing growth, Clorox's dividend is affordable, as earnings and free cash flow continue to exceed the dividend expense. Its balance sheet is in decent shape, with less than $3 billion in total net long-term debt and a financial debt-to-equity (D/E) ratio of 0.2.

Clorox is more leveraged than peers such as Kimberly Clark, Colgate-Palmolive, Church & Dwight, and Procter & Gamble by both D/E and debt to capital (D/C). Leverage ratios like D/E and D/C show how dependent a company is on debt financing, with lower ratios illustrating less reliance on debt to meet financial commitments.

CLX Financial Debt to Equity (Quarterly) data by YCharts

A top high-yield dividend stock to buy in 2026

Clorox's results have been lackluster, and there's little hope for near-term improvement. However, patient investors with at least a three- to five-year time horizon may want to take a closer look at this high-yield stock.

Downturns are the perfect time to undertake complicated, costly, and often messy companywide rollouts -- which is exactly what Clorox did with its ERP transition, the sale of its Vitamins, Minerals, and Supplements businesses, and its divestment from Argentina, Uruguay, and Paraguay in calendar year 2024.

Investors looking for a lower-risk play in the household and personal care industry should take a closer look at Procter & Gamble, which yields 3% and is a higher-quality company. But Clorox has arguably the highest upside potential in the industry for investors who believe it will be well positioned to leverage its diverse product portfolio when consumer spending eventually picks up.