CoreWeave (CRWV 6.37%) is a well-known cloud infrastructure company that many artificial intelligence (AI) hyperscalers are farming out computing loads to these days. Not every AI hyperscaler has the capacity they need to process all the workloads they want to run, and having some infrastructure that is owned by a different entity is also a smart move because it eliminates a single point of failure.

However, CoreWeave isn't the only company in this space. There are several other competitors, but my favorite is Nebius (NBIS 10.18%), which operates in a similar field as CoreWeave and offers graphics processing units (GPUs) in a full-stack platform to give its clients everything they need to run AI workloads on its servers.

Nebius could be primed for monster gains in 2026, but is it a better bet than CoreWeave? Let's find out.

Image source: Getty Images.

Nebius has huge expansion plans in 2026

Nebius was formerly a part of Yandex, the Russian equivalent of Alphabet's Google. After sanctions came down from Russia's war with Ukraine, Yandex decided to split its Russian and non-Russian assets, and Nebius was spun out. Nebius has been highly successful in its AI-focused cloud computing business, and it looks like it's slated to boom heading into 2026.

In Q3, Nebius grew its revenue by 355% year over year. A stat like that is enough to get any growth investor excited, but it gets better. In Q3, it had an annual run rate of $551 million. By the end of 2026, that figure is expected to be between $7 billion and $9 billion!

That's huge growth and shows how in-demand AI computing power is. It's so much growth that Nebius had to increase its contract power from 1 gigawatt to 2.5 gigawatts. If Nebius delivers that kind of growth, the upside for its stock could be massive.

Nebius stock may look expensive now, but it isn't

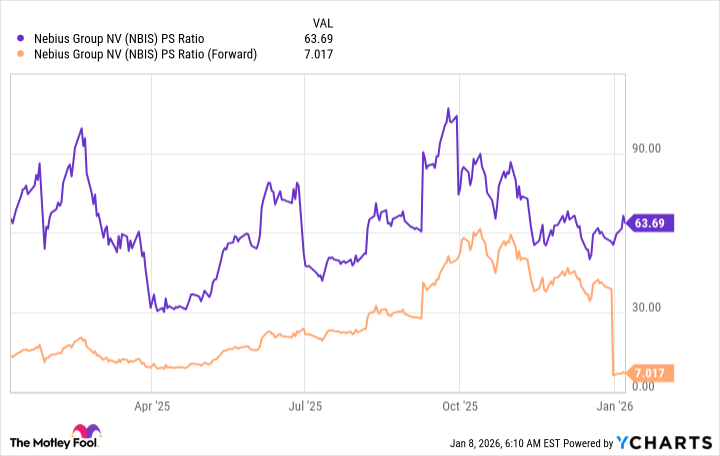

At 64 times sales, Nebius certainly looks expensive, but that's the wrong metric to use. The correct one to use is the forward sales metric, as it factors in the monster growth Nebius expects.

NBIS PS Ratio data by YCharts

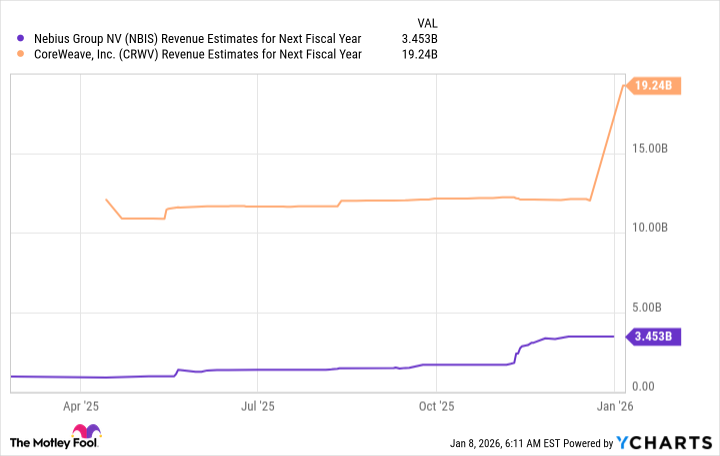

Now, there's certainly risk here, as there's no guarantee that Nebius delivers on its projections. Still, by the end of the year, Nebius will be much smaller than CoreWeave. CoreWeave is also experiencing massive growth and will be much larger than Nebius at the end of 2026. I'd expect Nebius to follow a similar growth trajectory as CoreWeave as long as AI spending stays up, which could be huge news for the stock.

NBIS Revenue Estimates for Next Fiscal Year data by YCharts

The biggest question surrounding both of these stocks is when they will make money. Currently, they're in the market-capturing phase of their development, where they are expanding as quickly as possible without worrying about profitability. This works well for some time, but eventually each will need to turn a profit. That likely won't happen for a few years, as there is unreal demand for computing capacity currently.

A fully mature cloud computing company like Amazon Web Services posts operating margins of 35%. If each of these companies could achieve that level of profitability, they would be considered highly successful businesses. But what kind of returns can we expect in 2026 if we know that neither of them will turn a profit?

NASDAQ: NBIS

Key Data Points

Ideal operating margins like AWS posts are akin to subscription software companies, which usually trade around 10 to 20 times sales. That leaves plenty of room for the stock to double, but CoreWeave is also in the same boat. It really depends on the market's appetite for growth-at-all-costs companies like CoreWeave and Nebius.

If the market is willing to take on risk, these two could soar. If they aren't, then these two may post massive growth in 2026, and the market will demand profitability. We'll see where the market heads, but I still wouldn't be surprised to see Nebius double this year.