Shares of Arm Holdings (ARM 3.25%) had a volatile year in 2025 as the semiconductor stock continued to deliver strong results and benefited from AI tailwinds, but its valuation and concerns about an AI bubble weighed on the stock.

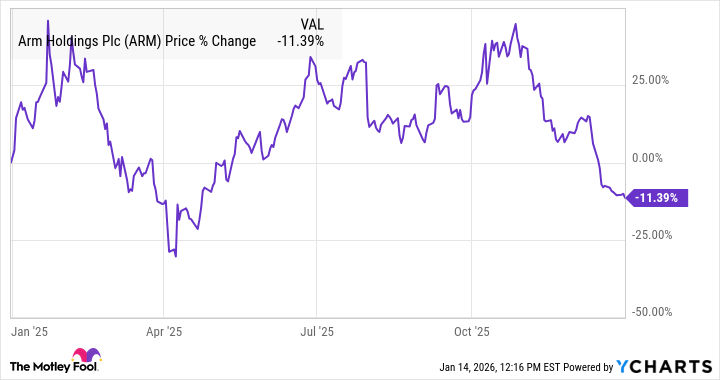

According to data from S&P Global Market Intelligence, the stock finished the year down 11%. As you can see from the chart below, there wasn't really a steady pattern in the stock, and it was trading in positive territory for most of the year.

What happened with Arm Holdings last year

Arm started off the year on a strong note as it was one of several companies that is involved with the Stargate Project, a $500 billion AI infrastructure project that includes companies like Nvidia, Oracle, OpenAI, and Softbank.

After that jump, the stock tumbled sharply with the broader retreat in the market in March that culminated with the "Liberation Day" tariff announcement.

It then rebounded with the broader recovery in tech before falling as investors seemed disappointed in its guidance in its latest earnings report and due to concerns about an AI bubble, which is reasonable given the stock's lofty valuation.

Arm continued to deliver strong results, though, due to the nature of its business model, which relies on licensing and royalty revenue, it's not growing as fast as other chip stocks because it doesn't sell chips directly. It licenses its CPU architecture to companies like Nvidia and then collects a royalty.

Arm's fiscal year ends in March. For the first half of the current fiscal year, the company reported 24% revenue growth, and its revenue growth rate tends to be erratic due to the licensing segment, which can be lumpy quarter to quarter.

Arm is also expanding its product portfolio with compute subsystems (CSS), a more complex architecture that speeds up the production time for its customers. Additionally, it's seeing solid momentum in cloud computing as it's partnered with Microsoft, Alphabet, and Amazon on cloud chips.

Image source: Getty Images.

What's next for Arm

Looking ahead, the company is guiding for $1.225 billion in revenue for the third quarter, up 24% from a year ago, and adjusted earnings per share of $0.41, up from $0.39 in the quarter a year ago.

Investors may want to see stronger growth on the bottom line, but Arm has a number of competitive advantages, and its investments in AI should pay off in the coming years.