Quantum computing is moving from theoretical to commercialization. There are two stocks to buy hand over fist now to take advantage. One is a pure-play, higher-risk, higher-potential-reward option. The other is a tech giant. The two no-brainers are IonQ (IONQ 6.35%) and Alphabet (GOOGL 0.91%) (GOOG 1.11%).

IonQ has momentum and high fidelity

IonQ has a lot of folks excited. The company recently set a world record in two-qubit gate fidelity, achieving the elusive "four nines" of 99.99% two-qubit gate performance. Fidelity is a measure of accuracy. “Reaching four-nines fidelity is a watershed moment for IonQ’s quantum leadership,” said CEO Niccolo de Masi. IonQ utilizes trapped-ion technology, which is preferred for its accuracy and scalability.

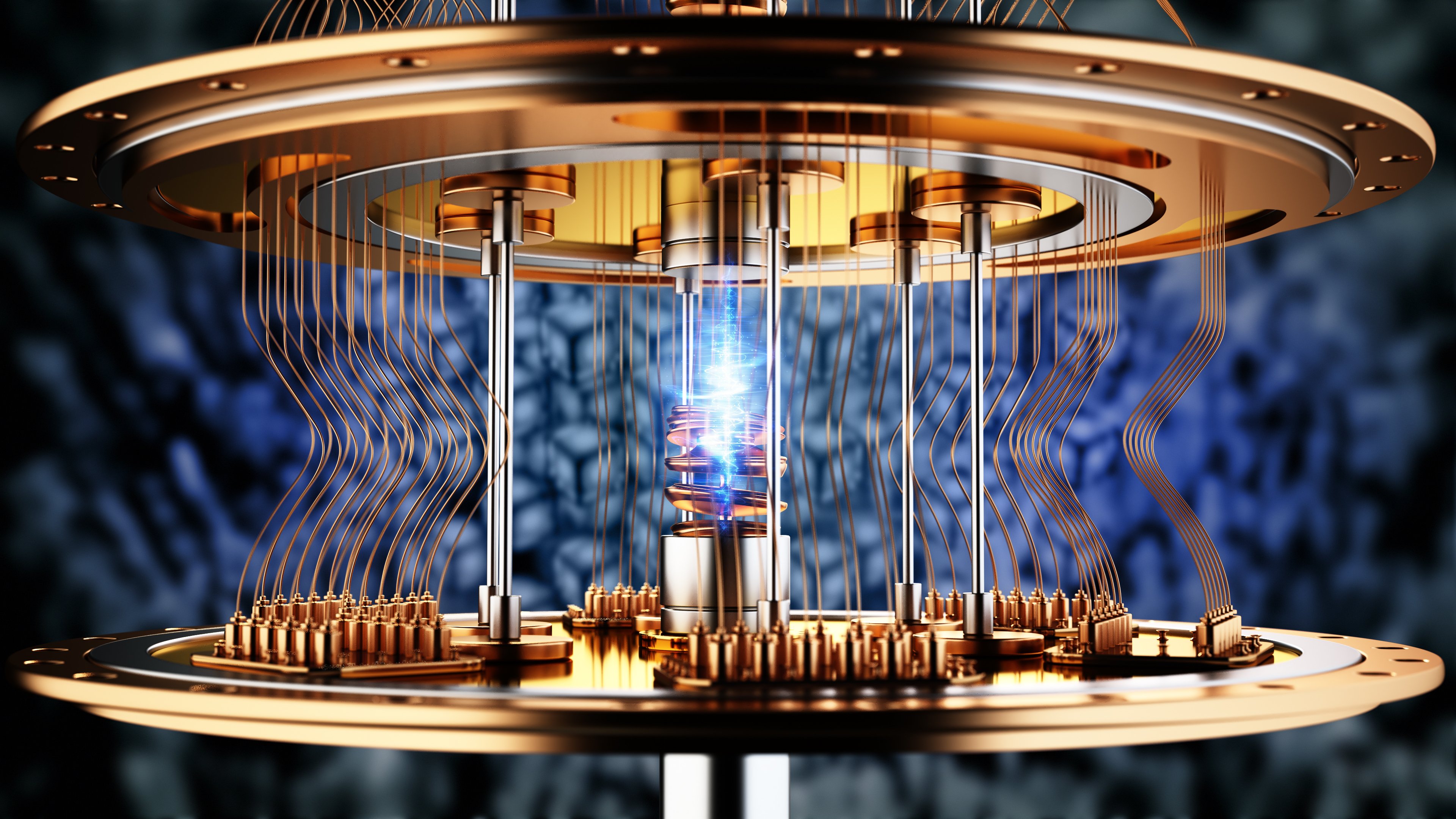

Image source: Getty Images.

The company has partnerships with government agencies, as well as Amazon, Microsoft, and other notable brands. IonQ is experiencing strong growth in its backlog, a bullish signal indicating that demand for its quantum computing services is increasing.

NYSE: IONQ

Key Data Points

IonQ's stock is expensive, with a price-to-sales ratio of 158 as of Jan. 12. However, IonQ's revenue was up 222% year-over-year in the third quarter 2025. The quantum computing market could reach $100 billion in a decade, according to some estimates, and if IonQ can capture a fraction of the future market share, investors won't be sorry they bought in 2026.

Google Quantum AI has every advantage

Alphabet's Google Quantum AI division is a global leader in research. The company's quantum roadmap includes six "milestones" -- it has hit two of them so far -- that it says will "lead us toward top-quality quantum computing hardware and software for meaningful applications." Alphabet isn't a pure-play quantum investment, but it's hard not to include the mega-cap company in the conversation.

NASDAQ: GOOGL

Key Data Points

Alphabet has deep pockets and elite talent. Its AI team can also leverage its other businesses for important breakthroughs in a way that smaller competitors cannot. Alphabet's stock offers a piece of the future of quantum computing, plus every other Alphabet business. Trading at a forward price-to-earnings ratio of just under 30 and price-to-sales of around 10, Google is an attractive buy for long-term investors.

The potential upside of IonQ, combined with the stability of Google, makes these two no-brainer buys in 2026.