For 60 years, Warren Buffett was the lead man in charge at Berkshire Hathaway (BRK.A +0.28%)(BRK.B +0.14%). Now, the Oracle of Omaha has finally stepped down at the age of 95. It's definitely the end of an era, but it was a great ride. Berkshire Hathaway went from a roughly $25 million company to one of only 11 companies with a trillion-dollar valuation (as of Jan. 13).

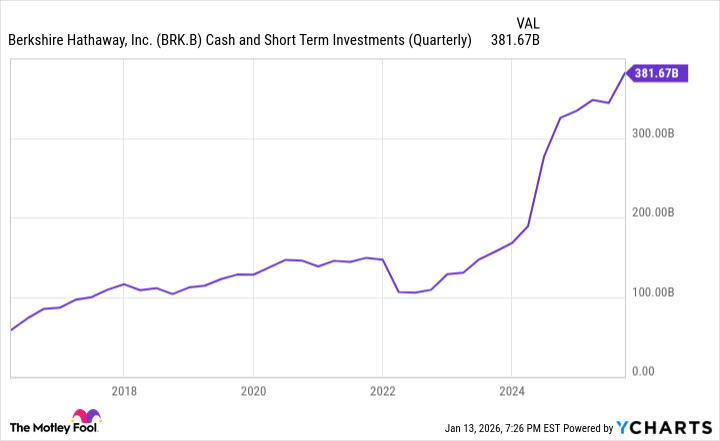

Understandably, some investors may have reservations about the post-Buffett era of Berkshire Hathaway because of the unknown. However, there are 382 billion reasons why I think investors should remain optimistic about Berkshire Hathaway's direction and long-term potential.

Image source: Getty Images.

Buffett handpicked his successor

Now that Buffett has stepped aside, Greg Abel has taken over the reins as the new CEO. The average investor may not know Abel by name, but he's a Berkshire Hathaway veteran, having been with the company since 1992.

Before taking over as CEO, Abel ran the company's energy and non-insurance operations for many years. Regardless of how some may feel about the choice, one thing is clear: Buffett handpicked Abel as his successor, and that says a lot about his trust in Abel's ability.

Buffett and Berkshire Hathaway have been synonymous for quite some time, but Buffett has done a good job at making sure the company's success wasn't solely reliant on him and his decisions. If he trusts Abel to follow him up, Abel deserves the benefit of the doubt from investors.

382 billion reasons to keep a positive attitude

At the end of the third quarter of 2025, Berkshire Hathaway had $382 billion in cash, cash equivalents, and short-term Treasury bills (T-bills). For perspective, that's more than the market cap of Robinhood Markets, Spotify, and Adobe -- combined.

BRK.B Cash and Short Term Investments (Quarterly) data by YCharts

Having this war chest serves two major purposes. The first is that Berkshire Hathaway is earning billions on the $305 billion it holds in T-bills without lifting a finger. Even at 3% (which is lower than the current rate), it could earn around $9.15 billion annually in interest alone.

The second purpose is that it leaves Berkshire Hathaway with plenty of financial flexibility to jump on an opportunity if one pops up. Berkshire Hathaway has been known for buying or investing in high-quality, but distressed, businesses when it sees a great deal. That's how it started its GEICO purchase and began its stake in companies like American Express, which it currently has a 22% stake in.

I trust that Abel and Berkshire Hathaway will continue Buffett's disciplined approach and not just jump on any opportunity for the sake of doing so. Even outside of potential acquisitions, Berkshire Hathaway's huge cash pile gives it flexibility for things like stock buybacks, funding existing businesses, and, just maybe, a potential dividend down the road, which would be its first one since 1967 (don't hold your breath).

NYSE: BRK.B

Key Data Points

Berkshire Hathaway is much more than stock investments

Even while Buffett was the face of Berkshire Hathaway and overseeing the company's investments, he didn't have much say in the company's subsidiaries. These operate autonomously, and their respective leadership teams run the business as they see fit. This means that despite Buffett's exit, many of Berkshire Hathaway's biggest moneymakers will continue business as usual. Key businesses this applies to are:

- GEICO: One of the largest U.S. insurers and one of Berkshire Hathaway's biggest revenue generators.

- Burlington Northern Santa Fe (BNSF): One of the largest rail networks in the country.

- Berkshire Hathaway Energy: One of the largest energy and utility infrastructure companies in North America.

There are also Berkshire Hathaway's manufacturing, retail, and service businesses that generate steady cash flow. Buffett and Berkshire Hathaway's stock portfolio gets a lot of attention, but it's a conglomerate that's far beyond just a one-man show. I trust that its long-term trajectory will remain strong.