Consumer stocks cover a diverse array of companies. Most operate in competitive environments where economic cycles, interest rate movements, or company missteps can significantly impact a stock.

Fortunately, since these moves often happen in cycles, shifts in the economy or correcting mistakes can likewise lead to a comeback. With that in mind, these two companies could experience a recovery in 2026; here's why.

Image source: Getty Images.

Realty Income

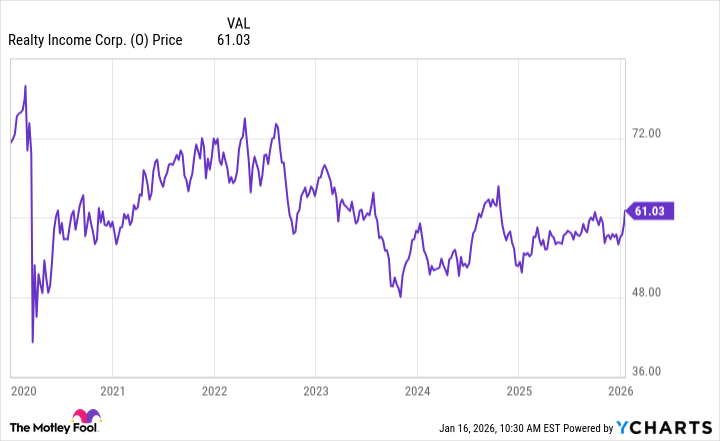

As a real estate investment trust (REIT), the stock of Realty Income (O +1.15%) likely became a victim of the rising interest rates earlier in the decade. Consequently, it is one of the few stocks that never recovered from the pandemic-inspired sell-off in early 2020 and sells at a near 25% discount from that all-time high.

However, Realty Income's business continued to grow despite the higher rates. Its approximately 15,500 single-tenant commercial properties have an occupancy rate of nearly 99%, and the company continues to buy and develop such properties to fuel its expansion.

NYSE: O

Key Data Points

The high rates also did not stop the growth of its monthly dividend, and the lower stock price resulted in a generous payout. The dividend, which has risen at least once every year since 1994, now amounts to $3.24 per share annually, a dividend yield of 5.3%.

Also, the company earned $4.20 per share in funds from operations (FFO) income in the last 12 months, a measure of a REIT's free cash flow. This means the stock trades at just 14 times its FFO income.

Finally, the falling interest rates should reduce interest expenses, potentially freeing more capital to invest in its continued expansion. As business conditions become more favorable and dividends keep rising, it could induce more investors to come back to Realty Income stock.

MercadoLibre

Until recently, MercadoLibre (MELI 1.05%) had driven massive returns for investors.

Its e-commerce, fintech, and logistics businesses worked together and separately to offer needed goods and services to its customer base in Latin America. Even amid periodic political or economic turmoil, it sold goods while providing needed services to the underbanked and logistics services that did not previously exist.

More recently, the stock has suffered amid rising e-commerce competition and an alarming rise in non-performing loans. The provision for doubtful accounts rose by 58% in the first nine months of 2025.

Even though the net income for that period of $1.4 billion still rose 13%, this was significantly slower growth than in the past. Now, the stock sells at around a 20% discount from its 52-week high.

NASDAQ: MELI

Key Data Points

Nonetheless, macro and micro challenges have not impeded revenue, which rose 37% in the first three quarters of 2025. Additionally, the prospects for economic improvement in Argentina and Venezuela could add to those increases.

Amid the stock's struggles, its P/E ratio is 52, well above the S&P 500 average of 31. Though steep, its closest U.S. equivalent, Amazon, supported significantly higher valuations in its growth years. With its already rapid revenue growth potentially on track to accelerate, a recovery in MercadoLibre stock appears increasingly likely.