Quantum computing caught the imagination of investors in 2025 as Nvidia CEO Jensen Huang, who had earlier in the year been dismissive about the technology, said quantum computing was near an inflection point. That sent shares of quantum computing stocks flying higher, although most have pulled back from their highs.

It's easy to see why investors can get excited about quantum computing, even though the technology may still be a ways away. After all, it wasn't long ago that artificial intelligence (AI) was still in the experimental phase, and now it's become a driving force in the economy. With quantum computing, there is the potential to take computing to an entirely new level and solve the most complex problems that are not solvable via classical computing.

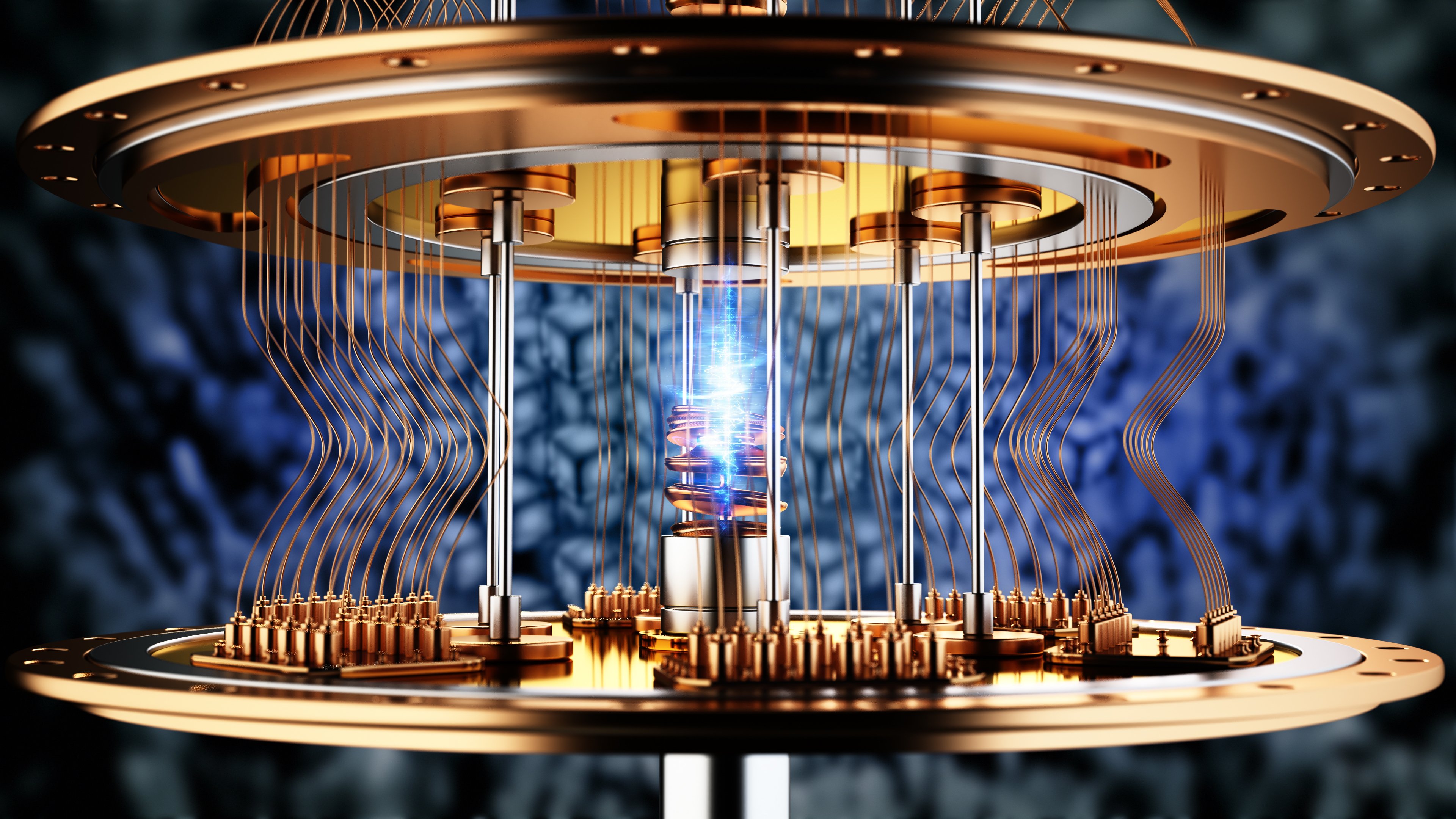

The biggest hurdle with quantum computers right now is that they are error-prone. Unlike classical computers that use bits, which can be 0 or 1, quantum computers use quantum bits, or qubits, which can exist in a combination of both until it's measured. This is called superposition, and is a big part of the reason why quantum computers can make calculations exponentially faster than regular computers. However, it also puts the qubits in a much more fragile state, vulnerable to being disrupted by outside forces, such as changes in temperature or vibrations. On top of that, quantum computers don't need to just keep a single qubit stable; they need to keep multiple ones stable in relation to each other.

One of the companies furthest along in having low error rates is IonQ (IONQ 0.28%). The company has achieved a 99.99% 2-gate fidelity, which is one of the most accurate recordings for a quantum machine. However, while being right 99.99% of the time sounds great, it is actually still considered very error-prone for a computer.

With the stock down about 40% from its highs, let's take a closer look to see if investors should be buying IonQ stock on the dip.

NYSE: IONQ

Key Data Points

A leader in accuracy

IonQ's strong accuracy numbers come in large part from its trapped-ion approach. Instead of using fabricated qubits like most competitors, the company uses ionized ytterbium atoms, which by nature are identical and thus more stable. It then turns the atoms into ions and uses a specialized chip to hold them in place within a high vacuum chamber. IonQ has also developed software technology called Clifford Noise Reduction for partial error reduction, and it is also working on Quantum Error Correction (QEC) codes to protect quantum information even when physical qubits experience issues.

IonQ's ambitions go far beyond just wanting to create a fault-tolerant quantum computer. The company has stated it wants to be the Nvidia of quantum computing, developing an entire quantum ecosystem. While Nvidia is best known for its graphics processing units (GPUs) used to power AI workloads, the reason the company is where it is today is because of the moat it established with its CUDA software platform and networking portfolio.

IonQ has raised a lot of cash, and with its balance sheet strength, the company has been an aggressive acquirer to gain complementary technologies to further its vision. Its largest deal was for Oxford Ionics, whose technology will help it reduce the size of its massive quantum computers. Meanwhile, LightSynq's photonic interconnects will give it the technology it needs to help scale its systems. It's also gained quantum sensing and space-based quantum data transmission technology from other acquisitions.

Image source: Getty Images.

Should investors buy the dip in the stock?

Given its strong accuracy metrics and the moves it's made to create a quantum ecosystem, IonQ is one of the most intriguing names in the quantum computing space. That said, with a market cap of around $17 billion, it's an expensive bet on a largely unproven technology, and the stock will likely remain volatile.

I think investors can take a small, speculative position in IonQ, because if it can crack the quantum code, the stock will have a lot of upside. At this point, though, it's still a risky bet with an uncertain payoff.